BMS Vs. Janssen: Which Company Will Dominate The Multiple Myeloma Treatment Market This Decade?

Jul 25, 2024

Table of Contents

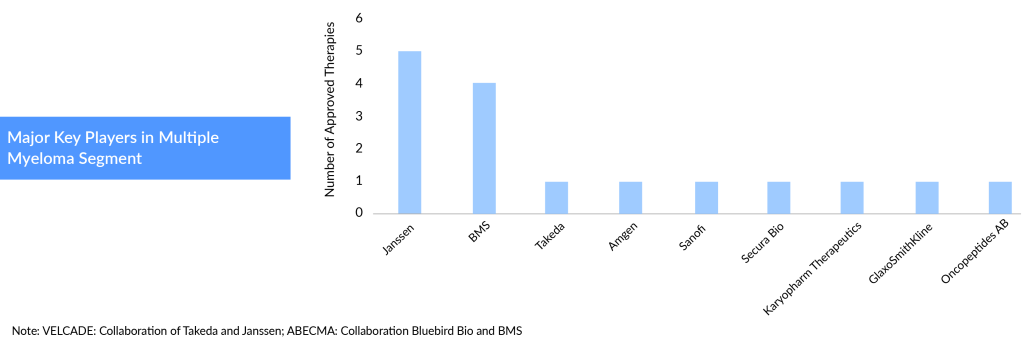

Over the past several years, multiple myeloma treatment options have expanded widely for patients, resulting in significantly improved outcomes. The FDA approved around 16 new agents and 30 treatment regimens, transforming the multiple myeloma treatment paradigm for patients with newly diagnosed and relapsed/refractory multiple myeloma. Bristol Myers Squibb (BMS) and Janssen, a subsidiary of Johnson & Johnson, are the two titans dominating the multiple myeloma treatment landscape with around nine FDA-approved products for multiple myeloma in different settings. This advancement is crucial in addressing multiple myeloma recurrence, offering new and effective solutions to manage and potentially overcome the challenges associated with disease relapse.

With its leading oncology portfolio, Janssen is set to spearhead the multiple myeloma treatment market.

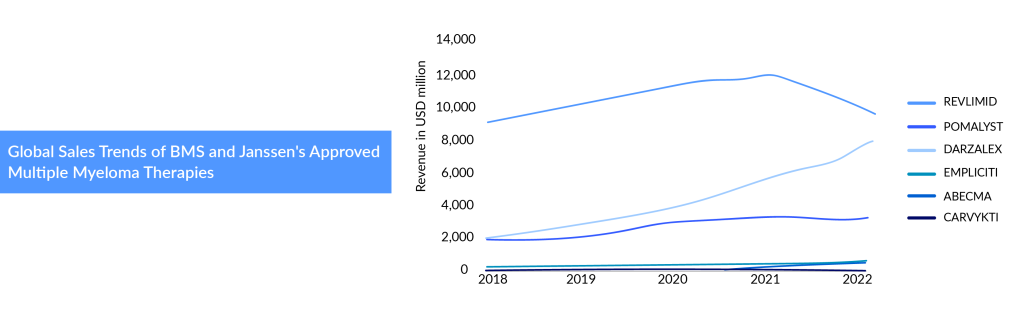

Multiple myeloma treatment has advanced at a rapid pace, thanks to many new drugs hitting the market. Beyond DARZALEX, Janssen is aggressively developing its multiple myeloma franchise. DARZALEX (Janssen) and EMPLICITI (BMS) were approved at the same time (2015), but DARZALEX has grown much more quickly, touching a revenue of nearly USD 9.7 billion in 2023 starting from nearly USD 0.5 billion in 2016.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Kalydeco got approved; Opdivo for SCLC; FDA approved for pain relief; GC4419 obviates

- Sanofi acquires Principia; FDA’s Nod to Roche’s Enspryng; BMS, Dragonfly’s Lice...

- Merck Wins FDA Approval for KEYTRUDA QLEX for Subcutaneous Use in Adults With Solid Tumors; Incyt...

