Unleashing the Potential: CD38 Directed Therapies Revolutionize Multiple Myeloma Treatment

Sep 24, 2024

Table of Contents

The landscape of multiple myeloma therapies has been revolutionized by the introduction of cutting-edge monoclonal antibodies (mAbs) targeting CD38. Among the standout advancements are DARZALEX (daratumumab) and SARCLISA (isatuximab-irfc), which have emerged as game-changers in the treatment of multiple myeloma. These innovative therapies are reshaping the approach to both newly diagnosed multiple myeloma (NDMM) and relapsed/refractory multiple myeloma (R/R MM), offering patients a new beacon of hope with their effective and groundbreaking solutions. This progress in therapy is also significantly impacting the multiple myeloma prognosis, providing more effective multiple myeloma medication options and potentially improving long-term outcomes for patients.

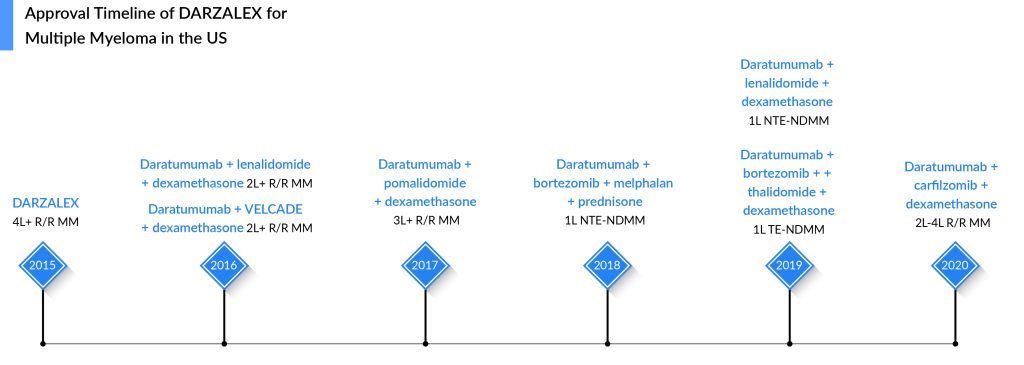

DARZALEX Sets New Standards in Multiple Myeloma Treatment Landscape With its Launch in 2015

DARZALEX (a monoclonal antibody targeting CD38) is approved for multiple myeloma alone and in combination with standard-of-care regimens. DARZALEX was first approved by the FDA in November 2015 for the treatment of patients with multiple myeloma who had received at least three prior lines of therapy, including a proteasome inhibitor (PI) and an immunomodulatory agent (IMiD). The approval of DARZALEX represented a significant advancement in the multiple myeloma therapeutic domain, especially for patients who had relapsed or were refractory to previous therapies. Its ability to target CD38-positive cells made it a promising option for newly diagnosed and relapsed/refractory patients.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- AstraZeneca’s Imfinzi Shows Positive Results; Novartis Announces Results of Tislelizumab; FDA Gra...

- Changing Landscape of EBV-associated Diseases Treatment: Is T-cell Immunotherapy the Answer?

- Outset Medical captures; Wright Medical Group to takeover Cartiva; Y-mAbs Therapeutics prepares f...

- TALVEY’s Versatility Shines: Key Insights from MonumenTAL-2 Study Illuminate Effective Stra...

- CAR-T cell therapy market for Non-Hodgkin lymphoma: Future prospects, and untapped opportunities

Over time, DARZALEX received subsequent approvals for various stages of multiple myeloma therapies. Notably, around 50% of DARZALEX usage comes from second-line multiple myeloma treatment, highlighting its significant role in supporting patients who require further therapeutic options. In the frontline multiple myeloma clinical trials, DARZALEX has emerged triumphant, surpassing all expectations and solidifying its position as the gold standard of therapy. Its unparalleled effectiveness and exceptional safety profile have exceeded rivals’ predictions and soon positioned DARZALEX to dominate the multiple myeloma treatment. Supported by the NCCN’s recommendation, this game-changing treatment’s spotlight is shining brightly.

