From Beta to Alpha Emitters: Radioligand Therapies Reshaping the Neuroendocrine Tumors Treatment Landscape

Nov 29, 2024

Table of Contents

Radioligand therapies are rapidly transforming the neuroendocrine tumor treatment landscape, offering new hope to patients and reshaping the market dynamics. This innovative approach, which combines the precision of targeted therapy with the potency of radiation, is gaining significant traction in the oncology community.

Keen to learn more? Read the full article to stay informed about the evolving landscape of NET awareness and treatment!

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Neuroendocrine Tumors (NETs): Unraveling the Mystery of a Complex Cancer

- Understanding Neuroendocrine Tumors (NETs): An In-Depth Look

- Prostate Cancer Market Experiences an Influx of the Pharma Players Veering the Market Ahead

- Gastrointestinal Cancers: Exploring the Range of Digestive Tract Malignancies

- Unveiling the Future: Global Neuroendocrine Tumor Market Trends & Innovations

The Rise of the first and only approved radioligand therapy for GEP-NET treatment

LUTATHERA (lutetium Lu 177 dotatate), a beta-emitting radioligand therapy, has been at the forefront of this revolution since its Food and Drug Administration (FDA) approval in 2018 for treating somatostatin receptor-positive (SSTR+) gastroenteropancreatic neuroendocrine tumors (GEP-NETs) in adults. Its success has been remarkable, with sales reaching USD 605 million in 2023, a 28% increase from the previous year. Novartis is making consistent efforts and is hoping that further label expansion opens up a much anticipated USD 1 billion market opportunity for LUTATHERA. The recent FDA approval of LUTATHERA for pediatric patients aged 12 and older in April 2024 further expands its reach, making it the first therapy specifically approved for this younger patient population. This milestone underscores the growing confidence in radioligand therapies and their potential to address unmet needs across different age groups.

Read the complete LUTATHERA’s journey in treating neuroendocrine tumors (NETs) in our blog

Novartis is eyeing LUTATHERA’s broad adoption that covers its first-line usage

While LUTATHERA has primarily been used as a second-line neuroendocrine tumor treatment, there is a growing interest in expanding its use to first-line settings for medium- and high-risk NETs. As per Novartis Q2 quarter report published in July 2024, LUTATHERA’s EU filing accepted for the treatment of newly diagnosed, unresectable or metastatic, well-differentiated (G2 and G3), SSTR+ GEP-NETs in adults, based on NETTER-2 study. NETTER-2 is the first and only positive Phase III trial for a radioligand therapy in the first-line setting, demonstrating the potential of radioligand therapies in earlier lines.

It is worth noting that LUTATHERA technically already has this indication within its US label (SSTR-positive GEP-NETs regardless of a patient’s prior treatment history), thanks to an FDA approval in 2018, but without data to support its widespread use. Since the approval-enabling NETTER-1 trial was conducted in patients with previously treated disease and in those with grade 1 and 2 tumors, the majority of LUTATHERA patients in the real world are getting the drug in the second line. Positive findings from NETTER-2 has highlighted and further strengthed LUTATHERA’s potential in earlier disease settings.

Novartis CEO Vas Narasimhan’s Statement during an investor call in October 2023 –“This (data from Phase III NETTER-2 study) would allow us then to add Lutathera on top and really, I think, benefit these patients in really meaningful ways. So we plan to present this data in the first part of next year. And in the case of the US, we wouldn’t need further label expansion and we plan to really move forward in educating the community on the importance of this data to move LUTATHERA into the frontline setting and in other jurisdictions around the world we’ll now evaluate how to further expand the label from a regulatory standpoint.”

With LUTATHERA and PLUVICTO, Novartis is working relentlessly to expand its radioligand therapy empire, while simultaneously preparing to take legal action against its rivals. Point Biopharma/Lantheus has filed what they say is the first generic version of Novartis’ top-selling cancer radionuclide therapy LUTATHERA in the US. Novartis has previously stated that it may take legal action to try to prohibit Lantheus’ generic based on patent infringement; under US law, this may result in a 30-month launch delay.

Beyond Beta-emitters radioligand therapies: What is the Market opportunity for Alpha-emitters radioligand therapies?

