Exploring Life-Saving Heart Devices: Innovations Transforming Cardiac Care

Jun 18, 2025

Table of Contents

Heart disease continues to be a major global health concern, impacting countless lives and placing a significant burden on healthcare systems worldwide. According to the World Health Organization, cardiovascular diseases are responsible for approximately 17.9 million deaths each year, accounting for nearly one-third of all global deaths. These conditions, ranging from heart failure to congenital defects, demand innovative solutions to improve patient outcomes and quality of life.

Heart devices have emerged as vital tools in this fight, offering advanced treatment options that manage symptoms, correct abnormalities, and, in many cases, save lives. From mechanical pumps to minimally invasive valves, these technologies represent the forefront of cardiac care. This blog provides a detailed exploration of various heart devices, their specific roles in treating cardiac conditions, recent advancements in the field, and the challenges and opportunities that lie ahead.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Zimmer Biomet Secures FDA Clearance for Upgraded ROSA® Knee Robotic System; IceCure’s ProSense® C...

- Neurovascular Thrombectomy Devices Market

- Mapping the Increasing Burden of Heart Failure: What Does it Bring for Healthcare Market Companies?

- FDA Grants Orphan Drug Designation for Ractigen’s RAG-21 in ALS; Intellia’s Nexiguran RMAT for AT...

- Roche’s Tecentriq combo proves effective in Bladder cancer

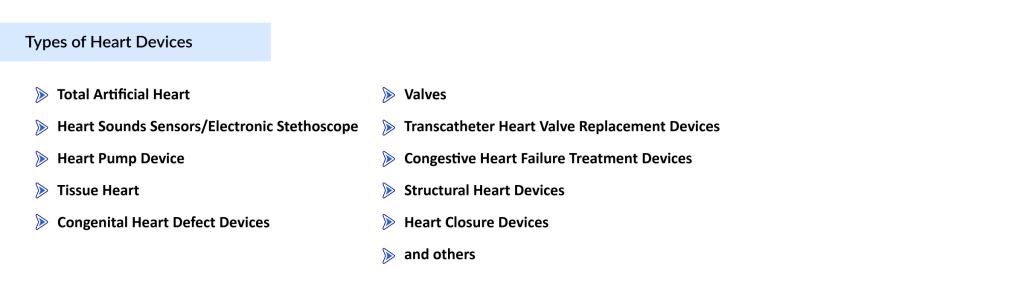

Types of Heart Devices

A wide range of heart devices has been developed to support, replace, or monitor cardiac function in patients with various cardiovascular conditions. These technologies play a crucial role in managing heart failure, rhythm disorders, and congenital defects, improving both survival and quality of life. Below are some of the key types of heart devices transforming cardiac care.

Total Artificial Heart

The Total Artificial Heart (TAH) is an advanced mechanical device that fully replaces both ventricles of a failing heart. Implanted after the natural heart is removed, it uses two artificial ventricles to pump blood to the lungs and body, typically powered by an external console or portable battery unit. The TAH is engineered to replicate the heart’s natural pumping rhythm.

Primarily used as a bridge to transplant for patients with end-stage heart failure when both ventricles fail, and other treatments like ventricular assist devices are insufficient. In rare cases, it serves as a long-term solution for those ineligible for heart transplants. Designed with biocompatible materials to reduce rejection risks, it includes sensors to adjust pumping based on the body’s needs, ensuring stable blood flow for critically ill patients.

The total artificial heart market is expected to grow due to the increasing prevalence of end-stage heart failure and a shortage of donor hearts. Innovations in portable power systems and device durability, led by companies like SynCardia Systems and others, are key drivers of market expansion.

Heart Sounds Sensors/Electronic Stethoscope

Heart Sounds Sensors, or electronic stethoscopes, are non-invasive devices that capture heart sounds with high precision using sensitive microphones and digital signal processing. They amplify and filter sounds to detect abnormalities like murmurs or irregular rhythms, often integrating with software for data visualization and storage.

Used for early diagnosis of heart conditions such as valve dysfunction, heart murmurs, or pericarditis in clinical settings or via telemedicine, enabling timely intervention to prevent complications like heart failure. Heart sound sensors/electronic stethoscopes offer digital amplification, noise reduction, and AI-powered analysis for enhanced diagnostic accuracy. Data recording and sharing capabilities support remote monitoring and collaborative diagnosis.

The heart sound sensors market is expected to grow due to rising demand for non-invasive diagnostic tools and the expansion of telemedicine. Companies like GE Healthcare, Koninklijke Philips N.V., Welch Allyn, and others are driving innovation in this field.