- DARZALEX FASPRO Quadruplet Regimen Demonstrates Striking Advancements in Treatment Outcomes for N...

- Kiadis inks license deal with Sanofi; Gilead Ends Hep B Collaboration; Merck & Foghorn inks ...

Several factors contributed to the continuous growth of DARZALEX and the slow uptake of EMPLICITI. DARZALEX has not stopped rolling since hitting the multiple myeloma treatment market with continuous label expansions, and the introduction of the subcutaneous formulation. DARZALEX dominates the multiple myeloma market with three front-line approvals, including one in eligible (DVTd) and two in transplant ineligible (DVMP, and DRd). While DARZALEX’s success has surged, late-stage pipeline entries of additional CD38-targeting drugs intensified competition in the busy multiple myeloma treatment market. To ward off the competition, Janssen launched the subcutaneous formulation of DARZALEX. DARZALEX Faspro cuts its dosing time to just a few minutes from hours and could help it fend off a challenge from Sanofi. Janssen has transitioned 85% of its US operations to subcutaneous formulation, while the conversion rate is at 80% in Europe. That is why, despite the growing competition, DARZALEX continues to move in the right direction, given the enhanced convenience and ease of use for the patient. DARZALEX was the first drug to receive regulatory approval in a quadruplet regimen for multiple myeloma in the first-line scenario. Another highly anticipated combination, D-RVd, is being studied in both eligible and ineligible settings for the treatment of multiple myeloma. Janssen plans to replace the RVd regimen in the earlier multiple myeloma treatment lines and shift the treatment paradigm to quadruplet regimens.

It is worth mentioning that Janssen now has five multiple myeloma medicines in the market. With this, Janssen is anticipated to dominate the multiple myeloma treatment segment this decade. Janssen has the most diversified approved drugs portfolio, ranging from monoclonal antibodies to CAR-T’s to bispecific antibodies.

Does BMS’s reign of dominance in multiple myeloma treatment segment has come to an end?

EMPLICITI received FDA approval in the United States in 2015. EMPLICITI started with a revenue of USD 150 million and achieved a maximum revenue of USD 380 million in 2020; after that, it started to decline and registered a global revenue of USD 296 million in 2022, with an 11% decline from 2021 (USD 334 million). J&J’s DARZALEX and Takeda’s NINLARO obtained regulatory approval in 2015. Since then, DARZALEX has swiftly grown in multiple myeloma treatment segments. DARZALEX became the first monoclonal antibody to be approved for use in newly diagnosed patients. In addition, EMPLICITI also failed to make its presence in the first-line segment as the drug experienced a setback in the ELOQUENT-1 clinical trial. The addition of EMPLICITI to a regimen of Rd in transplant-ineligible did not show significant improvement in preventing disease progression compared to using Rd alone.

Following its acquisition of Celgene in 2019, BMS took on REVLIMID and POMALYST, relegating Empliciti to a minor role within its extensive multiple myeloma portfolio. In 2018, REVLIMID and POMALYST generated $9.7 billion and $2 billion in global revenue, respectively. REVLIMID continued to deliver robust quarterly results, becoming one of BMS’s top-selling drugs with global revenue reaching $12.8 billion, including $8.7 billion from the US. However, this marked the peak of REVLIMID’s sales, which declined thereafter. BMS has now slashed its 2023 sales forecast for REVLIMID by $1 billion and reduced its overall revenue projection. In 2022, US revenues decreased by 4% due to lower demand driven by generic erosion, partially offset by higher average net selling prices. International revenues fell by 61% due to generic erosion across several European countries and Canada, lower average net selling prices, and a 4% impact from foreign exchange. While BMS revised its 2023 sales forecast for REVLIMID from $6.5 billion to $5.5 billion, the company also reduced its projection for Pomalyst by $300 million. In the second quarter, sales of POMALYST dropped 6% year-over-year to $847 million due to the same factors affecting REVLIMID.

