GPCR Inhibitors Market Summary

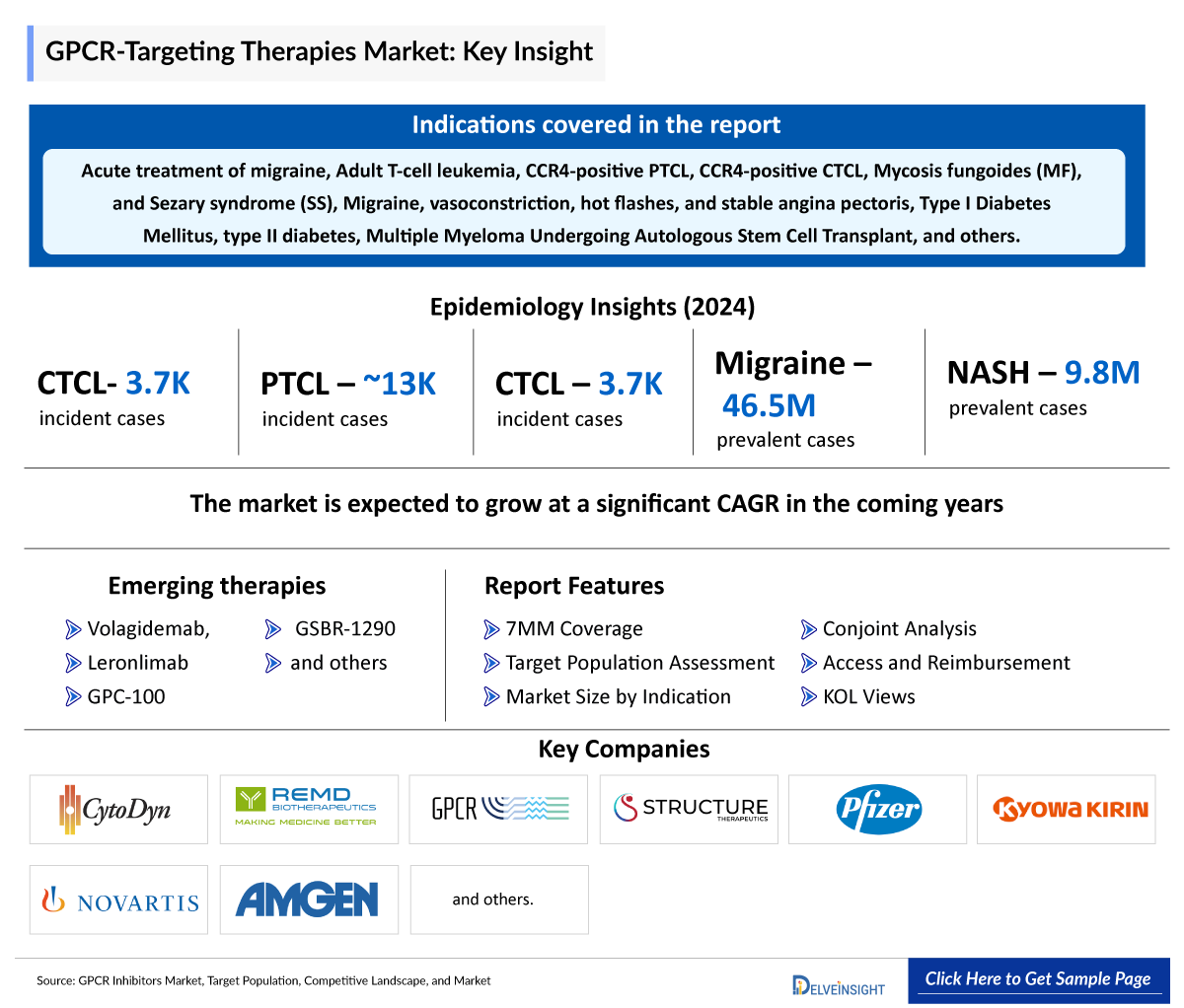

- The GPCR-Targeting therapies market in the 7MM is projected to grow at a significant CAGR by 2034 in leading countries (US, EU4, UK and Japan).

