Transforming Multiple Myeloma Treatment: The Promise of Novel Drug Classes

Jul 24, 2024

Table of Contents

Multiple myeloma is the second most prevalent blood cancer diagnosis in the United States, after non-Hodgkin lymphoma. Males are significantly more likely than females to have multiple myeloma. Myeloma incidence is strongly correlated with age, with the highest rates of diagnosis occurring in adults aged 65 years and older. Approximately 95% of cases are detected at a distant or metastatic stage, with a 5-year relative survival rate of around 53% for this stage. The majority of researchers are unsure of the specific cause of multiple myeloma. They have made progress, however, in understanding how particular alterations in DNA might cause plasma cells to become malignant.

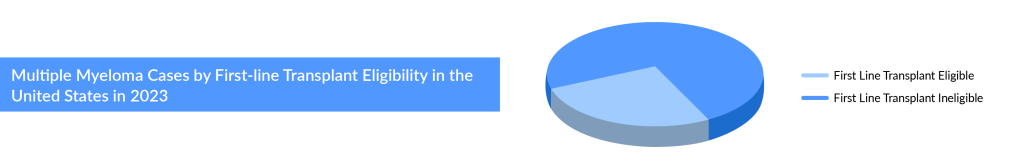

As per the assessment done by DelveInsight, the total incident cases of multiple myeloma in the 7MM comprised more than 75,000 cases in 2023, and these cases are projected to increase during the forecast period (2024–2034). Regarding age-specific cases of Multiple myeloma, the age group of 65 and above has the highest number of cases accounting for more than 70% of cases in the United States, followed by 55–64 and 0–54 years. Data suggests that roughly half of newly diagnosed multiple myeloma patients are ineligible for transplant, and around a third of eligible patients do not receive the transplant.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- 5 Most Promising CAR T-cell Therapies for Multiple Myeloma in Development

- Bispecific and Trispecific Antibodies: Are They Better Than CAR-Ts?

- The Rise of TCR Therapy: A Beacon of Hope in Cancer Treatment

- Rare Cancer Market: A Global Crusade on what is a ‘less common cancer’?

- Rise In Bispecific Antibodies Utilization As Antibody Therapeutics

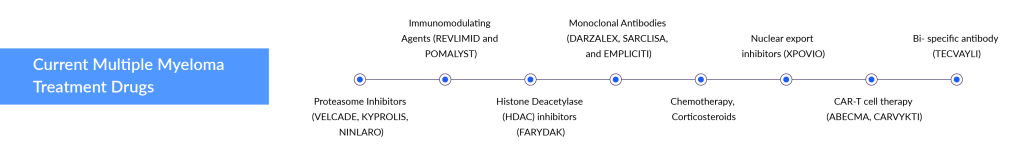

Despite the significant advancements in multiple myeloma treatment, including various biological drugs and their combinations like IMiDs (lenalidomide, pomalidomide), anti-CD38 monoclonal antibodies (daratumumab, isatuximab), anti-SLAM7 monoclonal antibody (elotuzumab), and new proteasome inhibitors (carfilzomib, ixazomib), relapse after first-line therapy remains a common challenge for most multiple myeloma patients.

Relapse Refractory Multiple Myeloma Treatment: The Race for CAR-Ts and Bi-specific Antibodies

The relapse refractory multiple myeloma treatment landscape is undergoing a radical transformation with recent FDA approvals of two CAR-Ts, ABECMA (Bristol-Myers Squibb) and CARVYKTI (Johnson & Johnson), and one bispecific antibody, TECVAYLI (Janssen). These developments open new avenues for companies developing therapies for later-line treatment, mainly fourth-line and above (4L+). Several key players, including Pfizer, Johnson & Johnson (Janssen), Regeneron Pharmaceuticals, Roche (Genentech), Abbvie, TeneoOne, and CARsgen Therapeutics, are harnessing the power of CAR-Ts and bispecific antibodies for relapse refractory multiple myeloma treatment.

Johnson & Johnson is a dominant force in multiple myeloma with its blockbuster products DARZALEX/DARZALEX FASPRO. In frontline multiple myeloma clinical studies, DARZALEX has set a new standard of therapy, outperforming rivals in effectiveness and safety. The frontline setting remains relatively untapped and offers lucrative opportunities, as evidenced by DARZALEX’s FDA approval in both frontline transplant-eligible and ineligible patient pools.