So the question is, is this game over for REVLIMID? Will the legacy of REVLIMID slowly diminish?Well, not yet. BMS is developing potential successors to REVLIMID to become the future cornerstone for multiple myeloma treatment. BMS revealed its two Cereblon E3 ligase modulators (CELMoDs) iberdomide and mezigdomide in ASH 2021. BMS is investigating these CELMoDs for multiple myeloma treatment that were intentionally designed to improve upon the demonstrated efficacy of the IMiDagents, along with manageable tolerability, ease of administration, and the potential to improve patient outcomes. These agents co-opt cereblon to induce the degradation of target proteins Ikaros and Aiolos, which inhibit tumor cell proliferation, promote tumor cell death, and induce immune-stimulatory effects.

BMS has established a comprehensive multiple myeloma treatment strategy; the company is quite optimistic about CELMoDs replacing REVLIMID in earlier lines of treatment. Now, it remains to be seen whether CELMoDs can live up to such high expectations or will be an utter disappointment. Further trials and clinical data will undoubtedly tell whether CELMoDs will become the next blockbuster.

Janssen and BMS are competing head-to-head in the BCMA CAR-T space

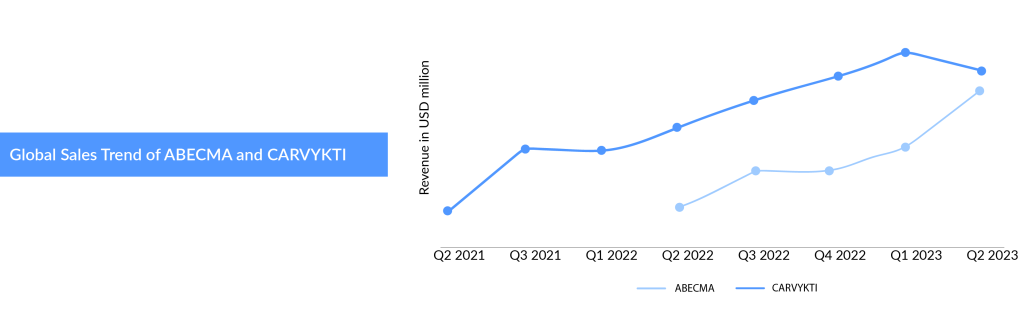

BMS, in partnership with Bluebird Bio, brought the first CAR T-cell therapy ABECMA, a first-in-class BCMA-directed personalized immune cell therapy delivered as a one-time infusion for triple-class exposed patients with multiple myeloma. Being the only available CAR-T therapy, the demand for ABECMA was huge, leading to supply constraints as the company struggled to meet this high demand. A year after BMS, Janssen with Legends entered into the multiple myeloma ring with the FDA approval of CARVYKTI in February 2022. J&J and Legend teamed up for the joint commercialization of CARVYKTI in the United States. The companies set the wholesale acquisition cost of CARVYKTI at USD 465,000, slightly higher than ABECMA’s initial list price of USD 419,500 upon launch.

ABECMA and CARVYKTI are in a tight race; both are approved in the fifth line in the US and fourth line in the EU and targeting earlier treatment settings with bigger multiple myeloma patient pools. ABECMA’s revenue was USD 388 million in 2022, increased by 136.6% compared to 2021; this represents a strong growth year-over-year reflecting significant patient demand and the work the company has done to increase manufacturing capacity. While CARVYKTI’s sales in Q3 and Q4 2022 remained the same with USD 55 and 54 million. Even in Q1 of 2023, ABECMA generated revenue of USD 147 million globally with USD 118 million from the US market, compared to CARVYKTI, which could generate sales of USD 72 million globally with USD 70 million from the US market only. However, sales of CARVYKTI jumped significantly from USD 72 million to USD 117 million in the 2nd quarter of 2023, which reflects improvements in supply, on the other hand, ABECMA’s sales declined to USD 132 million in Q2 from USD 147 million in Q1 2023.

In a close race with Janssen, BMS highlighted the success of ABECMA in an earlier setting with the submission of sBLA for ABECMA multiple myeloma patients who have failed two to four prior lines of therapy.