GPCR-Targeting Therapies Market and Epidemiology Analysis

- The overexpression of G protein-coupled receptors (GPCR) in many tumors makes them a viable target for a wide range of cancer indications, spanning from common to rare tumors.

- GPCR targeting therapies are crucial for treating Peripheral T-Cell lymphoma (PTCL), Cutaneous T-Cell lymphomas (CTCL), and their types such as mycosis fungoides, and Sezary syndrome, and are also approved for migraine treatment. Additionally, they are being developed for HIV-NASH (Nonalcoholic Steatohepatitis) and diabetes.

- POTELIGEO, AIMOVIG, and ZAVZPRET are among the approved therapies that act by targeting GPCRs.

- In March 2023, the US FDA approved Pfizer ZAVZPRET (zavegepant), marking it as the first and only calcitonin gene-related peptide (CGRP) receptor antagonist nasal spray for the acute treatment of migraine with or without aura in adults.

- VYEPTI is a treatment used to help prevent migraine episodes in adults. It works by blocking the activity of CGRP, a protein that plays a key role in triggering migraines.

- GSBR-1290 is a GLP-1 receptor agonist developed to treat obesity and type 2 diabetes. Designed as a biased GPCR agonist, it selectively activates the G-protein signaling pathway without triggering β-arrestin pathways.

- In December 2023, CytoDyn partnered with Albert Einstein College of Medicine and Montefiore Medical Center to conduct pre-clinical trials evaluating leronlimab effectiveness against glioblastoma, a deadly brain cancer.

- In July 2024, Radionetics Oncology entered into a strategic agreement with Eli Lilly and Company providing Lilly access to Radionetics’ proprietary GPCR targeting small molecule radiopharmaceuticals.

- Companies including CytoDyn, REMD Biotherapeutics, Structure Therapeutics, and GPCR Therapeutics are engaged in the development of GPCR-targeting therapies.

- In 2027, the United States is expected to hold the largest share of the total GPCR Inhibitors market among the 7MM.

DelveInsight’s “GPCR-Targeting therapies – Market Size, Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the GPCR-targeting therapies, historical and competitive landscape as well as the GPCR targeting therapies market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The GPCR-targeting therapies market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted GPCR-targeting therapies market size in 7MM from 2020 to 2034. The report also covers current GPCR-targeting therapies, treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2020–2034

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain), the UK, and Japan |

|

GPCR-Targeting Therapies Epidemiology Segmentation |

Segmented by:

|

|

GPCR-Targeting Therapies Key Companies |

|

|

GPCR-Targeting Therapies Key Therapies |

|

|

GPCR-Targeting Therapies Market Segmentation |

Segmented by:

|

|

GPCR-Targeting Therapies Market Analysis |

|

GPCR-Targeting Therapies Understanding

GPCR-Targeting Therapies Overview

G protein-coupled receptors (GPCRs) are important classes of cell surface receptors involved in multiple physiological functions. Aberrant expression, upregulation, and mutation of GPCR signaling pathways are frequent in many types of cancers, promoting hyperproliferation, angiogenesis, and metastasis. GPCRs are classified into several types based on their sequence and function: the main classes in humans are Class A (Rhodopsin-like), Class B (Secretin and Adhesion), Class C (Metabotropic glutamate/pheromone), and Class F (Frizzled/TAS2), with additional classes D (fungal mating pheromone receptors) and E (cyclic AMP receptors) found in other organisms. Class A is the largest group, including most hormone, neurotransmitter, and sensory receptors, while Class B is divided into secretin and adhesion subfamilies, Class C includes glutamate and GABA receptors, and Class F covers frizzled and smoothened receptors involved in Wnt signaling. This classification reflects the structural diversity and wide-ranging functions of GPCRs in health and disease.

