Roche’s Vabysmo Third US Approval Spiced Up the Battle With Regeneron and Bayer’s Eylea

Nov 10, 2023

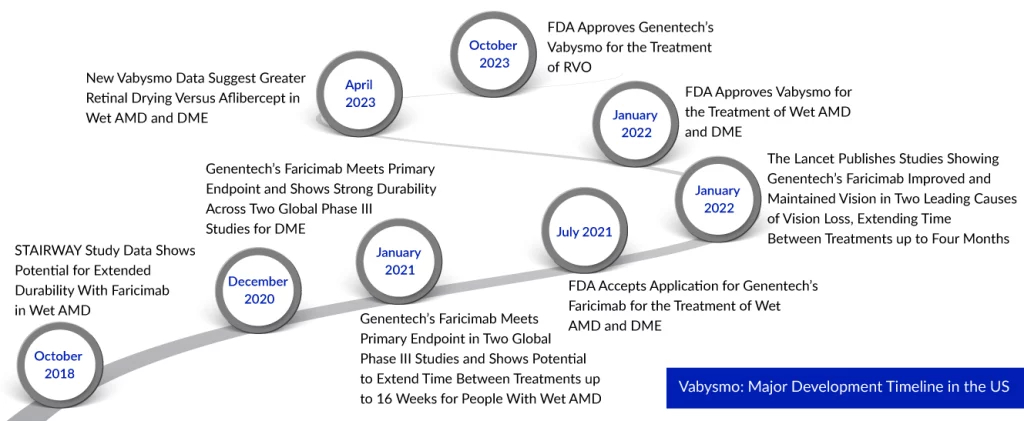

Roche’s Vabysmo secures a new FDA nod for retinal vein occlusion treatment, intensifying the competition with Regeneron and Bayer’s Eylea in the eye medication market. This approval for Vabysmo in RVO adds another shared medical indication for the competing eye medications. Vabysmo’s successful FDA approval for RVO follows its earlier nods from the FDA for treating wet age-related macular degeneration (AMD) and diabetic macular edema (DME).

Collectively, these three retinal conditions impact approximately 3 million individuals in the United States and stand as primary contributors to vision impairment. As per DelveInsight analysis, in the year 2021, the total retinal vein occlusion prevalent cases were approximately 2.7 million cases in the 7MM, which are expected to increase by 2032 at the CAGR of 1.0% during the study period (2019–2032). In the 7MM, total type-specific diagnosed prevalent cases of retinal vein occlusion were approximately 298K cases for CRVO and approximately 1.2 million cases for BRVO in the year 2021. As per the analysis, these cases are expected to increase by the year 2032.

“Vabysmo, a recently developed remedy for RVO, has shown promising results in enhancing and maintaining vision, alongside effectively reducing retinal moisture,” according to Dr. Levi Garraway, Roche’s Chief Medical Officer and Head of Global Product Development. “Extensive global clinical trials substantiate the established safety and efficacy of Vabysmo, complemented by a mounting body of real-world data from the treatment of hundreds of thousands of individuals.”

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Booming Healthcare sector in MENA: Lucrative opportunity for Global pharma players

- Takeda’s ADZYNMA Approved by FDA; AskBio Presents Preliminary Data from Phase I Trial of Gene The...

- Bayer Partners with DelSiTech to Develop; Amgen and Arrowhead Announce; Allergan, AstraZeneca’s d...

- AZ’s benralizumab; Sanofi, Regeneron set; Nordisk preps; European countries offer

- Angelman syndrome Pipeline: Unmet needs call for a robust pipeline

Vabysmo marks a significant milestone as the first approved bispecific antibody designed for ocular use. It works by simultaneously targeting and neutralizing two key signaling pathways associated with various sight-threatening retinal conditions: angiopoietin-2 (Ang-2) and vascular endothelial growth factor-A (VEGF-A). These pathways believed to contribute to vision loss by destabilizing blood vessels and promoting the formation of leaky vessels and inflammation, are effectively blocked by Vabysmo. The treatment aims to stabilize blood vessels, providing hope for improved visual outcomes.

The approval is grounded on favorable outcomes observed in the extensive Phase III BALATON and COMINO studies. These studies employed a randomized, multicenter, double-masked design to assess the safety and efficacy of Vabysmo (faricimab-svoa) in comparison to aflibercept. Over the initial 20 weeks, patients were randomly assigned in a 1:1 ratio to receive either Vabysmo (6.0 mg) or aflibercept (2.0 mg) through monthly injections for a span of six months. Following this, from weeks 24 to 72, all participants received Vabysmo (6.0 mg) up to every four months, following a treat-and-extend dosing regimen.