DARZALEX also maintains a dominant position among its competitors in the management of multiple myeloma, primarily because many drugs currently under evaluation for multiple myeloma treatment are more likely to complement DARZALEX rather than compete directly against it. Likewise, Johnson & Johnson (J&J) is actively exploring the combination of DARZALEX with TECVAYLI, CARVYKTI, and talquetamab.

With the D-RVd Quad Regimen, Janssen is Strengthening its Position in The Frontline Patient Segment (Both Transplant-eligible and Ineligible Settings)

Adding DARZALEX to both transplant-ineligible and transplant-eligible regimens has improved patient outcomes. Quadruplets combination for multiple myeloma has shown PFS benefits in clinical trials; hence quad-based regimens are predicted to broaden the frontline multiple myeloma therapies paradigm in coming years. In the Phase III CASSIOPEIA study, DARZALEX with VTd-approved quadruplet treatment has previously shown PFS improvements. Moreover, treatment with DVTd reduced the risk of progression or death by 53% compared to VTd alone. Apart from that, in the Phase III ALCYONE study in the transplant-ineligible newly diagnosed multiple myeloma, the trial demonstrated an improvement in PFS in the D-VMP arm as compared to the VMP arm, representing a 50% reduction in the risk of disease progression or death. After a median follow-up of 40 months, the median PFS was 36.4 months in the D-VMP arm.

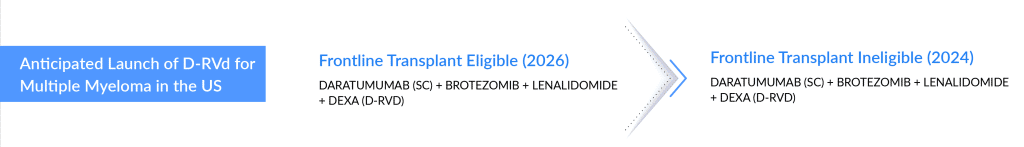

The most anticipated DARZALEX quadruplet regimen (D-RVd) is undergoing evaluation for treating newly diagnosed multiple myeloma in transplant-eligible and ineligible patients. The evaluation of this treatment regimen will continue as part of the registrational, Phase III PERSEUS, and CEPHEUS study.

Following the encouraging results from the GRIFFIN study, a Phase III trial (PERSEUS) was initiated for transplant-eligible multiple myeloma patients. Unlike GRIFFIN, this trial is designed with the statistical power to demonstrate a significant difference in progression-free survival. In addition to this, in the transplant-ineligible patients, the CEPHEUS study was started, which currently has no results.

The bottom line is that the quadruplets are well-tolerated, and incredibly high and sustained response rates have been observed. The PFS follow-up with the GRIFFIN trial is unprecedented in this setting. Researchers have never seen that kind of PFS benefit (showed a PFS benefit of 87% vs. 70%). Moreover, the high-risk subgroups benefit from quadruplet therapy, including those with 1q abnormalities with a stringent complete response (sCR) rate of 42% in the D-RVd arm vs. 32% in the RVd arm by the end of post-autologous stem cell transplant consolidation.

The randomized, phase II GRIFFIN study (NCT02874742) evaluated daratumumab combined with lenalidomide, bortezomib, and dexamethasone (D-RVd) in transplant-eligible patients with newly diagnosed multiple myeloma (NDMM). The initial analysis (median follow-up of 13.5 months) indicated that D-RVd improved stringent complete response (sCR) rates compared to RVd (42.4% vs. 32.0%). At final analysis (median follow-up of 49.6 months), the D-RVd group showed a higher complete response rate (83.0% vs. 60.2%), better minimal residual disease (MRD) negativity rates (64.4% vs. 30.1%), and a 55% reduction in the risk of disease progression or death (HR, 0.45). The 48-month progression-free survival (PFS) rates were 87.2% for D-RVd and 70.0% for RVd. The findings are supported by the phase III PERSEUS trial, which reported similar PFS benefits (HR, 0.42).