Heart Pump Device

Heart Pump Devices, such as Ventricular Assist Devices (VADs), are mechanical pumps that support a weakened heart by aiding blood circulation. They assist the left (LVAD), right (RVAD), or both ventricles (BiVAD), connected to the heart and powered by external batteries or control units, ensuring adequate blood flow.

Used for advanced heart failure patients as a bridge to heart transplant, recovery, or as destination therapy for non-transplant candidates. They alleviate symptoms like fatigue and shortness of breath, improving quality of life. Heart pump device features compact, durable designs with magnetically levitated systems for reduced wear and wireless monitoring for real-time patient data, enhancing treatment outcomes.

Valued at USD 4.44 billion in 2023, the heart pump devices market is expected to reach USD 6.20 billion by 2032, growing at a CAGR of 5.74% from 2025 to 2032, driven by rising heart failure cases, an aging population, and technological advancements by companies like Medtronic, Abiomed, Microport Scientific Corporation, and others.

Tissue Heart Valves

Tissue Heart Valves are bioprosthetic valves made from animal (e.g., porcine or bovine) or human donor tissue, designed to replace damaged heart valves. These valves restore normal blood flow and are implanted surgically or via minimally invasive methods.

Used to treat valvular heart diseases, such as aortic or mitral valve stenosis, particularly for patients who prefer to avoid lifelong anticoagulation therapy required by mechanical valves, improving long-term outcomes. Biocompatible and durable, these valves mimic natural heart function, reducing the need for ongoing medication and minimizing complications like blood clots.

The tissue heart valves market is estimated to grow at a CAGR of 7.56% from 2025 to 2032, driven by increasing valvular disease prevalence, an aging population, and advancements in tissue engineering. Leading companies include Abbott, Boston Scientific Corporation, Edwards Lifesciences Corporation, and others.

Transcatheter Heart Valve Replacement Devices

Transcatheter Heart Valve Replacement Devices use a minimally invasive catheter-based approach to replace damaged heart valves, such as aortic or mitral valves. Delivered through blood vessels, typically via the femoral artery, these devices avoid the need for open-heart surgery.

Primarily used to treat aortic stenosis or mitral valve regurgitation in high-risk patients, such as the elderly or those with comorbidities, offering a less invasive alternative with improved safety and recovery. Transcatheter heart valve replacement devices enable faster recovery, reduced complications, and precise valve placement, with advanced imaging and delivery systems ensuring optimal outcomes.

The transcatheter heart valve replacement devices market is estimated to grow at a CAGR of 13.75% from 2025 to 2032, driven by the rising prevalence of aortic stenosis, increasing adoption of minimally invasive procedures, and technological advancements in valve design and delivery systems. Leading companies include Medtronic, Boston Scientific Corporation, Edwards Lifesciences, Abbott, and others.

Congestive Heart Failure Treatment Devices

Congestive Heart Failure (CHF) Treatment Devices, such as Cardiac Resynchronization Therapy (CRT) devices and certain implantable pumps, are designed to improve heart function in patients with heart failure. CRT devices synchronize the contractions of the heart’s ventricles to enhance pumping efficiency, while some pumps assist blood circulation.

Used to manage symptoms of congestive heart failure, such as shortness of breath, fatigue, and fluid retention, improving heart efficiency and reducing hospitalizations for patients with moderate to severe heart failure. Congestive heart failure treatment devices provide tailored therapy with features like biventricular pacing for CRT devices and advanced monitoring to optimize heart function, significantly enhancing patient quality of life.

Valued at USD 17.41 billion in 2023, the congestive heart failure treatment devices market is expected to reach USD 27.96 billion by 2032, growing at a CAGR of 8.26% from 2025 to 2032, driven by the increasing prevalence of heart failure, advancements in CRT technology, and growing adoption of implantable devices. Key players include GE HealthCare, Boston Scientific Corporation, Medtronic, Abbott, Biotronik SE & Co. KG, and others.

Structural Heart Devices

Structural Heart Devices are specialized tools used to repair structural abnormalities in the heart, such as leaky valves, atrial septal defects (ASD), or ventricular septal defects (VSDs). These devices are typically delivered via minimally invasive, catheter-based procedures, avoiding the need for open-heart surgery.

Used to treat conditions like ASD, VSD, or paravalvular leaks, restoring normal heart function and blood flow in patients with congenital or acquired structural heart issues, often improving symptoms and preventing complications like heart failure or stroke. Structural heart devices offer precise, minimally invasive repairs with advanced imaging for accurate placement, reducing recovery time and improving heart performance with fewer complications compared to traditional surgery.

