In Search for a Curative Treatment Option for Duchenne Muscular Dystrophy

Aug 20, 2024

Sarepta Therapeutics, a leader in precision genetic medicine for rare diseases, has recently achieved a significant milestone with the FDA’s approval of AMONDYS 45 (casimersen). This antisense oligonucleotide, developed from Sarepta’s phosphorodiamidate morpholino oligomer (PMO) platform, is now approved for treating Duchenne muscular dystrophy (DMD) in patients with a confirmed mutation amenable to exon 45 skipping. This approval follows a demonstration of a statistically significant increase in dystrophin production in skeletal muscle, which is expected to provide clinical benefits for exon 45-amenable patients. Continued approval of AMONDYS 45 may depend on the results of ongoing confirmatory trials.

The ESSENCE trial, a placebo-controlled study designed to support AMONDYS 45’s approval, is ongoing and is expected to conclude in 2024. While no kidney toxicity was observed in the clinical studies, there is a risk of kidney toxicity, including potentially fatal glomerulonephritis, associated with some antisense oligonucleotides. Regular monitoring of kidney function is recommended for patients using AMONDYS 45. Common adverse reactions reported in at least 20% of patients included upper respiratory tract infections, cough, fever, headache, joint pain, and pain in the mouth and throat.

In June 2024, Sarepta Therapeutics also received FDA approval to expand ELEVIDYS (delandistrogene moxeparvovec) for use in ambulatory DMD patients aged 4 and older, and received accelerated approval for non-ambulatory patients. This expansion resulted in a notable 40% increase in Sarepta’s stock. However, Sarepta’s forecast of flat sales for ELEVIDYS, leading to a first-quarter sales estimate of $131 million, fell short of analyst expectations, causing a nearly 11% decline in the company’s stock.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- The Business Cocktail(Therapeutics)

- Pfizer’s RSV Vaccine; Forte Biosciences’ Atopic Dermatitis Asset; Bone Therapeutics’ Osteoarthrit...

- Top 5 Cancers Creating Major Challenge To The Global Healthcare System

- Emerging Therapies in the Chronic Pain Pipeline Transforming the Chronic Pain Market Landscape

- Notizia

ELEVIDYS, approved in June 2023, is the first gene therapy for treating pediatric patients aged 4-5 years with a confirmed DMD gene mutation. The therapy is administered with oral corticosteroids and requires weekly liver enzyme monitoring post-treatment.

VYONDYS 53 (golodirsen), another Sarepta product, is approved for treating DMD patients with a confirmed mutation amenable to exon 53 skipping. This approval, granted in December 2019, was based on observed increases in dystrophin production. VYONDYS 53 benefits from NCE exclusivity until December 2024 and Orphan Drug Exclusivity until December 2026.

Sarepta Therapeutics remains a key player in the DMD market, with three approved therapies and additional products in development. Despite its market leadership, emerging competition and geographic regulatory discrepancies continue to influence the DMD treatment landscape.

Duchenne muscular dystrophy is a rare genetic disorder, which is caused by the lack of functional dystrophin protein and the missing of exons in the dystrophin gene. DMD is characterized by muscle weakness, and over time heart and breathing muscles also begin to deteriorate, and ultimately the disease proves to be lethal. By the age of 12, most patients start to use a wheelchair. Inherited in X-linked recessive pattern, DMD mostly affects males; however, it can also affect females in an unusual, rare case. The total diagnosed Duchenne Muscular Dystrophy prevalent population in the 7MM was found to be 31,400 in 2023, estimated DelveInsight.