Currently, GPCR-targeting therapies are approved for treating conditions such as PTCL, migraine, CTCL, and their types, such as Sezary syndrome (SS) and mycosis fungoides. They are also being developed for Nonalcoholic Steatohepatitis (NASH), HIV-NASH, solid tumors, and both Type I and Type II diabetes mellitus.

Further details related to country-based variations are provided in the report…

GPCR-Targeting Therapies Epidemiology

The GPCR-targeting therapies epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total cases of selected indication for GPCR-targeting therapies, total eligible GPCR-Targeting therapies patient pool in selected indication, total treated cases in selected indication for GPCR-targeting therapies in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

- The total incident cases of cutaneous T-cell lymphomas in the 7MM comprised around 3,700 cases in 2024.

- Among EU4 and the UK, Germany had the highest incidence cases of cutaneous T-cell lymphoma, followed by France. On the other hand, Spain had the lowest incident cases in 2024.

- In 2024, gender-specific cutaneous T-cell lymphoma cases for males and females accounted for approximately 1,950 and 1,700 cases in the United States.

- The total incident population of PTCL in Japan was ~8,500 in 2024.

|

Epidemiology of Selected Indications | |

|

Indication |

Estimated Incidence/Prevalence Cases in the US (2024) |

|

PTCL |

13,000 (Incidence Cases) |

|

CTCL |

3,700 (Incidence Cases) |

|

Migraine |

46,462,200 (Prevalence Cases) |

|

NASH |

9,766,500 (Prevalence Cases ) |

GPCR-Targeting Therapies Drug Chapters

The drug chapter segment of the GPCR-targeting therapies report encloses a detailed GPCR-targeting therapies analysis: marketed drugs and late-stage (Phase III and Phase II) GPCR-targeting pipeline drugs. It also helps understand the GPCR-targeting therapies clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

GPCR-Targeting Marketed Drugs

ZAVZPRET (zavegepant): Pfizer

ZAVZPRET is a novel, small-molecule CGRP receptor antagonist approved for the acute treatment of migraine with or without aura in adults. ZAVZPRET blocks the CGRP receptor, which is implicated in migraine pathophysiology by mediating neurogenic inflammation and vasodilation. ZAVZPRET is formulated as a nasal spray, enabling rapid absorption through the nasal mucosa and direct entry into the bloodstream, bypassing gastrointestinal absorption and first-pass metabolism.

POTELIGEO (mogamulizumab-kpkc): Kyowa Hakko Kirin

POTELIGEO is a humanized monoclonal antibody developed by Kyowa Kirin that targets chemokine receptor 4 (CCR4), a protein frequently expressed on certain cancerous T-cells. By binding to CCR4, POTELIGEO attracts immune cells to destroy these malignant cells, enhancing the body’s immune response against the cancer.

POTELIGEO was first approved in Japan in 2012 for treating relapsed or refractory CCR4-positive adult T-cell leukemia (ATL). In 2014, its approval was expanded in Japan to include relapsed or refractory CCR4-positive peripheral T-cell lymphoma (PTCL) and cutaneous T-cell lymphoma (CTCL). The FDA approved POTELIGEO in 2018 for treating Mycosis Fungoides and Sézary Syndrome. It is also approved in Europe for these same conditions.

In June 2020, Kyowa Kirin announced the commercial availability of POTELIGEO in Germany for the treatment of adult mycosis fungoides patients and Sezary syndrome patients who have received at least one prior systemic therapy.

