Bispecific and Trispecific Antibodies: Are They Better Than CAR-Ts?

Jun 10, 2025

Table of Contents

CAR-T cell therapy has revolutionized the treatment of blood cancers, earning regulatory approval and delivering impressive results in hematologic malignancies. However, its success has not yet translated to solid tumors, where it continues to face significant challenges and limited long-term efficacy. As a result, ongoing CAR-T development remains largely focused on blood cancers.

In contrast, bispecific antibodies have emerged as a versatile and promising class of therapeutics, securing approvals for both blood cancers and solid tumors. Notably, they have shown more consistent and durable responses in solid tumor settings. Current research and development in the bispecific antibody space increasingly target solid tumors, driven by their favorable clinical outcomes and broader applicability.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Pfizer to acquire Arena Pharma; Takeda’s ‘Wave 2’ multiple myeloma med data; No...

- Sandoz’s Generic Revlimid; Agios’ Pyrukynd; Organon Announces 4Q & Full-year Earnings ...

- Exosomes: Tiny Messengers with Big Potential in Medical Science

- Novartis’ Canakinumab for NSCLC; Novartis’s Zolgensma Updates; Trodelvy Prospects in New Breast C...

- Navigating the Healthcare Horizon: Odyssey of Mergers, Funding, and Acquisitions in 2024

Moreover, the “off-the-shelf” nature and relatively simpler manufacturing process of bispecific antibodies offer a clear advantage over the complex and personalized production of CAR-T therapies. This makes bispecific antibodies an attractive and scalable option in the evolving landscape of cancer immunotherapy.

Target Patient Pool for Bispecific and Trispecific Antibodies

In the 7MM, the highest eligible pool of promising indications for bispecific antibodies in oncology was seen in the United States, followed by EU4 and the UK in 2024. The treatment-eligible pool of potential indications for bispecific antibodies in oncology in the United States was around 900K in 2024.

As per the estimates, of the selected hematological indications in the 7MM in 2024, the patient pool for DLBCL and Multiple Myeloma is high. For example, the patient pool for Acute Lymphocytic Leukemia (ALL), a less prevalent type of leukemia that primarily affects children, is smaller. In 2024, among the solid cancers, NSCLC and Breast cancer have significantly larger patient pools due to their higher incidence in the United States.

Numerous bispecific antibodies have received FDA approval, and Key Late-Stage (Registered, Phase III and II/III) emerging bispecific players include AstraZeneca (Generalised Myasthenia Gravis), Zenas BioPharma (IgG4-related Disease, Relapsing Multiple Sclerosis [RMS], and Systemic Lupus Erythematosus [SLE]), Merus (Pancreatic Cancer and HNSCC), Regeneron (DLBCL, Follicular lymphoma), Sichuan Baili Pharmaceutical (NSCLC), Alphamab (Pancreatic), AstraZeneca (BTC, NSCLC, HNSCC), SystImmune (Nasopharyngeal), Biotheus (TNBC), and others

Trispecific antibodies are a relatively uncharted territory with the majority of players such as Innovent Biologics (Multiple Myeloma), Merck (Multiple Myeloma and Neuroendocrine tumor), Genor Biopharma (NSCLC), Chimagen Biosciences (Non-Hodgkin’s lymphoma), Sanofi (Acute myeloid leukemia, Myelodysplastic syndromes, Blastic Plasmacytoid Dendritic Cell Neoplasia), Beijing Mabworks Biotech (Multiple Myeloma), Roche (Multiple Myeloma and Neuroendocrine tumor), Simcere Pharma (Multiple Myeloma), Johnson & Johnson Innovative Medicine (CLL, NHL, Multiple Myeloma), Novartis, Chugai, Numab Therapeutics, and others, in early stage of development.

Bispecific Antibodies: Bridging the Gap

Bispecific antibodies are designed to address complex diseases by targeting two disease factors simultaneously within a single molecule. Three main bispecific antibody fragment formats are Bispecific T-cell engager (BiTE), Dual-affinity re-targeting proteins (DARTs), and Tandem diabodies (TandAbs).

