The Race for Next-generation Wet AMD Therapies: Shaping the Future of Vision

Sep 15, 2025

Table of Contents

Neovascular age-related macular degeneration (nAMD or Wet AMD) is a progressive retinal condition and a primary cause of central vision loss among individuals over 60 years old. While it represents only 10–15% of overall AMD cases, it is responsible for nearly 90% of severe vision impairment linked to the disease. The condition is driven by abnormal blood vessel growth beneath the retina, leading to leakage, scarring, and irreversible central vision damage. Anti-vascular endothelial growth factor (VEGF) therapies have transformed outcomes for patients; however, treatment burden, limited durability, and ongoing challenges continue to affect long-term disease management.

“Risk factors for Wet AMD include advanced age, smoking, genetic predisposition, and cardiovascular health, highlighting the multifactorial nature of the disease and the importance of preventive lifestyle interventions.”

Downloads

Click Here To Get the Article in PDF

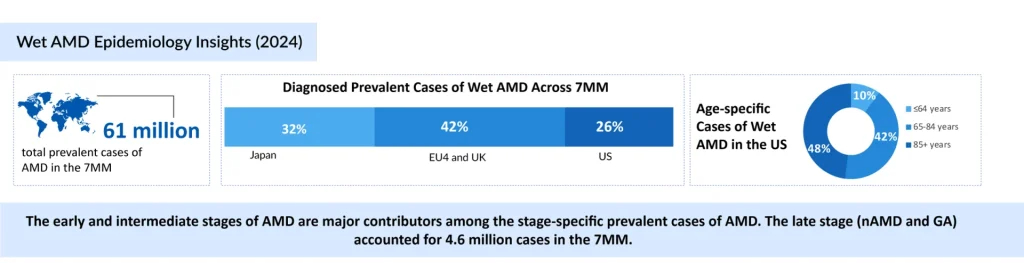

Wet AMD Epidemiology and Burden of Disease

Wet AMD is an increasing public health concern. According to DelveInsight, there are around 4 million diagnosed cases across major markets, including the United States, Germany, France, Italy, Spain, the United Kingdom, and Japan, with the US contributing nearly 1 million. Case numbers are expected to grow steadily, primarily driven by aging populations, as the prevalence of AMD is closely linked with advancing age.

A Multi-Billion Dollar Wet AMD Market Shaped by Biologics

The wet AMD market exceeded USD 8 billion in 2024 across major markets, with the US accounting for approximately 33%. Biologics, particularly anti-VEGF therapies, dominate by suppressing neovascularization and preserving vision. Yet, frequent intravitreal injections, adherence difficulties, and suboptimal outcomes highlight the demand for next-generation therapies offering longer durability, greater convenience, and improved efficacy.

“Current therapies for Wet AMD rely on frequent intravitreal injections, placing a significant burden on patients and caregivers. This intensive regimen often affects adherence, which in turn compromises long-term clinical outcomes.”

LUCENTIS (ranibizumab) to VABYSMO (faricimab): The Evolution of Anti-VEGF Leaders

LUCENTIS (ranibizumab), Genentech, a member of the Roche group, is a US FDA-approved intravitreal anti-VEGF agent widely used but requires frequent injections due to its relatively short duration of action. Its success paved the way for newer therapies such as EYLEA (aflibercept), developed by Bayer/Regeneron Pharmaceuticals, which emerged as a market leader by offering extended dosing intervals without compromising efficacy. The wet AMD market further expanded with VABYSMO (faricimab), developed by Roche, a bispecific antibody targeting both VEGF-A and angiopoietin-2, designed to provide improved durability and the possibility of even longer dosing schedules. Novartis’s BEOVU (brolucizumab-dbll) also entered with the promise of more extended durability, though its adoption was hindered by safety concerns, particularly the risk of retinal vasculitis. At the same time, AVASTIN (bevacizumab), Genentech, a member of the Roche group, despite lacking formal approval for Wet AMD, has remained widely utilized off-label due to its low cost, cementing its role particularly in resource-constrained healthcare settings.

