Shaping the Future of Ovarian Cancer Treatment: From PARP Inhibitors to ADCs

Oct 03, 2025

Ovarian cancer ranks among the most lethal gynecological cancers, largely because it is often detected at advanced stages and recurs frequently despite initial response to surgery and chemotherapy. Most cases are epithelial, with High-grade Serous Ovarian Cancer (HGSOC) being the most common and aggressive, typically diagnosed at advanced stages. Targeted therapies are reshaping treatment toward precision and personalization.

For over three decades, the cornerstone of ovarian cancer treatment has been surgery combined with platinum-based chemotherapy, typically a platinum analog like cisplatin or carboplatin paired with a taxane such as paclitaxel or docetaxel. Newly diagnosed patients follow one of the two paths: Either surgery first to surgically remove as much tumor as possible, then chemotherapy; or chemotherapy first to shrink tumors, followed by interval surgery and additional chemotherapy. While many respond initially to this regimen, an all-too-common challenge is the eventual development of platinum resistance, making recurrences harder to treat.

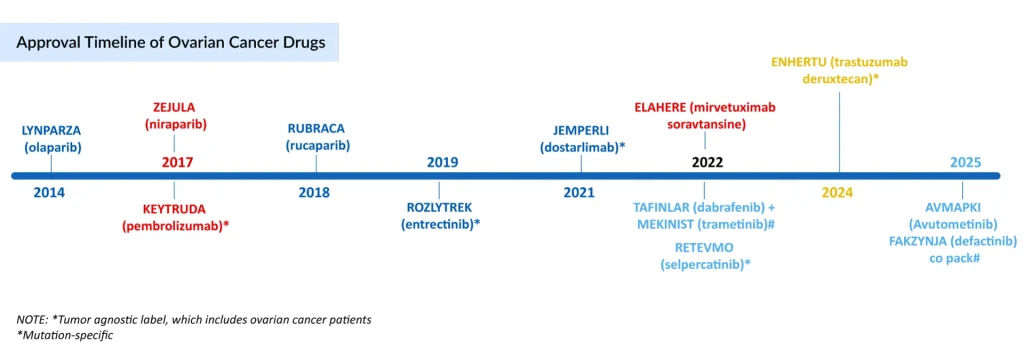

The ovarian cancer therapeutic landscape is witnessing a paradigm shift with the introduction of precision maintenance therapies that extend remission and improve outcomes. The VEGF inhibitor AVASTIN (bevacizumab) was among the first breakthroughs, slowing tumor blood vessel growth to delay progression. Then, targeted drugs called PARP inhibitors such as LYNPARZA (olaparib), RUBRACA (rucaparib), and ZEJULA (niraparib) have emerged as frontline-targeted agents, especially for ovarian cancer patients harboring BRCA mutations or Homologous Recombination Deficiency (HRD).

Downloads

Click Here To Get the Article in PDF

Recent Articles

- World Ovarian Cancer Day

- Sanofi Strengthens Amlitelimab’s Position in Atopic Dermatitis; Corcept Announces Statistically S...

- Ovarian Cancer Treatment Drugs and Unmet Needs

- Merck, Dewpoint’s HIV Pipeline; Pfizer, BioNTech ‘s COVID-19 Vaccines; Roche’s Tecent...

- AbbVie Presents Phase III CANOVA Study Results; Novartis’ Iptacopan Shows Promise in Phase III St...

