A Market Space Beyond Lucentis and Eylea for Retinal Vein Occlusion Treatment

Jul 22, 2022

- Competitive inroads by Regeneron’s Eylea in the retinal vein occlusion treatment landscape changed the market once dominated by Roche.

- Moving forward, RVO’s robust pipeline, along with several VEGF inhibitors, creates trouble for the big ones; Lucentis and Eylea.

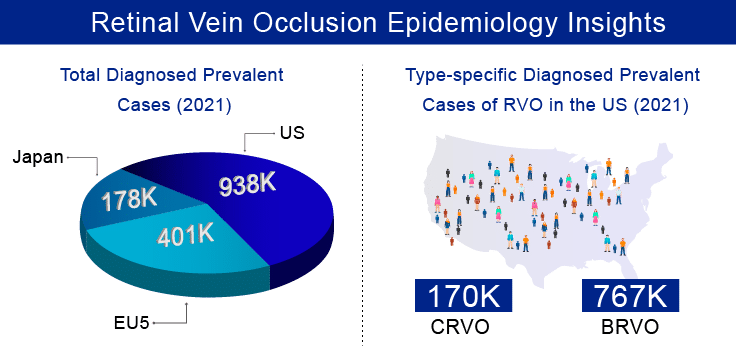

Retinal vein occlusion is the second most common sight-threatening retinal vascular disorder following diabetic retinopathy and the common cause of vision loss in older individuals. As per our estimates, there were approximately 1.5 million diagnosed prevalent cases of retinal vein occlusion in the 7MM in 2021, which is further expected to increase by 2032. Moreover, In the 7MM, total gender-specific diagnosed prevalent cases of RVO were higher among females than males in the year 2021. As per the estimates, these cases are expected to increase by the year 2032. Additionally, it was observed that out of total diagnosed prevalent cases of RVO in the US, the highest cases were of BRVO than CRVO in 2021, and these cases are expected to increase significantly by 2032.

Furthermore, the disease prevalence and awareness are increasing with the growing geriatric population as age, and systemic vascular disorders are major RVO risk factors, with age being a key determinant in its intensity of progression. It generally affects sexagenarians and beyond, leading to difficulty in diagnosis and treatment due to associated complications like diabetes and high blood pressure.

However, the available retinal vein occlusion treatment environment is as restrictive as it was a decade ago. Although there are FDA-approved drugs for the indication, a curative treatment reversing retinal vein occlusion is a major unmet need. Available retinal vein occlusion therapies control the associated symptom to prevent further visual loss and minimize the damage due to complications such as macular edema, ischemia, or neovascularization.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Analyzing the Most Promising Drugs That Will Lose Patent in the US & EU in 2022

- FDA’s Ok to Roche’s Oral SMA Therapy; Roche’s Etrolizumab Mixed Results in Ulce...

- Dendreon touts; Zytiga slashes risk; Lynparza posts; Dacomitinib wins; Alecensa trounces

- Top 5 Cancers Creating Major Challenge To The Global Healthcare System

- Booming Healthcare sector in MENA: Lucrative opportunity for Global pharma players

Currently, the three drugs approved by the FDA to treat visual impairment due to macular edema secondary to branch retinal vein occlusion and central retinal vein occlusion include Roche’s Lucentis (ranibizumab), Eylea (aflibercept) by Regeneron, which are intravitreal injections of anti-VEGF’s, and Ozurdex by AbbVie, a dexamethasone implant. The retinal vein occlusion market is vibrant with off-label therapies like Avastin (bevacizumab) by Roche and intravitreal triamcinolone, which are used extensively.

Lucentis (ranibizumab), developed by Roche, and marketed by Novartis and Chugai pharmaceuticals in North America and Japan, respectively, enjoyed the early mover advantage since its approval by the FDA in 2010. Lucentis injection, being the first approved VEGF inhibitor for RVO, dominated the retinal vein occlusion treatment market alone for a long time due to its patent exclusivity, complemented by the piecemeal approval of Eylea globally.

The recent loss of its patent exclusivity and the simultaneous approval of Lucentis biosimilars referencing ranibizumab, like Byooviz (ranibizumab-nuna) co-developed by Samsung Bioepis and Biogen approved by the FDA, and Ongavia developed by Teva Pharmaceuticals approved by the UK Medicines & Healthcare Regulatory Agency, will create a wide sink in the already restricted retinal vein occlusion market space of Lucentis which is contending with Eylea injection since its approval.

Earlier, the debate was only restricted to Roche’s stellar products, Lucentis and Avastin, a cancer drug that was repackaged for small doses to use in the eye and low-priced than Lucentis. However, Regeneron’s Eylea approval by the US FDA in 2012 to treat macular edema following central retinal vein occlusion has changed much for Roche.

Eylea injection approved globally for both CRVO and BRVO – dominates the retinal vein occlusion market due to enhanced safety and efficacy, better or comparative gains in visual acuity and BCVA levels, improved and less dosing, and low cost. In contrast, Avastin injection, a less expensive anti-VEGF drug than aflibercept, cannot bear a discount on Regeneron sales due to being an off-label drug.

As per our analysis, Regeneron will enjoy the lion’s share in the retinal vein occlusion treatment market space till Eylea attains its peak market share by 2024. However, the loss in its retinal vein occlusion treatment market dominance due to the entry of new, improved retinal vein occlusion therapies will be further exacerbated by the loss of its patent exclusivity by 2027.

