Is DLL3 Unlocking the New Code for the Neuroendocrine Cancers (NECs) Therapeutics’ Era?

Jan 02, 2026

Table of Contents

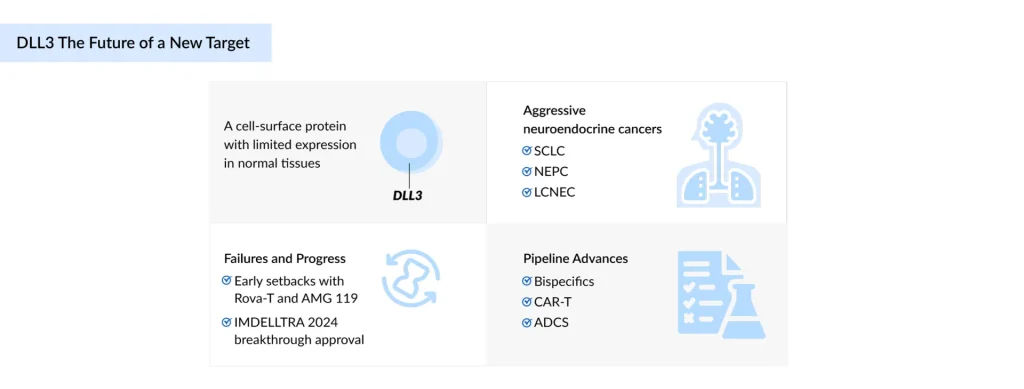

Delta-like Ligand 3 (DLL3) is rapidly establishing a position as one of the promising targets in the treatment of aggressive Neuroendocrine Cancers (NECs), including Small Cell Lung Cancer (SCLC), Neuroendocrine Prostate Cancer (NEPC), and Large-Cell Neuroendocrine Carcinoma (LCNEC), where existing treatments deliver only limited benefit. After being dismissed following high-profile failures of Rova-T and AMG 119, DLL3 made a comeback in 2024 with Amgen’s IMDELLTRA, the first approved DLL3-directed therapy, which reignited interest in the target and reshaped the treatment landscape. Now, the pipeline is surging with innovation: bispecific antibodies, Chimeric Antigen Receptor T-cell therapies (CAR-Ts), Antibody-drug Conjugates (ADCs), and radiopharmaceuticals are all in the game, each striving to raise the bar on efficacy, safety, and durability. Challenges such as variable DLL3 expression, safety risks, and cost hurdles still loom large, but the momentum is undeniable. With only one approved therapy to date, DLL3 stands out as both a risky bet and one of the most notable opportunities in oncology.

What is DLL3?

DLL3 is a unique member of the Delta/Serrate/Lag-2 (DSL) family of Notch ligands, which functions primarily as an inhibitory regulator of the Notch signaling pathway. It is a downstream target of ASCL1. It shows very limited expression in normal adult tissues, but is consistently expressed.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- GeneDx secures $92M funding; BioTech Innovations partners with Novartis for R&D collaboration

- 5 Most Promising CAR T-cell Therapies for Multiple Myeloma in Development

- Antibody-Drug Conjugate and Big Pharmaceutical Companies

- ADCs in Lung Cancer Treatment: ENHERTU’s Rise, HER3 & TROP-2 Challenges, and What’s Next in ...

- Nanoscope’s MCO-010 Begins FDA Rolling Submission for Retinitis Pigmentosa; Bayer’s KERENDIA Appr...

What is the Expression of DLL3 in key indications?

SCLC is an aggressive neuroendocrine tumor. According to DelveInsight, there were nearly 36,500 incident cases in the US in 2024. DLL3 is upregulated and often surface-expressed in up to 85% of tumors, although its stability during therapy remains uncertain. NEPC is an aggressive, treatment-resistant form of prostate cancer, with nearly 7,800 NEPC incident cases in the US in 2024. DLL3 is strongly expressed and closely tied to ASCL1.