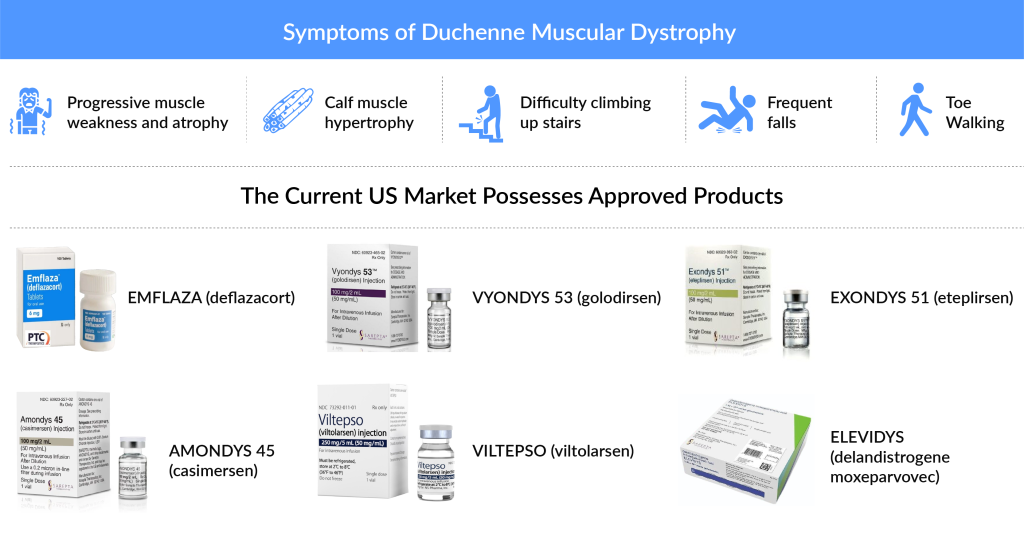

With no cure at present, the current US Duchenne Muscular Dystrophy Market is mainly dominated by the use of Glucocorticoids (Prednisone, Prednisolone along with several others) and approved therapies, which include both Exon skipping therapies (EXONDYS 51 and VYONDYS 53) and another approved corticosteroid EMFLAZA (PTC Therapeutics).

EXONDYS 51 (eteplirsen), which even though in a very dramatic manner, managed to get approval in 2016. The therapy is for DMD patients with a confirmed mutation amenable to exon 51 skipping. Although the accelerated approval faced a lot of criticism because of the lack of evidence of clinical benefit in disease progression, the FDA’s approval to Sarepta’s VYONDYS 53 (golodirsen), left the healthcare industry baffled. The approval of the therapy demonstrated the adequacy of dystrophy as a surrogate for winning the FDA’s accelerated approval in the case of DMD, a rare disorder with high unmet needs. It is not to be missed that VYONDYS 53, just like EXONDYS 51, has won conditional approval, and the final approval is based on the ESSENCE trial (NCT02500381) which is in Phase III and a post-marketing trial. However, the launch of Viltolarsen by NS Pharma, which is an Exon-53 skipping therapy is bound to give a significant face off to Sarepta’s VYONDYS 53.

Besides Sarepta, other pharmaceutical companies investing in the Duchenne Muscular Dystrophy Market are PTC Therapeutics, Nippon Shinyaku, Santhera Pharmaceuticals/ReveraGen BioPharma, Taiho Pharmaceutical, FibroGen, Capricor, Daiichi Sankyo, Italfarmaco, Antisense Therapeutics, Solid Biosciences, and others. Taiho Pharmaceutical’s TAS-205, FibroGen’s Pamrevlumab, and Capricor’s CAP-1002 are some of the other pipeline therapies in the DMD market.

Even though the therapies exist in the DMD market, the controversies regarding their use exist too. The therapies are not curative. Moreover, the therapies target only a fraction of the patients, such as VYONDYS 53, which only targets 13% of the DMD patient pool with no proven clinical efficiency. Another therapy with the potential to address the entire DMD patient population is DUVYZAT (givinostat), recently approved by the FDA in March 2024. Developed by Italfarmaco, givinostat is approved for use in boys aged 6 years and older with any genetic variant of Duchenne muscular dystrophy (DMD). This oral medication received fast track, orphan drug, and rare pediatric designations. Initially scheduled for a Prescription Drug User Fee Act date of December 21, the FDA extended the review period to March 21 to thoroughly evaluate Italfarmaco’s application.

However, the launch of emerging therapies in the Duchenne Muscular Dystrophy Pipeline, mostly in Phase II or III trials, is going to impact the DMD therapeutical landscape positively. As per DelveInsight, Duchenne Muscular Dystrophy Market is anticipated to grow promisingly well from USD 2,150 million as estimated in 2023 for the study period of 2020 to 2034. Moreover, the FDA’s flexibility in granting accelerated approvals to therapies for rare diseases with high unmet needs shows the agency’s sheer dedication to bringing relief to the patients suffering from the disease.

Downloads

Article in PDF

Recent Articles

- New Player in Ulcerative Colitis Treatment: Pfizer’s Etrasimod Entry Counters BMS’ Zeposia

- Hemophilia A- Market Scenario

- Pfizer’s RSV Vaccine; Forte Biosciences’ Atopic Dermatitis Asset; Bone Therapeutics’ Osteoarthrit...

- Eli Lilly’s Obesity Treatment Drug Candidates – A Show for the Competitors

- Merck’s Keytruda sales; Valeant on name change; Pfizer – BMS; Amgen puts Repatha outcomes for deal