AIMOVIG (erenumab-aooe): Novartis/Amgen

Erenumab is a fully human monoclonal antibody developed by Amgen and Novartis, which can specifically bind to CGRP receptors and is an antagonist that directly competes with CGRP ligands. CGRP ligands are small neuropeptides with potent vasodilating effects in the setting of chronic pain and migraine. When competing with CGRP, erenumab offers advantages over small-molecule drugs in specificity and potency. The antibody is suitable for treating migraine, vasoconstriction, hot flashes, and stable angina pectoris. The monoclonal antibody was listed in the US and the EU in May and July 2018, respectively.

|

Comparison of Key Marketed Drugs | ||||

|

Product |

Company |

ROA |

Approval |

Indication |

|

ZAVZPRET |

Pfizer |

Intranasal |

US: 2023 |

Acute treatment of migraine |

|

POTELIGEO |

Kyowa Hakko Kirin |

IV infusion |

US: 2018 EU: 2018 JP: 2012 |

Adult T-cell leukemia, CCR4-positive PTCL, CCR4-positive CTCL, Mycosis fungoides (MF), and Sezary syndrome (SS) |

|

AIMOVIG |

Novartis/Amgen |

IV infusion |

US: 2018 EU: 2018 Japan: 2021 |

Migraine, vasoconstriction, hot flashes, and stable angina pectoris |

|

VYEPTI |

Lundbeck |

Intravenous |

US: 2020 EU: 2022 |

Preventive treatment for migraine |

Note: Detailed current therapies assessment will be provided in the full report...

GPCR-Targeting Emerging Drugs

Volagidemab: REMD Biotherapeutics

Volagidemab (REMD-477) is a human anti-glucagon receptor antibody developed by REMD Biotherapeutics against juvenile type I diabetes (T1D) and type II diabetes (T2D). It binds to the human GCGR and competitively blocks glucagon receptors (GCGR) signal transduction to increase liver glucose uptake, reduce liver glycogen decomposition and gluconeogenesis, and promote glycogen synthesis, to achieve the effect of hypoglycemia (CK060182). Up to March 2021, there were multiple experimental projects under development, of which, the research and development of type I and type II diabetes were in clinical stage II, the study on glucose intolerance was in clinical stage I and the study on metabolic disorders was in the preclinical stage (CK060183).

Leronlimab: CytoDyn

Leronlimab is a viral entry inhibitor, a class of HIV therapies that prevent the virus from entering and infecting healthy cells. Unlike Highly Active Antiretroviral Therapy (HAART), which targets the virus after it has entered the cell and begun replicating, Leronlimab acts earlier in the infection process. The importance of the CCR5 receptor in HIV is underscored by the natural resistance to HIV infection seen in individuals with a genetic mutation that prevents CCR5 expression. It is being developed for the treatment of Nonalcoholic Steatohepatitis (NASH), HIV-NASH, and solid tumors. Currently, it’s in Phase II.

In April 2019, the Company entered into several agreements with Samsung, under which Samsung agreed to perform technology transfer, process validation, manufacturing, pre-approval inspection, and supply services for the commercial supply of leronlimab bulk drug substance.

|

Product |

Company |

ROA |

Phase |

Indication |

|

Leronlimab |

CytoDyn |

IV infusion |

II |

Nonalcoholic Steatohepatitis (NASH), HIV-NASH, and solid tumors |

|

Volagidemab |

REMD Biotherapeutics |

IV infusion |

II |

Type I Diabetes Mellitus, type II diabetes |

|

GPC-100 |

GPCR Therapeutics |

IV infusion |

II |

Multiple Myeloma Undergoing Autologous Stem Cell Transplant |

|

GSBR-1290 |

Structure Therapeutics |

Oral |

II |

Type 2 Diabetes Mellitus |

Note: Detailed emerging therapies assessment will be provided in the final report…

GPCR-Targeting Therapies Market Outlook

The market for GPCR-targeting therapies is expected to grow significantly in the coming years. This is due to the increasing number of patients who are being diagnosed with cancer, the growing awareness of GPCR-Targeting therapies, and the increasing number of GPCR-Targeting therapies that are under clinical trials and filed for approval by various companies.