Importantly, several of these biologics now have biosimilar counterparts, LUCENTIS (ranibizumab), EYLEA (aflibercept), and AVASTIN (bevacizumab), which are expanding treatment access and introducing cost-competitive options into the market. The arrival of wet AMD drug biosimilars is reshaping the pricing environment, offering physicians and healthcare systems greater flexibility while intensifying competition for branded products. This development signals a new Phase in the wet AMD landscape, where cost-effectiveness is increasingly weighed alongside efficacy and durability.

Beyond Needles: Port Delivery Systems Transform Wet AMD Treatment

Beyond injections, new delivery innovations are reshaping the wet AMD treatment paradigm. SUSVIMO, Genentech’s ranibizumab port delivery system, stands out as one of the most ambitious advances, offering a surgically implanted, refillable reservoir designed to provide continuous intravitreal drug release and substantially reduce the need for frequent injections. While its initial rollout was interrupted by device-related recalls, Genentech reported in July 2024 the reintroduction of SUSVIMO for patients with Wet AMD, following improvements to its design and safety profile. This milestone underscores the industry’s commitment to reducing treatment burden through novel modalities.

“Genentech is advancing Wet AMD care with SUSVIMO, a refillable ranibizumab port delivery system reintroduced in July 2024 after safety enhancements, aiming to reduce injection burden and strengthen patient adherence through sustained drug delivery.”

Innovation Drivers and Future Directions in Wet AMD Treatment

Innovation in Wet AMD targets key challenges of injection burden, adherence, and limited efficacy. Approaches include long-acting biologics, small molecules, novel delivery systems, and gene therapies enabling durable VEGF suppression. Gene therapy offers potential single-dose, long-term benefit, while implantable delivery systems provide sustained anti-VEGF release, reducing treatment frequency and reshaping management strategies.

One Shot For a Lifetime: Gene Therapy, The Game Changer

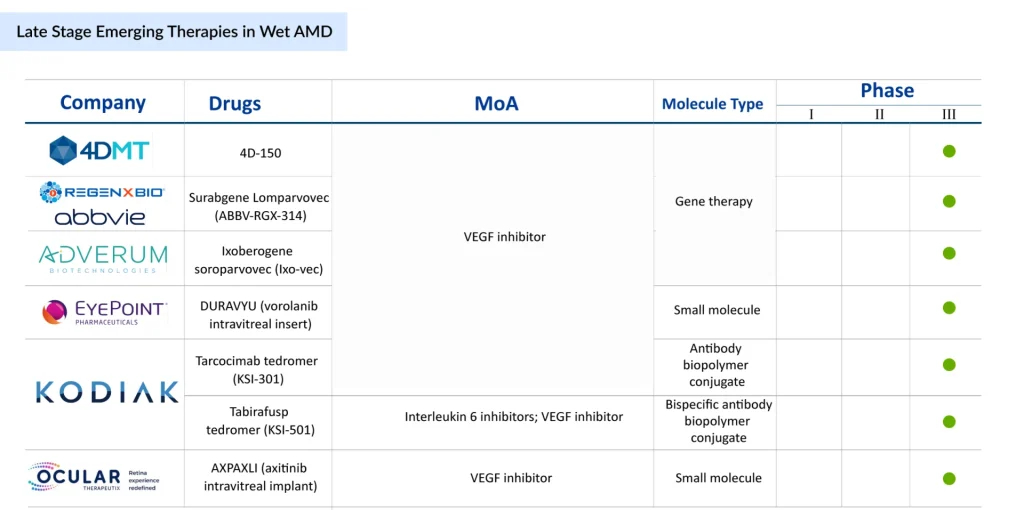

Gene therapy is rapidly emerging as the most transformative strategy in late-stage wet AMD development, with multiple candidates aiming to shift treatment from chronic management to durable, potentially permanent solutions. 4D Molecular Therapeutics’ 4D-150, delivered intravitreally, is designed to provide sustained VEGF suppression through a single genetic intervention. If successful, it could significantly reduce or even eliminate the need for repeated anti-VEGF injections, with pivotal Phase III readouts expected in 2027.