Despite treatment advancements, elderly and high-risk multiple myeloma patients still face poor prognoses. Using the most effective upfront treatments is crucial, especially for high-risk patients. High-risk disease is characterized by cytogenetic abnormalities, including del(17p), t(4;14), t(14;20), t(14;16), and gain/amp(1q21). Other high-risk factors include older age, advanced disease stage, plasma cell leukemia, extramedullary disease, and impaired renal function.

Randomized studies are vital for understanding novel therapies’ roles in high-risk subgroups. A post hoc analysis of GRIFFIN explored daratumumab’s impact on high-risk cytogenetic abnormalities (HRCAs) and other baseline high-risk characteristics, revealing significant prognostic value for high-risk NDMM.

The findings suggest that incorporating daratumumab into standard treatment regimens can enhance response rates and provide durable benefits, thereby improving the overall management of multiple myeloma.

Below mentioned is the expected launch year for D-RVd in both the frontline setting for patients eligible for transplantation and patients not eligible for transplantation.

Impact on DARZALEX’s Position After Entry of its First Direct Rival SARCLISA

SARCLISA, the second CD38 antibody, has received accelerated approval, started gaining some traction in key markets, and became the first direct rival to Johnson & Johnson’s DARZALEX. It is noteworthy that SARCLISA was Sanofi’s first wholly-owned cancer approval since JEVTANA in 2010. In March 2020, the drug was approved by the US FDA in combination with pomalidomide and dexamethasone for the treatment of R/R multiple myeloma, and in March 2021, the US FDA approved SARCLISA in combination with carfilzomib and dexamethasone for the treatment of R/R multiple myeloma.

Data from the Phase III ICARIA-MM study supported SARCLISA’s approval, showing a 40% reduction in the risk of disease progression or death in patients treated with Isa-Pd. Additionally, the Phase III IKEMA study supported SARCLISA’s label expansion, revealing a 45% lower risk of mortality or disease progression when SARCLISA was added to Kd. These results were slightly superior to the Phase III Candor study by DARZALEX-Kd, which showed a 37% reduction in the risk of disease progression or mortality with the addition of DARZALEX to carfilzomib and dexamethasone.

In May 2024, the FDA accepted a Priority Review for the supplemental Biologics License Application (sBLA) of SARCLISA (isatuximab) combined with bortezomib, lenalidomide, and dexamethasone (VRd) for treating transplant-ineligible newly diagnosed multiple myeloma (NDMM). If approved, Sarclisa would be the first anti-CD38 therapy with VRd for these patients, marking its third indication in multiple myeloma. The FDA’s decision is expected by September 27, 2024. A regulatory review is also underway in the European Union.

This approval would significantly benefit patients by providing an effective treatment option for those ineligible for transplant. Combining SARCLISA with standard-of-care VRd could enhance patient outcomes, potentially improving progression-free survival and reducing the risk of disease progression or death. It would also further establish Sarclisa as a critical therapy in the multiple myeloma treatment landscape, offering new hope for better disease management and patient quality of life.

In September 2024, Sanofi’s SARCLISA got approved by the FDA as the first anti-CD38 therapy in combination with standard-of-care treatment for adult patients with newly diagnosed multiple myeloma who are not eligible for autologous stem cell transplant. This approval is based on positive results from the IMROZ Phase III study, which demonstrated that SARCLISA, when combined with bortezomib, lenalidomide, and dexamethasone, significantly improved progression-free survival (PFS) by 40% compared to VRd alone.

Other than this, In August 2023, Pfizer Inc. announced that the FDA granted accelerated approval to ELREXFIO (elranatamab-bcmm) for the treatment of adult patients with relapsed or refractory multiple myeloma (RRMM) who have received at least four prior lines of therapy, including a proteasome inhibitor, an immunomodulatory agent, and an anti-CD38 monoclonal antibody. This approval was based on results from the single-arm Phase II MagnetisMM-3 trial. Continued approval for this indication is contingent upon verification of clinical benefit in a confirmatory trial(s). ELREXFIO is a subcutaneously delivered B-cell maturation antigen (BCMA)-CD3-directed bispecific antibody (BsAb) immunotherapy that binds to BCMA on myeloma cells and CD3 on T-cells, bringing them together and activating the T-cells to kill myeloma cells.