In April 2024, Johnson & Johnson announced that the FDA approved CARVYKTI for adult patients with relapsed or refractory multiple myeloma who have undergone at least one prior therapy, including a proteasome inhibitor and an immunomodulatory agent, and are refractory to lenalidomide. The approval is based on results from the Phase III CARTITUDE-4 study, which showed that treatment with CARVYKTI in 1-3 prior lines of therapy reduced the risk of disease progression or death by 59 percent compared to standard therapies. This highlights the growing importance of CAR-T therapy in multiple myeloma treatment.

With this approval, CARVYKTI becomes the first and only B-cell maturation antigen (BCMA)-targeted therapy approved for treating multiple myeloma patients as early as their first relapse. The drug has the potential to surpass ABECMA, as it was evaluated in an earlier treatment line (2L+) compared to ABECMA (3L+). CARTITUDE-4 included a significant number of patients with just one prior treatment line.

Summary

Janssen obtained regulatory approval in 2022 for its BCMA x CD3 bispecific antibody, TECVAYLI, for treating multiple myeloma and for CARVYKTI in 2024 for adult patients with relapsed or refractory multiple myeloma who have undergone at least one prior therapy. This addition expands the array of therapies accessible for this type of blood cancer. Janssen has reinforced its position as a leading player in the area of multiple myeloma, standing alongside Bristol Myers Squibb, with the market debut of TECVAYLI and the recent approval of TALVEY, in addition to their current drugs like DARZALEX. BMS’s another breakthrough in the multiple myeloma category is CELMoDs, which are not likely to receive regulatory approval anytime soon. With REVLIMID’s generic entry and POMALYST’s patent expiring soon, BMS has one CAR-T that might help retain the company among the top key players in multiple myeloma. However, we anticipate Janssen to be the next leader in the multiple myeloma treatment space.

As 2023 passed with the market experiencing ups and downs with these companies’ drugs, Janssen and BMS could be the leaders in the future of multiple myeloma treatment.

FAQs

DARZALEX changed the game. Its continuous label expansions, front-line approvals, and subcutaneous formulation adoption (85% in the US, 80% in Europe) have made it far more convenient than rivals, securing billions in revenue growth.

Yes and no. REVLIMID’s generic erosion hurt revenues, but BMS is betting on CELMoDs like iberdomide and mezigdomide to become the next backbone therapies. Their success will decide if BMS can rebound or cede leadership.

Because DARZALEX became more than just another antibody. Its rapid label expansions, front-line approvals, and patient-friendly subcutaneous formulation turned it into a treatment backbone, while EMPLICITI struggled with trial setbacks and limited first-line presence.

Initially, ABECMA led in sales due to its first-to-market advantage. But with CARVYKTI’s recent FDA approval in earlier treatment lines (1–3 prior therapies), Janssen may gain the upper hand in capturing a larger patient pool.

Timing of innovation. If BMS can accelerate CELMoDs and expand ABECMA’s indications, it could retain a strong role in the multiple myeloma market. But if Janssen continues pushing earlier-line approvals and next-gen drugs, it may dominate the multiple myeloma therapy segment well into the 2030s.

Yes, if iberdomide and mezigdomide can outperform older IMiD drugs with better tolerability and efficacy, they may help BMS regain share in the multiple myeloma drug market. However, without strong clinical data, Janssen’s dominance in multiple myeloma therapies will likely widen.

Downloads

Article in PDF

Recent Articles

- Bristol-Myers Squibb’s Opdivo Approval; Mirati’s KRAS-inhibitor Adagrasib; J&J and Legend Bi...

- EMA to review Cidara Therapeutics’ Rezafungin; EU Approves Gilead Sciences’ Sunlenca; FDA Approve...

- Meeting the Unmet: Nonalcoholic Steatohepatitis (NASH)

- 7 Companies at the Forefront of Trispecific Antibody Development

- FDA Approves BMS’s Reblozyl for MDS; FDA Awards Orphan Drug Designation to NXC-201; Janssen Submi...