Utilization and Perception of PARP Inhibitors in Clinical Practice

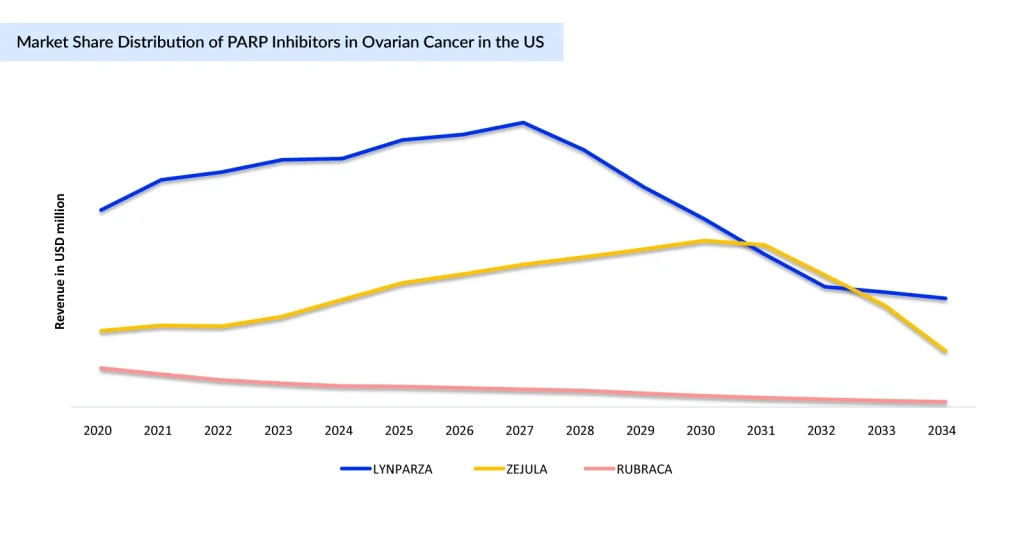

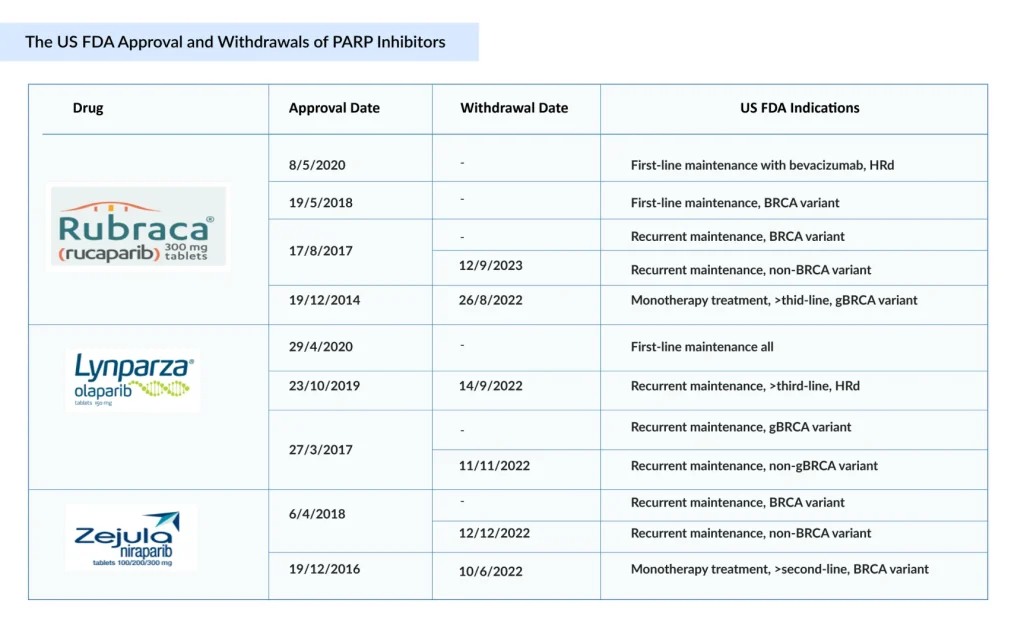

PARP inhibitors have revolutionized ovarian cancer care, establishing maintenance therapy as a standard. Since the approval of AstraZeneca’s LYNPARZA in 2014, PARP inhibitors have reshaped ovarian cancer treatment, expanding from late-line therapy to first-line maintenance across biomarker-defined populations. Following LYNPARZA, ZEJULA and RUBRACA became the second and third FDA-approved PARP inhibitors, respectively. ZEJULA was first approved in March 2017 for maintenance treatment of recurrent ovarian cancer, later expanded in October 2019 for HRD-positive advanced ovarian cancer, and by April 2020 for first-line maintenance regardless of BRCA status. RUBRACA was approved in December 2016 for BRCA-mutated advanced ovarian cancer, with its label expanded in April 2018 to include maintenance therapy for recurrent disease. These sequential approvals highlight the rapid expansion of PARP inhibitors across multiple ovarian cancer settings.