LCNEC is a rare, high-grade NEC, with 7,298 incident cases in the US in 2024. DLL3 is highly expressed in Stage IV LCNEC (74%) and linked to ASCL1 and neuroendocrine markers. There were ~8,800 incident cases of NECs in the US in 2024. DLL3 is absent or low in normal tissues but consistently elevated in high-grade NECs.

What is the scenario in the treatment landscape of DLL3-targeted therapies?

Foundations of DLL3 therapy: Early-generation inhibitors

Rovalpituzumab tesirine (ROVA-T), the first-in-class DLL3-directed ADC, was aimed to deliver a cytotoxic payload to DLL3-expressing SCLC cells selectively. Early trials showed modest efficacy, particularly in DLL3-high tumors, but its clinical use was hampered by significant toxicities, including pleural/pericardial effusions, edema, and skin reactions. Phase II and III studies confirmed limited benefit and no improvement in Overall Survival (OS) compared to standard therapies. Ultimately discontinued, ROVA-T underscored both the potential of DLL3-targeted therapy and the urgent need for safer, more effective next-generation approaches.

The new era: Second-generation DLL3 inhibitors and landmark approval

In 2024, Amgen and Royalty Pharma launched IMDELLTRA (tarlatamab-dlle), the first approved DLL3-targeted bispecific antibody, which harnesses DLL3 expression to enable selective T cell-mediated cytotoxicity in ES-SCLC. It addresses a critical unmet need in patients progressing after platinum-based chemotherapy, with step-up IV dosing that balances efficacy and safety. Regulatory approvals vary by region: the US (2024) for adults with disease progression after platinum therapy, Japan (2024) for post-chemotherapy SCLC, and the UK (2025) for ES-SCLC after at least two prior lines including platinum therapy. Phase III DeLLphi-304 showed notable OS benefit (13.6 vs. 8.3 months), improved PFS, better patient-reported outcomes, and a favorable safety profile compared to chemotherapy. Ongoing studies are evaluating first-line, combination, and relapsed settings, positioning IMDELLTRA as a transformative therapy for DLL3-targeted SCLC.

KOL: “The approval of DLL3-targeted therapies, led by IMDELLTRA, has reshaped the SCLC market, reflecting strong commercial uptake and high unmet clinical need. While Rova-T failed to meet efficacy endpoints, highlighting the need for precise patient selection, IMDELLTRA demonstrates meaningful clinical benefit but requires extended monitoring and presents logistical challenges. Early commercial success, with over USD 45 million in initial US sales, has fueled investment and collaboration in the DLL3 space, driving the development of next-generation therapies and innovative administration strategies, such as hospital-at-home models, to optimize both patient outcomes and market adoption.”

Emerging landscape

Following the paved pathway, the DLL3-targeted therapy landscape has started to evolve rapidly, with multiple approaches exploring bispecifics, CAR-T, T-cell engagers, and ADC platforms to address unmet needs in SCLC and other neuroendocrine tumors. Each therapy leverages unique mechanisms or platforms to differentiate itself in this competitive space. The table below shows some major emerging products from 7MM.

| Comparison of Emerging Drugs | ||||||

| Drug Name | Combination | Sponsor/Collaborator | Indication | MoA | Phase | Trial identifier |

| IMDELLTRA (tarlatamab) | Durvalumab + carboplatin + etoposide | Amgen | ES-SCLC | DLL3-directed CD3 T cell engager | III | NCT07005128 |

| Monotherapy | Relapsed SCLC | III | NCT05740566 | |||

| Durvalumab | ES-SCLC | III | NCT06211036 | |||

| Monotherapy | LSCLC | III | NCT06117774 | |||

| Monotherapy | SCLC | II | NCT06745323 | |||

| Monotherapy | R/R SCLC | II | NCT05060016 | |||

| Monotherapy | ES-SCLC | I | NCT06598306 | |||

| AB248 | ES-SCLC | I | NCT07037758 | |||

| YL201 ± PD-L1 inhibitor | I | NCT06898957 | ||||

| Atezolizumab ± chemotherapy (carboplatin, etoposide) | ES-SCLC | I | NCT05361395 | |||