While most are approved for cancer treatment, specifically for conditions like multiple myeloma and DLBCL, few, including HEMLIBRA and VABYSMO, have been sanctioned for non-cancer uses such as hemophilia A, wet age-related macular degeneration, and diabetic macular edema. Additionally, KIMMTRAK, another bispecific agent, has gained approval for treating uveal melanoma.

In addition, in the past few years, there have been significant breakthroughs in cancer therapy within the pharmaceutical field, particularly with the emergence of bispecific antibodies as a leading edge of progress. A significant achievement in this regard was the approval by the FDA of BLINCYTO, the pioneering bispecific antibody aimed at treating relapsed or refractory B-cell acute lymphoblastic leukemia, which targets CD19 X CD3.The approval of BLINCYTO marked a pivotal moment in the research and development landscape of bispecific antibodies. With this therapy, Amgen has fortified its position in treating acute lymphoblastic leukemia. Looking ahead, Amgen aims to broaden its reach by venturing into first-line consolidation treatment and addressing patients who can benefit from chemotherapy reduction. Furthermore, the company is actively working on a subcutaneous formulation of BLINCYTO to ensure its sustained presence in the market.

RYBREVANT boasts superior safety profiles compared to the now-withdrawn EXKIVITY, particularly in patients with EGFR mutations involving exon 20 insertion. In September 2024, the FDA approved RYBREVANT with chemotherapy (carboplatin and pemetrexed) for adults with advanced or metastatic NSCLC with EGFR exon 19 deletions or L858R mutations, whose disease progressed after EGFR TKI treatment. It also received FDA and European Commission approval, in combination with LAZCLUZE, for first-line treatment of advanced NSCLC, supported by Phase III PALOMA-3 results. The European Commission extended approval for a subcutaneous formulation of RYBREVANT with LAZCLUZE. Additionally, RYBREVANT is under investigation in the Phase III ORIGAMI-2 trial for colorectal cancer. Further, there are plans to broaden its application to target EGFR NSCLC, potentially positioning it as a competitor to TAGRISSO in the future.

TECVAYLI, ELREXFIO, and TALVEY targeting BCMAxCD3, BCMA X CD3, and GPRC5D xCD3 T-cell engagers, respectively, for the treatment of adult patients with relapsed or refractory multiple myeloma who have undergone at least four prior lines of therapy. TECVAYLI was approved in 2022, while ELREXFIO and TALVEY were approved in 2023 by the FDA.

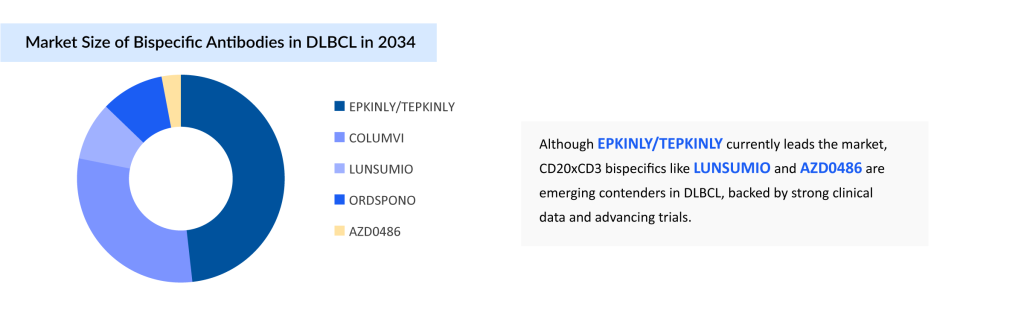

LUNSUMIO, a bispecific CD20-directed CD3 T-cell engager indicated for treating adult patients with relapsed or refractory follicular lymphoma after the FDA approved two or more lines of systemic therapy in 2022.