LYNPARZA led the way with strong survival benefits, followed by ZEJULA and RUBRACA, which expanded use in relapse and BRCA/HRD-positive disease. Together, they extend remission and delay progression in both frontline and recurrent settings. Together, this trio reshaped treatment by extending remission and delaying progression in both frontline and recurrent disease.

With mounting evidence of adverse outcomes in later-line use, 2022 marked a turning point for PARP inhibitors. Voluntary withdrawals of key indications for ZEJULA, RUBRACA, and LYNPARZA led to a significant reduction in the number of eligible patients and a notable decline in use, particularly in second-line and later settings. Yet, despite this contraction, PARP inhibitors remain central to ovarian cancer treatment, now firmly anchored in the first-line maintenance setting, where their clinical benefit is strongest.

Beyond PARP Inhibitors: Other FDA Approved Targeted Therapies in Ovarian Cancer Management

Apart from PARP Inhibitors, targeted therapies like KEYTRUDA (pembrolizumab) and JEMPERLI (dostarlimab) are approved for ovarian cancer patients with Microsatellite Instability-High (MSI-H) or DNA Mismatch Repair (dMMR) tumors, while RETEVMO (selpercatinib) is approved for RET fusion and ROZLYTREK (entrectinib) for NTRK gene fusion.

While targeted therapies mark a significant advancement in personalized ovarian cancer treatment, their clinical use remains limited. The low incidence of actionable mutations such as RET or NTRK fusions, modest overall efficacy, immune-related toxicities, and high costs restrict their broader application. Additionally, ovarian cancer’s inherent heterogeneity limits the number of patients who can benefit. Immune checkpoint inhibitors like KEYTRUDA and JEMPERLI have shown activity mainly in MSI-H/dMMR tumors and are predominantly used in late-line settings, with no established role in frontline therapy as of now. Addressing these challenges through combination strategies, biomarker-driven patient selection, and improved safety profiles will be crucial to maximizing the potential of targeted therapies in ovarian cancer management.

In February 2024, AbbVie acquired ImmunoGen for USD 10.1 billion in cash (USD 31.26 per share), securing ELAHERE (mirvetuximab soravtansine-gynx), a first-in-class ADC for ovarian cancer. The FDA approval of AbbVie’s ELAHERE marked a major advance in the platinum-resistant, FRα-positive ovarian cancer treatment, offering a new targeted option beyond PARP inhibitors and angiogenesis inhibitors. Its role was validated through the MIRASOL and SORAYA trials, and investigations are now expanding into earlier lines of therapy. However, ELAHERE’s use is limited to cancers that are both FRα-positive and resistant to platinum-based treatments.

In the parallel space of Low-grade Serous Ovarian Cancer (LGSOC), few companies are active, and therefore, therapeutic options remain limited. Currently, the only approved LGSOC treatments are the TAFINLAR + MEKINIST combination and the newly FDA-approved AVMAPKI/FAKZYNJA (avutometinib plus defactinib) combination. In May 2025, the FDA granted accelerated approval to AVMAPKI/FAKZYNJA for the treatment of recurrent KRAS-mutated LGSOC, based on positive data from the Phase II (RAMP 201) and Phase I (FRAME trials). The US launch followed swiftly within a week of approval, and the therapy achieved USD 2.1 million in net revenue in its first 6 weeks. However, the high annual AVMAPKI/FAKZYNJA cost may limit its widespread adoption, despite being the first and only approved treatment for the LGSOC patient population as of September 2025.