| Durvalumab ± chemotherapy (carboplatin, etoposide) | ES-SCLC | I | NCT05361395 | |||

| Monotherapy | Locally advanced/metastatic NEPC | I | NCT04702737 | |||

| Obrixtamig (BI 764532) | Monotherapy | Boehringer Ingelheim and Oxford BioTherapeutics | SCLC | DLL3/CD3 T-cell engager | II | NCT05882058 |

| Monotherapy | LCNEC | II | ||||

| Monotherapy | EPNEC | II | ||||

| Ezabenlimab | Locally advanced/metastatic-SCLC | I/II | NCT05879978 | |||

| Ezabenlimab | Locally advanced/metastatic LCNEC | I/II | ||||

| Monotherapy | ES-SCLC | I | NCT04429087 | |||

| Topotecan (chemotherapy) | ES-SCLC | I | NCT05990738 | |||

| Carboplatin + etoposide/cisplatin | NEC | I | NCT06132113 | |||

| Carboplatin/ cisplatin + etoposide + atezolizumab/ durvalumab | ES-SCLC | I | NCT06077500 | |||

| Monotherapy | Glioma | I | NCT05916313 | |||

| Gocatamig(MK-6070) | Monotherapy | Merck and Daiichi Sankyo | ES-SCLC and R/R SCLC | DLL3-directed tri-specific T-cell engager | I/II | NCT06780137, NCT04471727 |

| I-DXd | ES-SCLC and R/R SCLC | I/II | NCT06780137, NCT04471727 | |||

| Durvalumab | ES-SCLC | I/II | NCT06780137 | |||

| Monotherapy | R/R NEPC | I/II | NCT04471727 | |||

| Monotherapy | R/R NEC | I/II | ||||

| Atezolizumab | R/R SCLC | I/II | ||||

| Atezolizumab | R/R NEPC | I/II | ||||

| ZL-1310 | Monotherapy | Zai Lab and MediLink Therapeutics | Locally advanced/metastatic NEC | Targets DLL3 via its topoisomerase 1 inhibitor payload | Ib/II | NCT06885281 |

| Monotherapy | ES-SCLC | I | NCT06179069 | |||

| Atezolizumab | ES-SCLC | I | ||||

| Atezolizumab + Carboplatin | SCLC | I | ||||

| Peluntamig (PT217) | Monotherapy | Phanes Therapeutics and Roche | ES-SCLC | Targets DLL3 x CD47 | I/II | NCT05652686 |

| EPNEC | ||||||

| LCNEC | ||||||

| Carboplatin + etoposide | LCNEC | |||||

| Carboplatin + etoposide | EPNEC | |||||

| Carboplatin + etoposide | SCLC | |||||

| Paclitaxel | SCLC | |||||

| Paclitaxel | LCNEC | |||||

| Paclitaxel | EPNEC | |||||

| Atezolizumab | R/R ES-SCLC | |||||

| Atezolizumab | R/R LCNEC | |||||

| Atezolizumab | R/R EPNEC | |||||

| Atezolizumab | ES-SCLC | |||||

| Carboplatin + etoposide + atezolizumab | ES-SCLC | |||||

| LB2102 | Monotherapy | Legend Biotech and Novartis | ES-SCLC | DLL3 directed autologous | I | NCT05680922 |

| Monotherapy | LCNEC | |||||

| ABD147 | Monotherapy | Abdera Therapeutics | ES-SCLC | Targets DLL3 | I | NCT06736418 |

| Monotherapy | Locally advanced/metastatic LCNEC | |||||

| Alveltamig (ZG006) | ZG006 | Suzhou Zelgen Bio-pharmaceuticals | SCLC | Targets DLL3×DLL3×CD3 | I | NCT06592638 |

| Clesitamig/ALPS12/CHU* | Obinutuzumab | Chugai Pharmaceutical and Roche | ES-SCLC | Targeting DLL3, with bivalent CD3/CD137 binding | I | NCT07107490 |