Valued at USD 9.81 billion in 2023, the structural heart devices market is expected to reach USD 18.67 billion by 2032, growing at a CAGR of 11.33% from 2025 to 2032, driven by the rising prevalence of structural heart diseases, increasing adoption of minimally invasive techniques, and advancements in device technology. Key players include Medtronic, Boston Scientific Corporation, Edwards Lifesciences, W. L. Gore & Associates, Inc., and others.

Heart Closure Devices

Heart Closure Devices are implants designed to seal holes or defects in the heart, such as patent foramen ovale (PFO) or atrial septal defects (ASD). Delivered via minimally invasive catheter-based procedures, these devices close abnormal openings to restore normal blood flow.

Used to prevent abnormal blood flow that can lead to stroke or heart failure, particularly in patients with congenital defects like PFO or ASD, offering a less invasive alternative to surgical repair. Heart closure devices provide high success rates in defect closure with biocompatible materials, ensuring quick recovery and improved heart function while reducing risks like stroke or embolism.

Valued at USD 2.51 billion in 2023, the market is expected to reach USD 3.99 billion by 2032, growing at a CAGR of 6.85% from 2025 to 2032, driven by increasing awareness of stroke prevention, rising diagnoses of PFO and ASD, and advancements in minimally invasive closure technologies. Key players include Abbott, W. L. Gore & Associates, Inc., Boston Scientific Corporation, Occlutech, and others.

Congenital Heart Defect Devices

Congenital Heart Defect Devices are specialized implants designed to correct structural abnormalities present at birth, such as ventricular septal defects (VSD), atrial septal defects (ASD), or patent ductus arteriosus (PDA). These devices are often delivered via catheter-based procedures, tailored for pediatric or adult patients with complex heart anatomies.

Used to treat congenital heart defects in children or adults, restoring normal heart function and blood flow to prevent complications like heart failure, pulmonary hypertension, or developmental issues, offering minimally invasive alternatives to open-heart surgery. Congenital heart defect devices feature precise, biocompatible designs suited for diverse anatomies, with advanced imaging for accurate placement, ensuring effective correction with minimal recovery time and improved long-term outcomes.

The market is expected to grow due to advancements in pediatric cardiology, improved diagnostic techniques for early detection of congenital defects, and increasing demand for minimally invasive procedures. Key players include Abbott, Medtronic, and Edwards Lifesciences, focusing on tailored device innovations.

Revolutionize your heart device innovations with our MedTech and Diagnostics services, offering a resilient approach for a dynamic industry that helps improve reaction to uncertainties, develops an advantage over competitors, and improves overall PERFORMANCE in business.

Request for Proposal today to lead in cardiac care solutions.

Recent Developments in Heart Devices

The cardiovascular device landscape continues to evolve rapidly with groundbreaking innovations aimed at improving diagnosis, treatment, and patient outcomes. From next-generation artificial hearts and AI-powered diagnostics to growth-adaptive pediatric stents and needle-free interventions, recent FDA approvals and clearances signal a strong shift toward more personalized, minimally invasive, and high-precision cardiac care. Below are some of the most notable updates from the past year.

June 2025 – Bivacor received FDA Breakthrough Device Designation for its fully implantable titanium total artificial heart (TAH), aimed at adults with severe biventricular or univentricular heart failure as a bridge to transplant (BTT), especially where LVADs are inadequate.

April 2025 – LUMA Vision Ltd. gained FDA clearance for VERAFEYE™, a catheter-based imaging platform offering real-time 360° visualization for electrophysiology and structural heart procedures, with magnetic navigation compatibility.

April 2025 – CardioVia received FDA clearance for its ViaOne system, enabling needle-free access to the pericardial space, reducing heart perforation risk during diagnostic and therapeutic interventions.

December 2024 – Johnson & Johnson MedTech secured FDA premarket approval (PMA) for its Impella 5.5 and Impella CP with SmartAssist heart pumps for pediatric patients with acute decompensated heart failure and cardiogenic shock.

November 2024 – BrightHeart received FDA 510(k) clearance for its AI-powered prenatal ultrasound software, a breakthrough in fetal heart evaluation and prenatal cardiology.

October 2024 – Abbott launched TEAM-HF, a novel clinical trial using AI and CardioMEMS™ HF System to optimize early intervention strategies in heart failure patients, potentially leading to advanced therapies like HeartMate 3™ LVAD.

August 29, 2024 – Renata Medical got FDA approval for the Minima Growth Stent, uniquely designed for neonates and young children with congenital heart defects. It can expand as the child grows, solving a long-standing challenge in pediatric cardiology.

