ADCs in Lung Cancer Treatment: ENHERTU’s Rise, HER3 & TROP-2 Challenges, and What’s Next in the Pipeline

May 09, 2025

Table of Contents

Lung cancer remains the leading cause of cancer-related death in the United States; approximately 85% of lung cancers are non-small cell lung cancer (NSCLC), with ~530K cases in the 7MM. The main subtypes of NSCLC are adenocarcinoma (~57%), squamous cell carcinoma (~26%), and large cell carcinoma (~2%). Despite advances in chemotherapy, targeted therapies, and immunotherapy, the high prevalence of NSCLC continues to present a significant challenge in treatment.

ADCs in lung cancer represent an exciting advancement in cancer therapy, combining the precision of monoclonal antibodies with the potency of cytotoxic drugs to deliver targeted treatment directly to cancer cells while minimizing damage to surrounding healthy tissue. In NSCLC, HER2-targeted ADCs, such as ENHERTU, have shown promising clinical results, offering new hope for patients with HER2-mutant or HER2-amplified tumors. With ongoing research and encouraging outcomes, ADCs in lung cancer are poised to become a cornerstone of NSCLC treatment, potentially improving patient outcomes and opening new avenues for combination therapies to enhance efficacy.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- CRISPR gene-editing tested in a person for the first time

- AZ, Daiichi inks an oncology deal; Moderna begins Phase III trial of its COVID-19 vaccine; No goo...

- Non-Small Cell Lung Cancer Market: Treatments and Market Forecast

- Potential of EGFR Inhibitors: A Promising Avenue in Cancer Treatment

- Assessment of Key Products that Got FDA Approval in Second Half (H2) of 2021

A Brief Look at the Anticipated ADCs in Development

As NSCLC remains a major global health burden, the therapeutic landscape is rapidly evolving with the emergence of ADCs. These targeted agents are designed to selectively deliver potent cytotoxic payloads to tumor cells, offering new hope for patients with specific biomarkers.

Below is a snapshot of some of the most anticipated ADCs currently in development for NSCLC, highlighting their targets, developers, payloads, clinical stages, and associated biomarker prevalence.

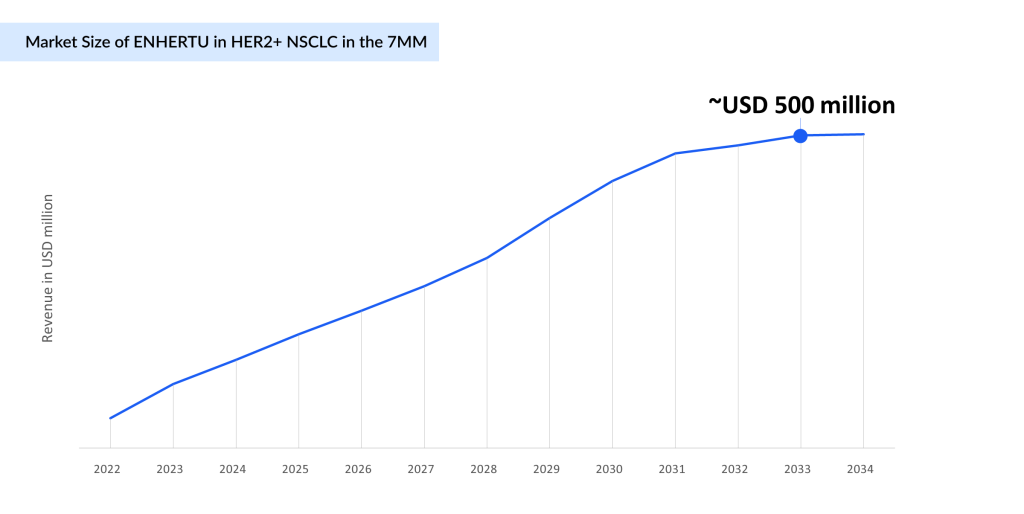

ENHERTU Poised to Dominate HER2-Mutant NSCLC Market With Expanding Approvals in First-line Setting

Daiichi and AstraZeneca’s ENHERTU is primarily focusing on indications such as breast and lung cancer, with breast cancer being its major revenue driver.

The first ADC for NSCLC, approved under accelerated approval in August 2022, is used to treat adult patients with previously treated, HER2-mutant metastatic NSCLC. Later, in April 2024, it was approved for adult patients with unresectable or metastatic HER2+ (IHC 3+) solid tumors who have received prior systemic treatment and have no satisfactory alternative treatment options. In August 2023, ENHERTU also secured approval from Japan’s MHLW for HER2 NSCLC, followed by approval in Europe the following month. The company is now focused on expanding ENHERTU’s use in the first-line setting through Phase III (DESTINY-Lung04), with data readout from the DESTINY-LUNG04 trial anticipated in H2 2025.