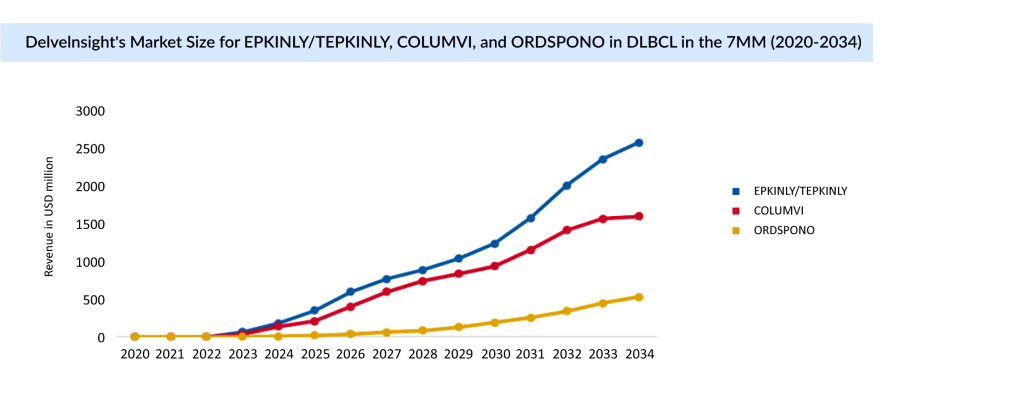

EPKINLY and COLUMVI are bispecific CD20-directed CD3 T-cell engagers approved by the FDA in 2023 for the treatment of adult patients with relapsed or refractory DLBCL, not otherwise specified (DLBCL, NOS), or Large B-cell Lymphoma (LBCL) originating from follicular lymphoma, following two or more lines of systemic therapy.ORDSPONO was approved by the EU (2024) for treating relapsed/refractory follicular lymphoma and DLBCL after two or more lines of systemic therapy. In February 2025, the FDA accepted the resubmission of the Biologics License Application (BLA) for ORDSPONO, aimed at treating relapsed or refractory follicular lymphoma after two or more lines of systemic therapy. The FDA’s target action date for a decision is July 30, 2025.

In November 2024, ZIIHERA received FDA approval for intravenous use in adults with previously treated, unresectable, or metastatic HER2-positive (IHC 3+) Biliary Tract Cancer (BTC), as confirmed by an FDA-approved test. This makes it the first and only dual HER2-targeted bispecific antibody approved for HER2-positive BTC in the US. The approval was granted under the accelerated pathway based on findings from the HERIZON-BTC-01 clinical trial, which reported a 52% objective response rate and a median duration of response of 14.9 months, as assessed by Independent Central Review (ICR). It is also being explored in various other tumor types, including ongoing Phase III trials for Gastroesophageal Adenocarcinomas (GEA) and metastatic Breast Cancer (mBC).

BIZENGRI was approved by the FDA in 2024 for adults with pancreatic adenocarcinoma and NSCLC that are advanced, unresectable, or metastatic and harbor NRG1 gene fusions.

IMDELLTRA, a bispecific delta-like ligand 3 (DLL3)-directed CD3 T-cell engager indicated for the treatment of adult patients with Extensive Stage Small Cell Lung Cancer (ES-SCLC) with disease progression on or after platinum-based chemotherapy, was approved by the FDA in 2024.

Promising Bispecific and Trispecific Antibodies in the Pipeline

Bispecific antibodies have gained significant attention, whereas trispecific antibodies remain largely unexplored. Most companies are still in the initial phases of research and development. Sanofi and Johnson & Johnson stand out for their ambitious efforts in this area, with several projects underway. In contrast, many other companies have only one trispecific antibody in their developmental pipeline. The majority of the upcoming key players are focusing on oncology indications; only a few, such as AstraZeneca, are active in the non-oncology space.

The promising bispecific antibodies in the pipeline include Ivonescimab (Akeso/Summit Therapeutics), Zenocutuzumab and Petosemtamab (Merus), and Cevostamab (Roche), Volrustomig and Rilvegostomig (AstraZeneca), DR-0201 (Dren Bio), among others.