The GPCR-targeting therapies market outlook is promising, driven by successful drugs like ZAVZPRET, POTELIGEO, AIMOVIG, and VYEPTI. Mogamulizumab, developed by Kyowa Hakko Kirin and marketed as POTELIGEO, targets the CCR4 receptor and has proven effective in treating CCR4-positive adult T-cell leukemia, peripheral T-cell lymphoma, and cutaneous T-cell lymphomas. AIMOVIG (erenumab), developed by Amgen and Novartis, targets the CGRP receptor and is used for migraines, vasoconstriction, hot flashes, and stable angina pectoris, showcasing the specificity and potency of GPCR-targeting therapies. VYEPTI is the FDA-approved IV treatment for migraine prevention.

Emerging therapies like Volagidemab and Leronlimab, GPC-100, and GSBR-1290 highlight the expanding potential of this market. Volagidemab, an anti-glucagon receptor antibody, is in Phase II for Type I and Type II diabetes clinical trials, promoting hypoglycemia by blocking glucagon receptor signaling. Leronlimab, a viral entry inhibitor in Phase II development, targets the CCR5 receptor and is being developed for HIV, Nonalcoholic Steatohepatitis (NASH), HIV-NASH, and solid tumors. These advancements underline the significant therapeutic potential and market opportunities for GPCR-targeting drugs across various conditions.

Several key players, including CytoDyn, REMD Biotherapeutics, Structure Therapeutics, GPCR Therapeutics, and others, are involved in developing drugs for GPCR-targeting therapies for various indications such as NASH, Multiple Myeloma, Diabetes, and others. Overall, this is an exciting new class of agents with great potential for development. The maturation of current studies over the next few years will lead to a better understanding of GPCR-targeting therapies and define their role in cancer therapy.

GPCR-Targeting therapies Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging GPCR-targeting therapies expected to be launched in the market during 2024–2034.

GPCR-Targeting Therapies Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key companies developing targeted therapeutics.

The presence of numerous drugs at different stages is expected to generate immense opportunities for the GPCR-Targeting therapies market growth over the forecasted period.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and GPCR-targeting therapies patent details.

KOL Views

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on GPCR-Targeting therapies' evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Johns Hopkins Sidney Kimmel Cancer Center and others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or GPCR-Targeting therapies market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“We are using molecular dynamics simulations to understand the allosteric modulation of GPCRs at atomic resolution. This approach helps us identify cryptic binding pockets and design next-generation ligands that could transform treatment in cardiovascular and neurodegenerative diseases.” -PhD, Stanford University, US |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated, wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and a payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs, including Medicare, Medicaid, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces, are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

The abstract list is not exhaustive, and will be provided in the final report

Scope of the Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of the GPCR-Targeting therapies, explaining its mechanism, and therapies (current and emerging).

- Comprehensive insight into the GPCR-targeting therapies competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the GPCR-Targeting therapies market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM GPCR-Targeting therapies market.

GPCR-Targeting Therapies Report Insights

- GPCR-Targeting Therapies Targeted Patient Pool

- Therapeutic Approaches

- GPCR-Targeting Therapies Pipeline Analysis

- GPCR-Targeting Therapies Market Size and Trends

- Existing and future Market Opportunity

GPCR-Targeting Therapies Report Key Strengths

- 10-years Forecast

- The 7MM Coverage

- Key Cross Competition

- Drugs Uptake and Key Market Forecast Assumptions

GPCR-Targeting Therapies Report Assessment

- Current Treatment Practices

- GPCR-Targeting Therapies Unmet Needs

- GPCR-Targeting Therapies Pipeline Product Profiles

- GPCR-Targeting Therapies Market Attractiveness

- GPCR-Targeting Therapies Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions

- What was the GPCR-Targeting therapies total market size, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative GPCR-Targeting therapies market?

- What are the pricing variations among different geographies for approved therapies?

- How the reimbursement landscape has for GPCR-Targeting therapies evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with GPCR-Targeting therapies? What will be the growth opportunities across the 7MM for the patient population of GPCR-Targeting therapies?

- What are the key factors hampering the growth of the GPCR-Targeting therapies market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for GPCR-Targeting therapies?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the GPCR-Targeting therapies Market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.