This approval positions Pfizer as a strong competitor in the multiple myeloma therapeutic landscape, potentially rivaling established players such as Sanofi and Johnson & Johnson. With its unique mechanism of action and subcutaneous delivery, ELREXFIO offers a novel therapeutic option that could enhance patient outcomes and expand Pfizer’s footprint in the oncology market. As the market for multiple myeloma therapies continues to evolve, the addition of ELREXFIO underscores Pfizer’s commitment to innovation and strengthens its competitive edge against other leading pharmaceutical companies.

SARCLISA Also Aims to Capture Transplant-eligible and Ineligible Patients With Isa-RVd

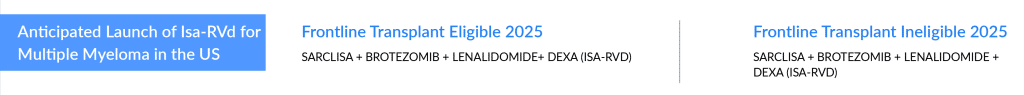

A gripping showdown between the two CD38 antibodies awaits transplant-eligible and non-transplant-eligible patients. The mounting evidence for the efficacy of CD38-RVd combinations emerges from groundbreaking studies in the transplant-eligible group, setting the stage for a battle between these cutting-edge therapies. The patients can look forward to an expanded array of options in the first-line transplant-eligible setting, particularly regarding anti-CD38 monoclonal antibodies. A groundbreaking moment came with the GMMG-HD7 study’s positive findings, which unveiled the efficacy of the potential combination of the anti-CD38 monoclonal antibody Isatuximab with RVd compared to RVd alone.

The GMMG-HD7 study first presented the anti-CD38 monoclonal antibody Isatuximab with RVd vs. RVd alone. The design of the GMMG-HD7 study was very similar to the GRIFFIN study. Both studies used an RVd backbone, and in the GMMG-HD7 study, Isatuximab was used instead of daratumumab. One of the key differences is that the GMMG-HD7 study is a Phase III study, so the number of patients was higher. The primary endpoint was looking at the MRD negativity rate. At the ASH 2022 meeting, the company presented some findings from the MRD negativity rate. GMMG-HD7 showed higher response rates and deeper responses in the quadruplet arm, with 50% of the quadruplet arm being MRD negative vs. 35% being MRD negative in the RVd-alone arm at the end of induction therapy. The other pivotal trial (IMROZ) also evaluates the Isa-RVd for not transplant-eligible patients with newly diagnosed multiple myeloma. The expected filing submission for GMMG-HD7 study and IMROZ study is anticipated in 2024.

Below mentioned is the expected launch year for Isa-RVd in both the frontline setting for patients eligible for transplantation and patients not eligible for transplantation.

The companies are focusing on entering the frontline setting after witnessing the acceptance of treatments like REVLIMID and VELCADE, and now DARZALEX. Market presence in frontline settings is essential from a business perspective because of the greater patient base and less emerging competition. This ambitious endeavor promises to introduce a fresh wave of competition, potentially reshaping the multiple myeloma treatment landscape and offering new hope for those facing this complex and challenging disease in earlier lines.

Uptake Analysis of DARZALEX and SARCLISA

While Johnson & Johnson’s DARZALEX, Bristol Myers Squibb, and AbbVie’s EMPLICITI debuted in the same month, DARZALEX has so far surpassed EMPLICITI regarding blockbuster status. DARZALEX has revolutionized the treatment landscape of multiple myeloma. DARZALEX is a blockbuster therapy, and its strong uptake is attributed to its outstanding safety and efficacy, in addition to the significant increase in the adoption of the subcutaneous (SC) formulation. J&J holds a convenience advantage with DARZALEX FASPRO, which takes 3–5 min to administer instead of the hours needed for the drug’s intravenous (IV) form. Fortunately, the subcutaneous formulation of daratumumab provides a big convenience for both patients and nurses, and this convenience factor and the low-infusion reaction may replace the IV formulation moving forward.