Way Forward: Ovarian Cancer Treatment in the Next 5 Years

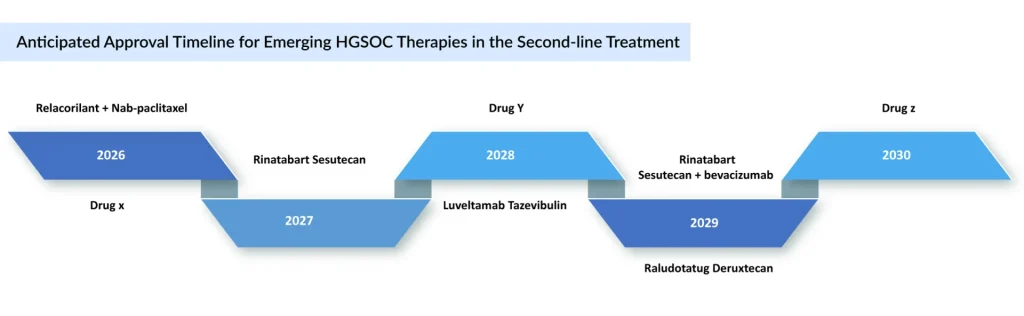

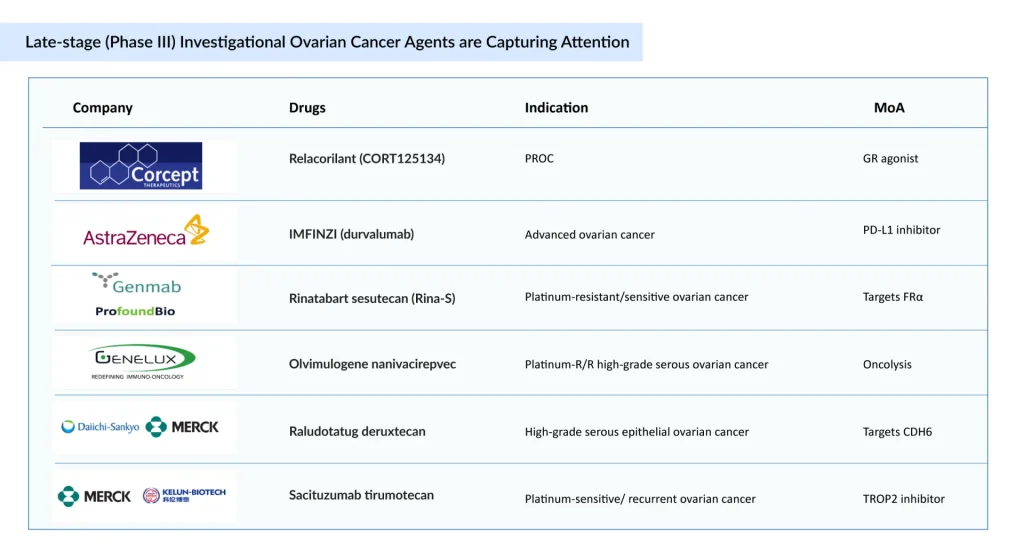

The majority of companies are focusing on platinum-resistant ovarian cancer, with key pipeline therapies including Merck’s KEYTRUDA + paclitaxel ± bevacizumab, Daiichi Sankyo and Merck’s raludotatug deruxtecan, Corcept Therapeutics’ relacorilant + nab-paclitaxel, and Genmab’s rinatabart sesutecan, among others. The expected launch of these potential therapies is expected to increase the ovarian cancer market size in the coming years, driven by an expansion of the patient pool.