In the future, ENHERTU’s potential use marks a new era in the treatment of HER2-mutant NSCLC, giving patients hope and changing the course of treatment. At this point, no company is developing an ADC for late-stage HER2-mutated NSCLC. With fewer competitors, ENHERTU will have an edge in the upcoming years as companies focus on developing tyrosine kinase inhibitors.

The Uncertain Fate of TROP-2 ADCs in NSCLC: A Rollercoaster of Hope and Disappointment

TROP2, a transmembrane glycoprotein overexpressed in several cancers, including NSCLC, has become a promising therapeutic target for ADCs. Among the leading TROP2-targeting ADCs in NSCLC are Dato-DXd, TRODELVY (sacituzumab govitecan), and Sacituzumab Tirumotecan.

Initially, Dato-DXd was expected to make a major impact in the NSCLC market, with expectations of securing a first-mover advantage over TRODELVY. With an anticipated approval in December 2024, hopes were high until the outlook dramatically changed. In a shocking turn, Daiichi Sankyo withdrew both the Marketing Authorization Application (MAA) in the EU and the Biologics License Application (BLA) in the US for Dato-DXd after failing to meet the overall survival (OS) endpoint in the Phase III TROPION-Lung01 trial for locally advanced or metastatic nonsquamous NSCLC.

However, just when it seemed like the door was closing, Daiichi made a bold strategic move. In November 2024, the company re-entered the race by submitting a new BLA to the FDA, this time for the treatment of adult patients with locally advanced or metastatic EGFR-mutated NSCLC in 2L+ (second-line or later treatment). This new submission is backed by promising results from the TROPION-Lung05 Phase II trial, with additional support from the TROPION-Lung01 Phase III and TROPION-PanTumor01 Phase I trials.

Notably, in December 2024, Daiichi Sankyo presented the pooled analysis of the TROPION-Lung05 Phase II and TROPION-Lung01 Phase III trials at the late-breaking proffered paper session (LBA7) at the 2024 ESMO Asia Congress. The analysis showed that Dato-DXd demonstrated clinically meaningful tumor responses in patients with previously treated advanced or metastatic EGFR-mutated NSCLC.

All eyes are now on the FDA’s PDUFA decision, slated for Q3 2025, as it will ultimately decide the future of Dato-DXd. Will it finally reach the market and offer hope to patients, or will it face another heartbreaking setback? The future of Dato-DXd is uncertain.

As TROP-2 ADCs continue advancing in clinical trials, the data are painting a mixed picture, bringing both setbacks and glimpses of hope for NSCLC patients. In a major blow to the field, Gilead Sciences discontinued the Phase III EVOKE-01 trial of TRODELVY in September 2024, after the study failed to meet its primary endpoint of overall survival in second-line NSCLC. This setback crushed expectations, raising concerns about the viability of TROP-2 ADCs in lung cancer treatment.

However, not all hope is lost. Despite the failure of EVOKE-01, data from Gilead and Merck’s EVOKE-02 trial suggested a potential breakthrough in the first-line treatment setting, indicating that TRODELVY, when combined with pembrolizumab (without chemotherapy), might offer a meaningful benefit for patients with metastatic NSCLC. These encouraging findings have fueled the ongoing Phase III EVOKE-03 trial, reinforcing Gilead and Merck’s commitment to redefining the standard of care in lung cancer treatment.

With these highs and lows, the future of TROP-2 ADCs in lung cancer and especially NSCLC remains uncertain. Will they secure a place in the market, or will clinical setbacks limit their adoption even if approved? The coming years will be crucial in determining whether these therapies can truly deliver on their promise or if the challenges prove too great to overcome.

Merck is strategically betting on TRODELVY in partnership with Gilead while also collaborating with Kelun-Biotech to develop an emerging TROP-2 ADC, sacituzumab tirumotecan (MK-2870/SKB264). SKB264 is currently undergoing a Phase III pivotal trial for first-line treatment of EGFR wild-type NSCLC in combination with pembrolizumab. In December 2024, the FDA granted Breakthrough Therapy Designation for sacituzumab tirumotecan for patients with advanced or metastatic nonsquamous NSCLC harboring EGFR mutations (exon 19 deletion or exon 21 L858R) who have progressed on a TKI and platinum-based chemotherapy.

Additionally, as of January 2024, SKB264 combined with KL-A167 has demonstrated promising efficacy and a manageable safety profile in treatment-naïve advanced NSCLC, and a Phase III study of SKB264 + pembrolizumab in first-line metastatic NSCLC with PD-L1 TPS ≥50% (NCT06170788) is ongoing.