| IDE849 (SHR-4849)** | – | Jiangsu Hengrui/IDEAYA Biosciences | SCLC, NET | Targets DLL3- topoisomerase-I | I | – |

| RG6810/IBI3009 | – | Roche and Innovent | SCLC | DLL3 targeted ADC with Topo1 isomerase payload | I | – |

| AMG 119**** | – | Amgen | R/R SCLC | Target DLL3 | I | NCT03392064 |

| *The trial is scheduled to begin in September 2025 and is currently listed as not yet recruiting.**As per July 2025, the US Phase I trial of IDE849 in SCLC patients initiated in 3Q 2025.***IBI3009 has already obtained IND approvals in the US, with the first patient for the Phase I study dosed in December 2024. Currently, only the Phase I trial (NCT06613009) in China and Australia is active.****The Phase I trial of AMG 119 in relapsed/refractory SCLC (NCT03392064, sponsored by Amgen) is currently suspended, with enrollment on hold and no active subjects, but may potentially resume; the study was last updated in September 2024. | ||||||

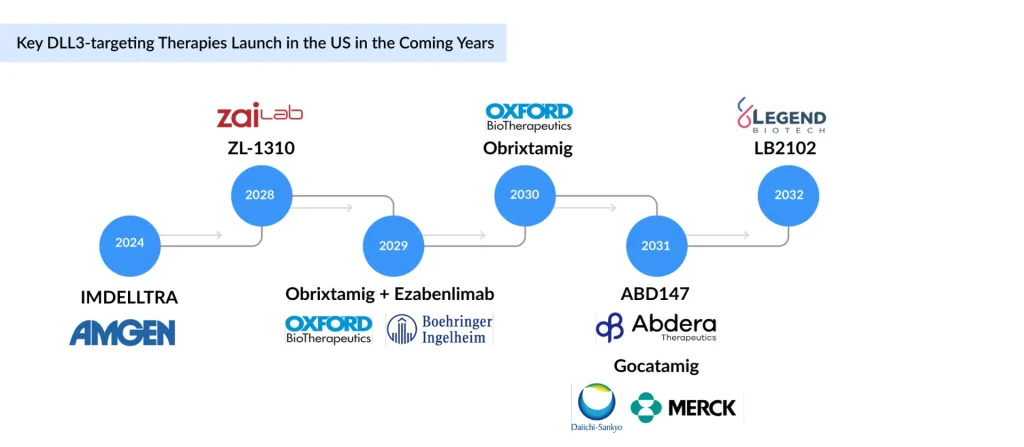

In the third-line and above, obrixtamig, developed with the OGAP platform, shares its drug class with IMDELLTRA and the same line of therapy but is being tested more broadly across gliomas, LCNEC, EPNEC, SCLC, EP-NECs, with early data showing meaningful activity in heavily pretreated patients, including in combination with ezabenlimab, where it was well tolerated and suggested added efficacy over topotecan. It has the potential to secure a strong position, though competition from bispecifics like peluntamig remains significant. It has been granted FTD for the treatment of advanced or metastatic LCNEC-Lung with disease progression following at least one prior line of treatment, including platinum-based chemotherapy. BI 764532 was also granted ODD for the treatment of SCLC and FTD for the treatment of patients with ES-SCLC that has progressed following at least two prior lines of treatment, including platinum-based chemotherapy, and for patients with advanced or metastatic extra-pulmonary NEC that has progressed following at least one prior line of treatment, including platinum-based chemotherapy.

In the second-line and above, gocatamig, using TriTAC technology, is being investigated in combination studies with ifinatamab deruxtecan (I-DXd) ± durvalumab, and, while alveltamig shares a similar mechanism, gocatamig benefits from Merck’s execution capabilities and positions itself as a potentially more effective option leveraging innovative combinations.

AMG 119 is a genetically engineered autologous T-cell therapy created by transducing patient T cells with a lentiviral vector encoding an anti-DLL3 binding domain, CD28, and 4-1BB co-stimulatory domains, and a CD3 signaling domain. In preclinical studies, it showed specific cytotoxicity against DLL3-expressing SCLC cells and antitumor activity in xenograft models. Developed by Amgen, AMG 119’s Phase I clinical development (NCT03392064) is currently on enrollment hold, with the study potentially resuming in the future, reflecting challenges related to safety, efficacy, or strategic prioritization.