The ovarian cancer treatment landscape is poised for significant transformation over the next 5 years, driven by advances in targeted therapies, combination regimens, and precision medicine. Currently, no single therapy exists that addresses the overall ovarian cancer patient population comprehensively, but emerging treatment strategies are charting a more hopeful future. Relapsed and platinum-resistant patients will benefit from emerging ADCs and novel combination regimens, improving the outcomes where chemotherapy has limited efficacy.

ELAHERE continues to show a promising launch trajectory for FRα-positive platinum-resistant ovarian cancer. The same trajectory is expected to be followed by Luveltamab tazevibulin and rinatabart sesutecan, both ADCs targeting 2L+ platinum-resistant ovarian cancer, which will compete with ELAHERE in later treatment lines. Rinatabart Sesutecan is expected to enter the market by 2027 and will capture more than USD 300 million by 2034 in the United States. Currently in Phase III PROC clinical trial (NCT06619236) with recruiting status. Rinatabart sesutecan is delivering on its promise from platinum-resistant ovarian cancer to endometrial cancer and beyond.

Sacituzumab tirumotecan has joined raludotatug deruxtecan at the pivotal stage of ovarian cancer development. While no CDH6-targeting ADCs are yet approved, raludotatug deruxtecan leads this emerging class. In October 2023, Daiichi Sankyo and Merck entered a global agreement to co-develop and commercialize three DXd ADCs—patritumab deruxtecan, ifinatamab deruxtecan, and raludotatug deruxtecan. Sacituzumab tirumotecan (TroFuse-022) is in evaluation as second-line maintenance for platinum-sensitive ovarian cancer, while raludotatug deruxtecan (Rejoice-Ovarian01) is targeting second-line platinum-resistant. Together, these agents represent the forefront of pivotal-stage ADC innovation in ovarian cancer.

Beyond ADCs, Corcept Therapeutics’ relacorilant achieved its primary endpoint in the Phase III ROSELLA trial. In September 2025, the FDA accepted Corcept’s NDA for relacorilant in PROC treatment and set a PDUFA date of July 11, 2026. This milestone positions relacorilant as a potential new standard for a disease with limited treatment options, underscoring its promise to reshape the management of PROC.

BioNTech licensed Gotistobart, an improved anti-CTLA-4 antibody from OncoC4, for USD 200 million. Gotistobart is currently in Phase II PRESERVE-004 trials for platinum-resistant ovarian cancer, representing a promising advance in immunotherapy.

Early companies in the ovarian cancer pipeline include Leap Therapeutics (Sirexatamab), AstraZeneca (AZD5335), OncoC4 and BioNTech/Merck (Gotistobart), Biostar Pharmaceuticals (Utidelone Capsule), and others.

In conclusion, the ovarian cancer treatment landscape is evolving, moving beyond traditional chemotherapy to precision-targeted therapies, PARP inhibitors, ADCs, and novel immunotherapies. While significant progress has been made in improving outcomes for molecularly defined subgroups, substantial unmet needs remain, particularly in PROC and LGSOC. The late-stage pipeline, which includes therapies such as relacorilant and gotistobart, offers promising potential to redefine the standards of care. Alongside these, sacituzumab tirumotecan and raludotatug deruxtecan lead pivotal ADC development, while Corcept’s relacorilant and BioNTech’s Gotistobart show promise in PROC through novel immunotherapy and glucocorticoid receptor antagonism. Early ovarian cancer pipeline companies further enrich this evolving treatment landscape. Continued innovation, biomarker-driven personalization, and strategic clinical development will be crucial to delivering more effective, durable, and patient-centric treatment options in the years to come.

Downloads

Article in PDF

Recent Articles

- Altering the course of Ovarian cancer with emerging therapies in the horizon

- VBL Therapeutics’ VB-111 (ofranergene obadenovec); BMS’s mavacamten (Camzyos); Merck’s KEYTRUDA; ...

- Antibody–Drug Conjugates: An Emerging Concept in Cancer Therapy

- World Ovarian Cancer Day

- Assessment of Key Products that Got FDA Approval in Second Half (H2) of 2021