August 2024 – Boston Scientific received the CE mark for the ACURATE Prime™ Aortic Valve System, a next-generation TAVR solution advancing structural heart therapy in Europe.

July 2024 – FibriCheck received FDA clearance in the Digital Health (DHX) category for its smartphone/smartwatch ECG app, enabling remote detection of arrhythmias like atrial fibrillation and enhanced data sharing with physicians.

Challenges and Benefits of Heart Devices

Challenges

High Costs and Accessibility: Advanced heart devices, such as Total Artificial Hearts and Transcatheter Heart Valve Replacement systems, often come with significant costs, ranging from tens to hundreds of thousands of dollars. These expenses, coupled with surgical and follow-up care, can limit access, particularly in low-income regions or for uninsured patients, exacerbating healthcare disparities.

Risk of Complications: Despite technological advancements, devices like Heart Pump Devices and Heart Closure Devices carry risks of complications, including infections, bleeding, or device malfunctions. For example, ventricular assist devices may lead to blood clots, requiring careful monitoring and anticoagulation therapy, which can impact patient quality of life.

Lifelong Monitoring and Maintenance: Many heart devices, such as Congestive Heart Failure Treatment Devices and Tissue Heart Valves, require ongoing medical oversight to ensure functionality and detect issues like valve degeneration or battery depletion. This necessitates regular check-ups and potential device replacements, adding to patient burden and healthcare costs.

Benefits

Life-Saving Interventions: Heart devices like Total Artificial Hearts and Heart Pump Devices provide critical support for patients with end-stage heart failure, extending life expectancy while awaiting transplants or serving as permanent solutions. These interventions have transformed outcomes for conditions previously considered untreatable.

Enhanced Quality of Life: Devices such as Cardiac Resynchronization Therapy units and Transcatheter Heart Valve Replacement systems alleviate debilitating symptoms like shortness of breath and fatigue, enabling patients to resume daily activities and improve their overall well-being.

Minimally Invasive Options: Advances in Structural Heart Devices and Heart Closure Devices allow for catheter-based procedures, reducing recovery times and complications compared to open-heart surgery. This is particularly beneficial for high-risk patients, such as the elderly or those with comorbidities.

Emerging Technologies

Bioresorbable Heart Devices: Researchers are developing bioresorbable stents and closure devices that dissolve naturally after restoring heart function, eliminating the need for long-term implants. These are particularly promising for Congenital Heart Defect Devices, reducing risks in pediatric patients as their hearts grow.

3D-Printed Heart Valves: Customized 3D-printed tissue heart valves, tailored to a patient’s unique anatomy, are advancing through clinical trials. This technology enhances compatibility and durability, potentially revolutionizing Tissue Heart Valves and Transcatheter Heart Valve Replacement systems.

Wearable Heart Monitors with Cloud-Based Analysis: Next-generation Heart Sound Sensors are integrating with wearable devices that transmit real-time data to cloud platforms for AI-driven analysis. This enables early detection of heart conditions and supports remote monitoring, expanding telemedicine applications.

Gene-Editing Therapies Combined with Device Implants: Combining CRISPR-based gene therapies with heart devices, such as Congestive Heart Failure Treatment Devices, aims to address the underlying genetic causes of heart disease. Early trials suggest potential for long-term solutions, reducing reliance on mechanical interventions.

Conclusion

Heart devices have revolutionized cardiac care, offering life-saving solutions for conditions ranging from heart failure to congenital defects. From Total Artificial Hearts sustaining critically ill patients to minimally invasive Heart Closure Devices preventing strokes, these technologies have significantly improved survival rates and quality of life. Recent advancements, such as Medtronic’s TAVR trial outcomes and Boston Scientific’s strategic shifts, underscore the dynamic nature of this field.

However, challenges like high costs, complications, and the need for lifelong monitoring highlight the importance of continued innovation. Emerging technologies, including bioresorbable devices and gene-editing therapies, promise to address these hurdles, paving the way for more accessible and effective treatments. To stay proactive about heart health, readers are encouraged to stay informed about these advancements and consult cardiologists for personalized care, ensuring a healthier future.

Downloads

Article in PDF

Recent Articles

- Inspira™ Approval of INSPIRA™ ART100 System; Oticon Medical’s Sentio™ System Received Regul...

- Breakthrough Device Designation granted to the AI Software for CTEPH

- Johnson & Johnson MedTech Secures CE Mark for Dual Energy THERMOCOOL SMARTTOUCH™ SF Catheter;...

- Robotic Surgery: Navigating the Growing Demand, Ongoing Trends & Developments in the Global ...

- The Rise of TCR Therapy: A Beacon of Hope in Cancer Treatment