LB2102, the only DLL3-targeted CAR-T therapy, demonstrates early anti-tumor activity in SCLC and LCNEC, though pricing and scalability may pose challenges; Novartis secured global rights via a USD 100M upfront deal (>USD 1B milestones), bringing its T-Charge platform to solid tumors, with FDA IND clearance, Orphan Drug Designation (ODD), and an ongoing Phase I making LB2102 a high-risk but differentiated strategy.

ZL-1310, developed on the TMALIN ADC platform, is a next-generation DLL3-targeting ADC positioned to address the limited survival gains in SCLC despite immunotherapy, with manageable toxicity, and, if registrational trials confirm activity and safety, could become a first- or best-in-class DLL3 ADC in ES-SCLC, targeting regulatory submission as early as 2026 and potential accelerated approval in 2028, underscoring its near-term value potential.

Peluntamig, built on the PACbody platform, received IND clearance in 2022 and designations in SCLC and NEC, with a clinical supply agreement with Roche to evaluate combination therapy with TECENTRIQ, providing strategic value, though intense competition persists from IMDELLTRA and obrixtamig; its differentiation lies in technology and broad trial design.

ABD-147, developed on ROVEr platform, links a targeting molecule to a radioisotope to improve tumor selectivity and minimize renal/myelosuppressive toxicity, with an FDA ODD for NEC highlighting its differentiation, though competition exists from agents like ZL-1310.

Alveltamig, a Tri-TE, aims to enhance immune-mediated killing durability versus conventional bispecifics, with early clinical data from China showing tolerability and encouraging activity in SCLC and NEC, potentially providing a competitive edge over gocatamig and IMDELLTRA if efficacy is confirmed. The DLL3-targeted therapies treatment market is poised for significant growth, driven by innovative therapies and expanding clinical development pipelines, promising improved patient outcomes shortly. Continued advancements and regulatory support will further accelerate access to effective treatments.

DLL-3-targeted therapies market size

The market size of DLL3-targeted therapies in the 7MM was nearly USD 115 million in 2024. It is expected to grow at a significant CAGR through 2034. IMDELLTRA, the first and only DLL3-targeting BiTE, is priced in the US at USD 31,500 for the first treatment cycle and USD 30,000 for each subsequent cycle. Based on Amgen’s disclosure, mPFS was 4.9 months with IMDELLTRA; the estimated cost is around USD 166,500. The approval of IMDELLTRA in the US, UK, and Japan has allowed it to capture a significant portion of revenue; however, approval in the EU4 is still pending.

Following IMDELLTRA’s approval, most DLL3-targeted assets remain in early development, limiting near-term market impact. Companies are expanding into other neuroendocrine indications such as LCNEC, NEC, and NEPC, but their contribution will be delayed until later-stage data readouts. As a result, meaningful diversification beyond SCLC is expected only in the longer term.

What are the challenges posed in the landscape of DLL-3?

Early trials with limited data: IMDELLTRA is currently the only approved DLL3-targeted therapy, limited to relapsed SCLC, validating DLL3 as a target but leaving the field underdeveloped as other candidates (obrixtamig, gocatamig, peluntamig, ZG006, ZL-1310, LB2102) remain in early trials with limited data on durability, safety, and broader use, keeping patient options scarce.

Skepticism due to past trial failures: Early DLL3-targeting efforts faced major setbacks as AbbVie’s ADC Rova-T was discontinued in 2019 after Phase III failure due to toxicity and limited efficacy, and Amgen’s CAR-T AMG 119 was suspended, highlighting challenges in solid tumors and DLL3 biology and fueling.

Need for selective immune-based therapies: First-line chemotherapy in SCLC and other high-grade NECs yields brief remissions, with relapsed patients facing rapid progression, resistance, and poor survival. Given DLL3’s consistent tumor expression and minimal presence in normal tissue, there is a clear need for selective immune-based therapies to improve outcomes.