Running in parallel, REGENXBIO and AbbVie’s ABBV-RGX-314 (suradgane lomparvovec) has become a frontrunner, buoyed by strong enthusiasm from both clinicians and patients. This program, now in Phase III with subretinal delivery (after earlier suprachoroidal trials), is positioned to become the first gene therapy approved for wet AMD, with global regulatory submissions projected for 2026. Adding to the competitive landscape, Adverum Biotechnologies is advancing ixoberogene soroparvovec (ixo-vec), an intravitreal gene therapy that directly targets VEGF-A. With enrollment in the ARTEMIS trial progressing ahead of schedule and topline data anticipated in 2027, optimism around its potential remains strong. Importantly, the program has also secured the RMAT designation, underscoring its regulatory momentum.

“Nearly half of ~1,000 retina specialists identified gene therapy as the most promising advance in Wet AMD, surpassing tyrosine kinase inhibitor. Yet, market valuations undervalue its potential, exposing a disconnect between clinical optimism and investor perception.”

Together, these advances suggest that gene therapy may soon reframe Wet AMD as a disease treated with a single, durable intervention rather than a lifelong cycle of injections.

Implantable Drug Delivery Systems

Ocular Therapeutix is advancing AXPAXLI, an axitinib-based sustained-release implant designed to inhibit VEGF pathways. With pivotal programs on the horizon, including the DAYBREAK Phase III trial and a second planned Phase III study expected to launch in late 2025 or early 2026, the program reflects a strategic push toward long-acting, procedure-based solutions. Aiming for a potential biologics license application (BLA) submission by mid-2027, AXPAXLI highlights the growing momentum behind implantable therapies that combine durability with surgical precision to reduce treatment burden in Wet AMD.

Expanding Horizons: Inserts and Bioconjugates Offer New Pathways

Another front in the innovation race is the use of sustained-release small molecules and biologic conjugates. EyePoint Pharmaceuticals is advancing DURAVYU, a vorolanib intravitreal insert designed to provide long-lasting VEGFR antagonism. With Phase III results expected in 2026, DURAVYU could emerge as the first small-molecule insert with durable efficacy. On the biologics side, Kodiak Sciences is developing a dual portfolio: tarcocimab tedromer (KSI-301), an antibody–biopolymer conjugate designed for high durability with dosing intervals beyond 6 months, and tabirafusp tedromer (KSI-501), a bispecific molecule that uniquely combines VEGF and IL-6 inhibition to address both angiogenesis and inflammation. These approaches broaden therapeutic scope, targeting not just VEGF suppression but also inflammatory pathways that may drive disease progression.

“Although anti-VEGF agents revolutionized treatment, not all patients respond equally, prompting ongoing research into biomarkers, combination therapies, and alternative targets to optimize personalized care for wet AMD.

From Frequent Injections to Potential Cures: The Decade Ahead in Wet AMD

Wet age-related macular degeneration remains a leading cause of blindness worldwide. While anti-VEGF biologics such as ranibizumab, aflibercept, and faricimab have revolutionized care, their reliance on frequent injections underscores the need for more durable solutions. The development wet AMD pipeline is shifting toward transformative approaches, including single-dose gene therapies that aim for lasting VEGF suppression, surgical implants offering continuous intravitreal delivery, and extended-interval biologics designed to ease treatment burden. Biosimilars are also reshaping access and pricing dynamics, particularly in cost-sensitive markets. With pivotal trial readouts expected in 2026–2027, the coming decade may mark a transition from maintenance-based therapies to long-lasting, potentially curative interventions, redefining both clinical outcomes and economic impact for millions at risk of vision loss.

Downloads

Article in PDF

Recent Articles

- Lilly’s Morphic Acquisition; IDEAYA’s IDE397 Positive Phase II Trial Result; XPOVIO (seline...

- A Market Space Beyond Lucentis and Eylea for Retinal Vein Occlusion Treatment

- Promising therapies that might shift Wet Age-related Macular Degeneration Market in the next decade

- AgomAb Therapeutics raises $23.5M; Allergan’s eye drug; Good news for the patients; Dyne Th...

- Analyzing the Growth of the Biosimilar Market Through Years