HER3 ADCs Advance in NSCLC: Patritumab Deruxtecan Nears 2025 Launch Amid Regulatory Hurdles

Daiichi and Merck’s patritumab deruxtecan, an anti-HER3 monoclonal antibody linked to the potent cytotoxic agent deruxtecan (Dxd), is demonstrating promising potential in early clinical trials for NSCLC, especially in patients with EGFR mutations or those who have progressed on prior therapies. HER3-DXd utilizes the same linker and cytotoxic payload as both ENHERTU and Dato-DXd. With a similar DAR with a drug-to-antibody ratio (DAR) of seven to eight, similar to ENHERTU, this consistency allows for the potential to apply efficacy insights from those compounds, reducing developmental risks.

As of September 2024, in the context of studies such as HERTHENA-Lung02, the trial has met its primary endpoint of PFS, showing a statistically significant improvement compared to platinum plus pemetrexed induction chemotherapy followed by pemetrexed maintenance chemotherapy. However, OS data were immature at the time of the analysis, prompting the continuation of the trial to assess OS as a secondary endpoint further. In June 2024, the FDA issued a Complete Response Letter (CRL) for the BLA seeking accelerated approval of Daiichi Sankyo and Merck’s patritumab deruxtecan due to inspection findings at a third-party manufacturer, delaying its approval.

Now anticipated to hit the market by 2025, the drug is estimated to generate approximately USD 600 million in the 7MM by 2034, positioning itself as a key player in the evolving NSCLC landscape.

Another HER3 ADC, YL202/BNT326, developed by MediLink Therapeutics and BioNTech, has shown promising efficacy in heavily pretreated locally advanced or metastatic NSCLC during its Phase I trial. However, in June 2024, the FDA placed a partial hold on the trial due to concerns about unreasonable and significant safety risks at high doses. In a turn of events, by August 2024, the FDA granted clearance for BioNTech and MediLink to resume the trial, reigniting hope for the drug’s potential in the HER3 ADC landscape.

AbbVie’s Teliso-V Poised to Become First-in-class Therapy for c-Met Overexpressing NSCLC.

Around 32% of NSCLC patients exhibit cMET overexpression. Teliso-V targets c-Met overexpression, showing promise in early trials against c-Met-positive NSCLC. Recently, in September 2024, AbbVie submitted a BLA to the FDA for accelerated approval of Teliso-V in adult patients with previously treated, locally advanced or metastatic EGFR wild-type, nonsquamous NSCLC with c-Met protein overexpression. The submission was supported by data from the Phase II LUMINOSITY trial (M14-239), which is conducted under the FDA’s Oncology Center of Excellence (OCE) Real-Time Oncology Review (RTOR) program. AbbVie anticipates receiving accelerated approval for 2L+ NSCLC in 2025.

Since there are currently no approved anti-cancer therapies specifically for c-Met overexpressing NSCLC, Teliso-V, if approved, would be the first-in-class therapy for this patient population and is estimated to generate ~USD 1 billion in the 7MM by 2034.

Apart from this, REGN5093-M114 and MYTX-011 are also being evaluated for targeting c-MET NSCLC.

Future Challenges and Considerations

ADCs targeting TROP-2, HER2, HER3, c-MET, and others (IB6, AXL, FolR alpha, Anti-nectin-4, and TF-directed ADC) are being investigated as both standalone treatments and in combination with other therapies. While ADCs in lung cancer treatment are gaining ground in clinical practice, understanding resistance mechanisms is crucial for future development, though current data remain limited due to the relatively early stage of ADC research in this area.

With early clinical trials showing encouraging results, these therapies hold the potential to improve outcomes for patients, particularly those with advanced or refractory disease. As ongoing research refines these agents, future ADCs in lung cancer treatment are likely to demonstrate enhanced efficacy and safety, offering a valuable addition to the NSCLC therapeutic landscape and renewed hope for improved survival rates and quality of life.

Downloads

Article in PDF

Recent Articles

- “Endometrial Cancer – Pipeline Insights, 2015”- A DelveInsight’s Report

- GeneDx secures $92M funding; BioTech Innovations partners with Novartis for R&D collaboration

- Sumitomo to Purchase Myovant; AstraZeneca’s Tremelimumab Plus Imfinzi Approved in the US; AbbVie ...

- X4 Pharmaceuticals’ XOLREMDI FDA Approval; ONO to Acquire Deciphera Pharmaceuticals; Johnson &...

- Telegenomics nets $23M; Merck acquires Tilos; ADC nabs; Sobi buys Novoimmune’s assets