In March 2025, Sanofi and Dren Bio had entered into a definitive agreement under which Sanofi had agreed to acquire DR-0201, a targeted bispecific myeloid cell engager (MCE) that has shown robust B-cell depletion in pre-clinical and early clinical studies.

Ivonescimab, also referred to as SMT112 in the US, Canada, Europe, and Japan, and AK112 in China and Australia, is a new investigational bispecific antibody targeting PD-1 and VEGF. Discovered by Akeso, Ivonescimab is currently undergoing multiple Phase III clinical trials. Summit and Akeso joined forces in December 2022 through a collaboration and licensing agreement for Ivonescimab. The Company has launched Phase III clinical trials for ivonescimab in NSCLC, including the HARMONi study for EGFR-mutated advanced/metastatic NSCLC and HARMONi-3 for first-line metastatic NSCLC with chemotherapy. Additionally, the HARMONi-7 study is investigating ivonescimab monotherapy in first-line metastatic NSCLC patients with high PD-L1 expression. In October 2024, Summit Therapeutics announced the completion of enrollment in the HARMONi clinical trial, a multi-regional Phase III study comparing ivonescimab plus platinum-doublet chemotherapy to placebo plus platinum-doublet chemotherapy in patients with EGFR-mutated, locally advanced or metastatic non-squamous NSCLC.

Petosemtamab, or MCLA-158, is a Biclonics low-fucose human full-length IgG1 antibody targeting EGFR and LGR5. Petosemtamab was granted Breakthrough Therapy designation by the US FDA for 1L PD-L1 positive head and neck squamous cell carcinoma. The drug is also being investigated in 1L, 2L, and 3L metastatic colorectal cancer (mCRC).

In addition to these bispecific antibodies, the promising trispecific antibodies in the pipeline include GB263T (Genor Biopharma), and SAR442257 (Sanofi), MK-6070 (formerly HPN328) and MK-3000 (Merck), SIM0500 (Jiangsu Simcere Pharmaceutical), among others. The anticipated launch of bispecific and trispecific antibodies is poised to revolutionize targeted therapy in biomedicine. These innovative antibodies hold the promise of enhanced efficacy and precision by simultaneously targeting multiple disease-associated molecules, potentially leading to improved treatment outcomes and expanded therapeutic options for patients across various medical conditions.

Bispecific and Trispecific Antibodies: Future Directions

Bispecific and trispecific antibodies are redefining the landscape of targeted therapies, offering unmatched precision, adaptability, and the potential to address complex disease mechanisms. According to DelveInsight’s analysis, the bispecific antibody market in oncology across the 7MM (US, EU4, Japan) reached approximately USD 1.5 billion in 2024, and is poised for significant growth over the forecast period of 2024–2034.

While hematologic malignancies currently dominate the bispecific antibody market, the therapeutic focus is rapidly shifting toward solid tumors, including non-small cell lung cancer (NSCLC), which is expected to capture a substantial market share in the coming years. Notably, RYBREVANT is anticipated to be a major growth driver, with projected revenues nearing USD 3.6 billion by 2034.

Looking forward, research and development in this field are intensifying to overcome current limitations and broaden clinical utility. Innovations in antibody engineering, computational modeling, and high-throughput screening are enabling the creation of next-generation biologics with superior efficacy, specificity, and safety. These advancements are set to expand the therapeutic potential of bispecific and trispecific antibodies across oncology and beyond, heralding a new era in precision medicine.

Downloads

Article in PDF

Recent Articles

- PTC Therapeutics’ Gene Therapy Upstaza; Sanofi and Regeneron’s Dupixent; Bayer CAR-T Collaboratio...

- Collaboration provides new insight into cancer treatment

- Iovance’s Breakthrough: Amtagvi Paves the Way for Cell Therapies in Solid Tumors

- 5 Upcoming Bispecific & Trispecific Antibodies Beyond Oncology

- Rise In Bispecific Antibodies Utilization As Antibody Therapeutics