On the other hand, Ozurdex injection by AbbVie, a dexamethasone implant with a different mechanism of action, has secured a significant place in the competitive retinal vein occlusion treatment market because it is a single approved drug in the separate corticosteroid niche with no considerable competitor. With a patent exclusivity till 2023, this second-line therapy for eyes with chronic edema poorly responsive to anti-VEGF injections has little to fear. However, off-label intravitreal triamcinolone cuts into this exclusive space with fewer consequences.

Several new therapies are currently under investigation for retinal vein occlusion treatment. Some of the promising new treatments for retinal vein occlusion include ONS-5010/Lytenava (Outlook Therapeutics), KSI-301 (Kodiak Sciences), TLC399/ProDex (Taiwan Liposome Company), AR-1105 (Aerie Pharmaceuticals), GB-102 (Graybug Vision), and Vabysmo (faricimab/RG7716) (Roche/Chugai Pharmaceuticals). Quite a few of these emerging retinal vein occlusion therapies have anti-VEGF agonist mechanisms of action and will vie with the already approved biggies: Lucentis and Eylea.

Vabysmo (faricimab/RG7716), being developed by Roche with CrossMab technology targeting two distinct pathways (VEGF and angiopoietin inhibitor) that drive several retinal conditions, is expected to enter the retinal vein occlusion treatment market by 2024. With improved dosing, reduced retinal vein occlusion treatment burden, and improvements in vision loss owing to a novel mode of action in Vabysmo, Roche has found an excellent replacement for Lucentis, which has lost its patent exclusivity and market shine. It will help Roche regain the lost retinal vein occlusion treatment market from Regeneron.

However, Roche will have to share its space with another Phase III anti-VEGF, KSI-301, being developed by Kodiak Sciences. KSI-301 will give tough competition to similar retinal vein occlusion therapies with enhanced therapeutic absorption and distribution in the eye and a novel design that will maintain effective drug levels in ocular tissues longer than the existing agents. As per DelveInsight analysis, KSI-301 will dominate the retinal vein occlusion treatment market during the forecast period (2022–2032) after its expected launch in 2024.

Another candidate whose approval will impact others in the retinal vein occlusion treatment market space is Outlook Therapeutics’ ONS-5010/Lytenava, an investigational ophthalmic formulation of bevacizumab. It has the potential to mitigate the risks associated with the use of off-label Avastin, and once approved, it will be the first and only FDA-approved, on-label, responsibly priced bevacizumab for ophthalmic indications. The only drawback with this late-stage drug is its limited branch retinal vein occlusion target audience, a boon for others but a bane for Outlook Therapeutics.

In addition to these emerging performers, there are a few early-stage retinal vein occlusion drugs worth mentioning like ANXV by Annexin Pharmaceuticals, Autologous Bone Marrow CD34+ Stem Cells by The Emmes Company, and EYP-1901 (vorolanib) by EyePoint Pharmaceuticals, which can change the entire retinal vein occlusion treatment market scenario if approved as they may provide the much-needed cure for RVO. It is too early to be over-enthusiastic about these products, but according to our analysis, these are products to watch out for in the future in a retinal vein occlusion treatment market dominated by anti-VEGF and corticosteroids.

FAQs

A blood clot plugs the vein, resulting in retinal vein occlusion. It can happen when the veins in the eye are too narrow. It is more common in persons with diabetes and those with high blood pressure, high cholesterol, or other health issues that influence blood flow.

The retinal vein occlusion symptoms range from mild to severe. There is no pain associated with the blurring or loss of eyesight. It nearly always occurs in only one eye. The blurring or loss of vision may be mild at first but gradually worsens over the next few hours or days. Occasionally, full visual loss occurs nearly quickly.

There are several tests used for retinal vein occlusion diagnosis. The most common include optical coherence tomography, ophthalmoscopy, fluorescein angiography, and others.

The specific retinal vein occlusion causes are still unknown. However, several factors can put an individual at the risk of having retinal vein occlusion.

The available retinal vein occlusion treatment environment is as restrictive as it was a decade ago. Although there are FDA-approved drugs for the indication, a curative treatment reversing retinal vein occlusion is a major unmet need.

Leading pharma companies such as AbbVie, Roche, Regeneron Pharmaceuticals, Taiwan Liposome Company, Aerie Pharmaceuticals, Graybug Vision, Outlook Therapeutics, Kodiak Sciences Inc, Chugai Pharmaceuticals, and others are currently developing novel therapies to improve the retinal vein occlusion treatment landscape.

Several new therapies are currently under investigation for retinal vein occlusion treatment. Some of the promising new treatments for retinal vein occlusion include ONS-5010/Lytenava (Outlook Therapeutics), KSI-301 (Kodiak Sciences), TLC399/ProDex (Taiwan Liposome Company), AR-1105 (Aerie Pharmaceuticals), GB-102 (Graybug Vision), and Vabysmo (faricimab/RG7716) (Roche/Chugai Pharmaceuticals).

Downloads

Article in PDF

Recent Articles

- Analyzing the Key Trends Driving the Biosimilar Market Growth

- Roche signs Icagen; UCB devote $255M; Siemens Healthineers celebrates

- Roche’s drug; Cancer drugs risk; FDA norms; Takeda sets deal

- 4D Molecular Therapeutics raises; Arvinas slates for IPO; Sutro ruminates for $ 75M; Emergent Bio...

- Revolutionizing the Food Allergy Treatment: The Impact of Xolair’s Approval