These studies exhibited that regular administration of Vabysmo produced prompt and lasting enhancements in vision for individuals with both branch and central RVO. The BALATON study enrolled 553 individuals affected by branch retinal vein occlusion, while the COMINO study involved 729 participants diagnosed with central retinal or hemiretinal vein occlusion. The primary objective of achieving visual acuity gains at 24 weeks, compared to aflibercept, was met. Additionally, data highlighted Vabysmo’s ability to rapidly and effectively reduce retinal fluid. Throughout BALATON and COMINO, Vabysmo demonstrated generally good tolerance with a safety profile consistent with prior trials. The primary reported adverse reaction, conjunctival hemorrhage, occurred in 3% of cases. Safety outcomes remained uniform across all arms of the studies.

New data has been included in the Warnings & Precautions part of the U.S. label due to infrequent instances of retinal vasculitis and/or retinal vascular blockage observed after the product was marketed. These cases usually occur alongside inflammation within the eye. The documented occurrence rate of retinal vasculitis with vascular blockage is 0.06 for every 10,000 injections. This frequency aligns with the actual reported rates in the real world for other commonly used intravitreal treatments for individuals managing wet AMD, DME, and RVO.

As of now, Vabysmo has received approvals in over 80 countries worldwide for individuals coping with wet AMD and DME, with an approximate global distribution of 2 million doses.

Vabysmo has emerged as a formidable rival to the long-standing leader, Regeneron and Bayer’s Eylea. Eylea gained FDA approval for RVO treatment in 2014. However, during the second quarter of this year, Eylea experienced a 7% decline in sales year-over-year, amounting to $1.5 billion. Conversely, Vabysmo achieved blockbuster status shortly after its initial approval in January 2022. Roche’s medication generated 957 million Swiss francs ($1.1 billion) in revenue during the first half of 2023, establishing itself as the primary catalyst for the company’s growth.

Bayer acknowledges the challenge, as highlighted by Stefan Orlerich, the head of the pharmaceutical division, cautioning that the success trajectory of Eylea might not match the levels seen in previous years during the company’s earnings call for the fourth quarter and full year of 2022. To counter this, Eylea introduced a high-dose version following an unexpected manufacturing-related setback in June, gaining approval in August. Results from Phase III retinal vein occlusion trials indicate that this new variant demonstrates prolonged effectiveness compared to Vabysmo.

Genentech has a comprehensive Phase III clinical development program dedicated to Vabysmo, including studies such as AVONELLE-X, an extension of TENAYA and LUCERNE, assessing the long-term safety and tolerability of Vabysmo in neovascular age-related macular degeneration (AMD). Additionally, RHONE-X, an extension of YOSEMITE and RHINE, is examining the long-term safety and tolerability of Vabysmo in diabetic macular edema. Furthermore, Genentech has commenced various Phase IV studies: ELEVATUM, focusing on underrepresented DME patient populations; SALWEEN, targeting a prevalent subpopulation of wet AMD in Asia, and the global real-world data collection platform, VOYAGER (VOYAGER study). Genentech is also actively supporting independent studies to further comprehend retinal conditions with substantial unmet needs.

FAQs

A blood clot plugs the vein, resulting in retinal vein occlusion. It can happen when the veins in the eye are too narrow. It is more common in persons with diabetes and those with high blood pressure, high cholesterol, or other health issues that influence blood flow.

The retinal vein occlusion symptoms range from mild to severe. There is no pain associated with the blurring or loss of eyesight. It nearly always occurs in only one eye. The blurring or loss of vision may be mild at first but gradually worsens over the next few hours or days. Occasionally, full visual loss occurs nearly quickly.

There are several tests used for retinal vein occlusion diagnosis. The most common include optical coherence tomography, ophthalmoscopy, fluorescein angiography, and others.

The specific retinal vein occlusion causes are still unknown. However, several factors can put an individual at the risk of having retinal vein occlusion.

The available retinal vein occlusion treatment environment is as restrictive as it was a decade ago. Although there are FDA-approved drugs for the indication, a curative treatment reversing retinal vein occlusion is a major unmet need.

Downloads

Article in PDF

Recent Articles

- Follicle Stimulating Hormone for treatment of Endometriosis

- 4D Molecular Therapeutics raises; Arvinas slates for IPO; Sutro ruminates for $ 75M; Emergent Bio...

- Gilead Sciences’ Sunlenca Approval; FDA Approves Roche’s CD20xCD3 Bispecific Antibody Lunsumio; E...

- Chronic Kidney Disease: Complex Debilitating Condition

- Acquisition of Stemline; Roche’s Elecsys Anti-SARS-CoV-2 antibody test; Newron’s abandonment of S...