As the field of radioligand therapy evolves, there is an exciting shift towards alpha-emitting radioisotopes. Since only beta-emitting radioisotopes are currently approved, companies are now focusing on developing alpha emitters. Alpha particles offer several advantages over beta particles, including:

- Higher linear energy transfer (LET), resulting in greater biological damage to cancer cells

- Potential to overcome radio- and chemoresistance

- More focused cytotoxicity, sparing nearby healthy cells

Companies like ITM Solucin GmbH is working on a non-carrier-added beta-emitter therapy, while companies like Bristol Myers Squibb/RayzeBio, Radiomedix/Orano Med, Perspective Therapeutics, and others are actively advancing alpha-emitter therapies for neuroendocrine tumor treatment.

With its ability to selectively destroy cancer cells and even bulky tumors while giving patients an improved quality of life during treatment, Radioligand therapies hold great promise. Increasing global production measures, expanding the use across NETs subtypes, and exploring the potential of new radioisotopes (Actinium-225, Lead-212, and others) will be essential to serve a growing patient population of NETs.

Following the approval of LUTATHERA, there has been a significant shift in focus among pharmaceutical companies toward the development of radioligand therapies. While some players, such as ITM Solucin GmbH, are advancing more refined beta-emitting radioligand therapies, others, including Bristol Myers Squibb/RayzeBio, Radiomedix/Orano Med, and Perspective Therapeutics, are exploring the potential of alpha-emitting radioligand therapies. This innovation-driven competition is transforming the therapeutic landscape for NETs.

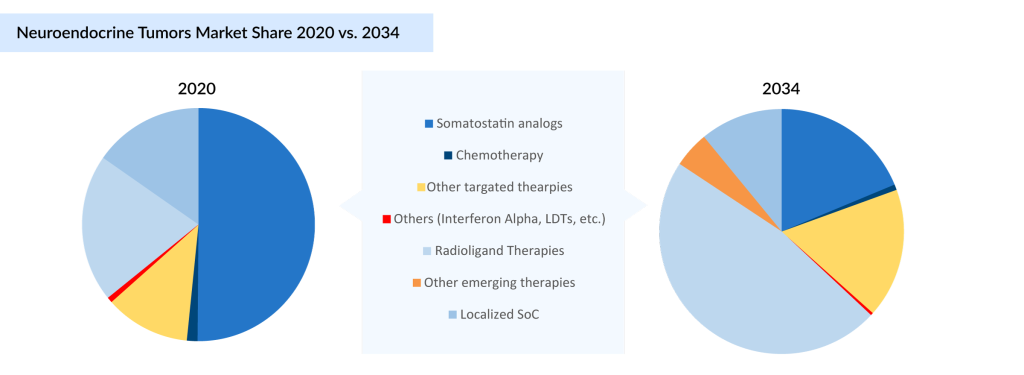

In 2020, SSAs dominated the US neuroendocrine tumor treatment market, accounting for approximately 50% of the market share. However, by 2034, radioligand therapies are projected to capture the maximum share of the neuroendocrine tumor treatment market, reflecting a paradigm shift driven by their enhanced efficacy and the growing adoption of targeted treatment approaches. This trend underscores the rising prominence of radioligand therapies in redefining neuroendocrine tumor treatment standards.

ITM-11, an emerging radioligand therapy from ITM Solucin GmbH, is anticipated to capture USD 409 million in the US by 2034. Radiomedix and Orano Med are developing AlphaMedix, the first radioligand therapy to receive breakthrough therapy designation (BTD). AlphaMedix has demonstrated a response rate of 62.5% in GEP-NET patients who had not previously undergone peptide receptor radionuclide therapy (PRRT) with LUTATHERA. AlphaMedix is expected to capture a revenue of USD 211 million in the US by 2034.

Summary

The development of innovative therapies, particularly radioligand treatments (both beta-emitting radioligand therapies and alpha-emitter-based therapies) are expected to drive the overall NETs market size. On the other hand, the complex nature of NETs, combined with challenges in drug manufacturing and administration (especially for radiopharmaceuticals), poses significant barriers to market entry and growth. Additionally, the impact of generic competition affects the sales of approved drugs. As research continues and new neuroendocrine tumor therapies emerge, patients with NETs can look forward to more effective, targeted treatments that offer the promise of better outcomes and improved quality of life.

Downloads

Article in PDF

Recent Articles

- Novartis’ LUTATHERA for GEP-NET Treatment: Ray of Hope for Pediatric Patients

- Unveiling the Future: Global Neuroendocrine Tumor Market Trends & Innovations

- Neuroendocrine Tumors (NETs): Unraveling the Mystery of a Complex Cancer

- Understanding Neuroendocrine Tumors (NETs): An In-Depth Look

- Prostate Cancer Market Experiences an Influx of the Pharma Players Veering the Market Ahead