Variable DLL3 expression: Intratumoral heterogeneity, variable DLL3 expression across sites, and changes over time complicate its use, underscoring the need to clarify its links to outcomes and stability to improve patient selection and guide the sequencing of chemotherapy, checkpoint inhibitors, and DLL3 therapies in NECs.

NICE’s rejection of IMDELLTRA: Safety remains a key weakness across DLL3 platforms: T-cell engagers (obrixtamig, gocatamig) need step-up dosing and CRS/ICANS monitoring; autologous CAR-T (LB2102) faces scalability and manufacturing hurdles despite dnTGFβRII armoring; dual-target peluntamig (DLL3/CD47) risks unanticipated toxicities; and trispecific ZG006 adds complexity to safety evaluation.

IMDELLTRA comes with a black-box warning for CRS and neurologic toxicity, including ICANS, which might limit its usage and hinder drug performance, unless well-trained clinical management exists. Most DLL3 therapies remain in early-phase development, with limited long-term safety and efficacy data; programs like ABD-147, ZG006, peluntamig, and LB2102 still need validation of durability and CNS activity, highlighting clinical uncertainty. Tumor adaptation through DLL3 downregulation or compensatory signaling limits the long-term efficacy of DLL3-targeted therapies.

Safety concerns: NICE’s rejection of IMDELLTRA in the UK over cost-effectiveness concerns may set a precedent for restrictive reimbursement decisions in EU4, posing a barrier to market access and slowing adoption despite regulatory approval.

Reimbursement risks: CAR-Ts (like LB2102) and radiopharmaceuticals (like ABD-147) face significant reimbursement risks, as high manufacturing complexity, costly isotopes such as 225Ac, and inpatient requirements drive costs and limit scalability, threatening broad adoption in cost-sensitive healthcare systems.

What are the derived opportunities and future expectations with the landscape of DLL3-targeted therapies?

The DLL3 pipeline spans diverse modalities, including bispecific antibodies (peluntamig, ZG006), ADCs (ZL-1310), radiopharmaceuticals (ABD-147), and armored CAR-Ts (LB2102), creating opportunities to optimize efficacy, safety, and patient segmentation. IMDELLTRA anchors first-line use (alone or with durvalumab ± chemotherapy), while peluntamig, obrixtamig ± ezabenlimab, gocatamig ± I-DXd, LB2102, and ZL-1310 are advancing in second-line and beyond, with IMDELLTRA and obrixtamig also explored in third-line and later, reflecting a competitive landscape across ES-SCLC, LS-SCLC, and relapsed/refractory disease.

Combination strategies are central, with gocatamig paired with checkpoint inhibitors and ADCs, and peluntamig tested in combination with chemotherapy and immunotherapy to broaden its utility. Regulatory incentives, including Fast Track Designations for obrixtamig and ZL-1310 and dual Orphan Drug status for peluntamig, are accelerating development and de-risking investment. The failure of Rova-T has spurred renewed industry focus, with next-generation programs such as CStone’s CS5008 (a bispecific ADC targeting DLL3 and SSTR2) underscoring the momentum and innovation driving this space.

The DLL3-targeting therapy market holds substantial potential, driven by the high unmet medical need in SCLC and NEC, an expanding pipeline of innovative modalities, and the opportunity to capture significant commercial value across both early and late-stage development candidates.

Downloads

Article in PDF

Recent Articles

- 4D Molecular Therapeutics raises; Arvinas slates for IPO; Sutro ruminates for $ 75M; Emergent Bio...

- Navigating the Healthcare Horizon: Odyssey of Mergers, Funding, and Acquisitions in 2024

- 5 Upcoming Bispecific & Trispecific Antibodies Beyond Oncology

- DelveInsight’s Oncology based Reports, 2015

- Intellia’s Quest with CRISPR; Innovent, Synaffix ADC Tech Deal; Lilly’s Diabetes Bloc...