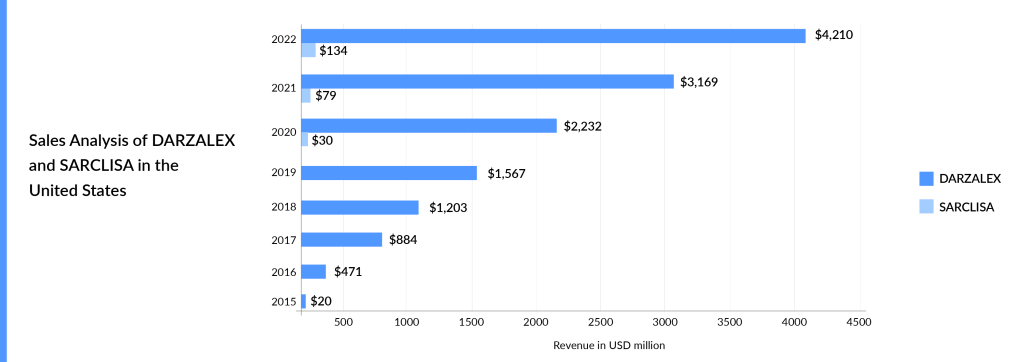

SARCLISA is way behind DARZALEX in terms of market expansion, and DARZALEX has also got an early mover advantage of over 4 years. In addition to this, DARZALEX has already been approved in the transplant-eligible and transplant-ineligible settings. SARCLISA could become a blockbuster only after an aggressive label expansion and availability of subcutaneous formulation. Sanofi is also coming up with a subcutaneous formulation of SARCLISA in collaboration with Blackstone Life Sciences to treat multiple myeloma. In addition to that, the filing submission of SARCLISA subcutaneous in 3L R/R multiple myeloma (IRAKLIA) is anticipated in 2025 and beyond. Both DARZALEX and SARCLISA have seen growth since their market launch. DARZALEX, in particular, experienced significant uptake since its approval, generating approximately USD 470 million in revenue in the United States in 2016. DARZALEX generated approximately USD 8 billion in global revenue during the year 2022. The graph below illustrates the revenue of these approved CD38-directed therapies from their respective market introductions. The graph highlights the strong market acceptance and commercial success of DARZALEX.

The competition intensifies in the later stages of treatment with the emergence of CART-s and bispecific antibodies. Two CAR-T therapies, ABECMA and CARVYKTI, have been approved for the treatment of multiple myeloma. CAR-Ts are not expected to pose a significant threat to DARZALEX due to their better efficacy and safety profile and evolving use in earlier lines of setting.

Summary

The multiple myeloma therapeutic field is undergoing significant changes, with the emergence of monoclonal antibodies as a key approach for newly diagnosed patients. DARZALEX holds a dominant position compared to its competitors in the market. Moreover, the potential synergy between DARZALEX and other Multiple Myeloma drugs market suggests a collaborative rather than a direct competitive future. As the field continues to advance, DARZALEX remains a strong player, paving the way for improved therapeutic options and outcomes for patients with this challenging disease. Furthermore, DARZALEX has established its supremacy and has solidified its position as a leading treatment option across all lines of multiple myeloma. The comprehensive analysis demonstrates Janssen’s remarkable strength in multiple myeloma therapies. Their portfolio stands out as a dominant force across all classes of molecules, including CAR T-cell therapy, CD38-directed therapies, and bispecific antibodies. This outstanding performance highlights Janssen’s commitment to advancing innovative and effective treatments, ultimately significantly impacting patients’ lives in the battle against multiple myeloma.

Downloads

Article in PDF

Recent Articles

- GSK Acquires Sierra Oncology; BriaCell’s Targeted Breast Cancer Immunotherapy; Merck’s Tepmetko; ...

- Outset Medical captures; Wright Medical Group to takeover Cartiva; Y-mAbs Therapeutics prepares f...

- A New Addition to Existing Chimeric Antigen Receptor Therapies –Potential for a Game Changer in B...

- BMS Vs. Janssen: Which Company Will Dominate The Multiple Myeloma Treatment Market This Decade?

- Gilead’s TRODELVY Shows PFS Benefit in 1L Metastatic TNBC; Otsuka’s Sibeprenlimab Gets FDA Priori...