Janssen is poised to grab market share in the bispecific space with the recent approval of TECVAYLI for relapse refractory multiple myeloma. The company is also preparing to launch another bispecific antibody, talquetamab, targeting approval in 2023 for 4L+ relapsed refractory multiple myeloma in the US and Europe. Talquetamab’s Phase I/II trial showed an impressive ORR of 73%.

Recently, on July 22, 2024, GSK announced its aim to relaunch BLENREP (belantamab mafodotin) after its 2022 market withdrawal, targeting a second-line treatment niche for relapsed or refractory multiple myeloma. The European Medicines Agency (EMA) has accepted GSK’s marketing authorization application for BLENREP as part of a combination regimen with either bortezomib plus dexamethasone (BorDex) or pomalidomide plus dexamethasone (PomDex). The EMA’s Committee for Medicinal Products for Human Use will review the application before making a final recommendation to the European Commission.

GSK’s relaunch of BLENREP offers renewed hope for multiple myeloma patients and could significantly improve treatment outcomes, enhancing competition and innovation in the pharmaceutical industry.

In January 2021, the European Commission granted talquetamab PRIority MEdicines (PRIME) designation. In June 2022, Janssen announced that the FDA had granted BTD for talquetamab to treat adult patients with R/R multiple myeloma who have previously received at least four prior lines of therapy. In June 2023, the company presented the updated results from its Phase I studies investigating talquetamab as a monotherapy and combined with other drugs in patients with R/R multiple myeloma at the American Society of Clinical Oncology (ASCO) 2023 conference. In August 2023, the company announced that the European Commission granted conditional marketing authorisation for TALVEY (talquetamab) as monotherapy for adult patients with relapsed and refractory multiple myeloma (RRMM) who have received at least three prior therapies and demonstrated disease progression on the last therapy.

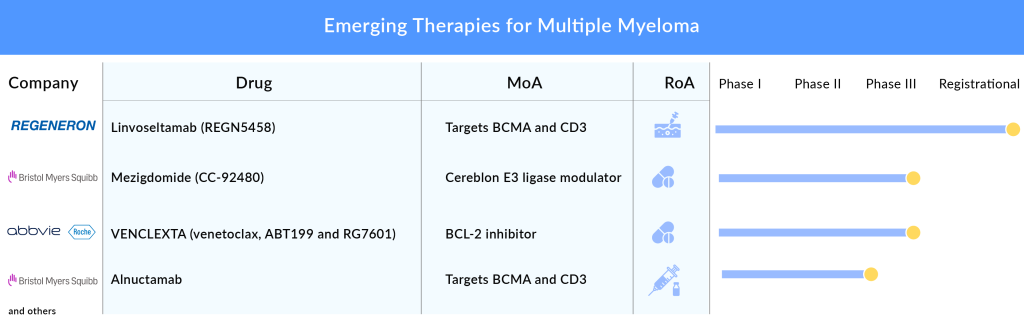

Another bispecific antibody that is eyeing approval in 2023 is elranatamab by Pfizer, which delivered an ORR of 61% in the Phase I/II trial. Elranatamab will face stiff competition from Johnson & Johnson’s talquetamab and TECVAYLI, as well as from Regeneron Pharmaceuticals’ linvoseltamab and REGN5459, Roche’s cevostamab, and Abbvie’s ABBV-383 (TNB383B). Regeneron’s linvoseltamab targets BCMA × CD3 in RRMM patients and showed an ORR of 64% in the 200 mg dose group and 50% in the 50 mg dose group in a Phase II trial presented at ASCO 2023. Regeneron plans to file for approval in the second half of 2023.

Another approach in relapse refractory multiple myeloma treatment involves the use of CAR-T cell therapies. Although CAR-T treatments have demonstrated significant effectiveness, they also come with safety issues, such as called Cytokine Release Syndromes (CRS). Cost, convenience, and manufacturing turnaround time initially could prevent CAR-T from being widely adopted, but over time, companies may reduce side effects and speed up manufacturing time. CAR-Ts might not pose a significant threat to DARZALEX due to its better efficacy and safety profile, and its evolving use in earlier lines of setting.

Two CAR-T cell therapies, ABECMA and CARVYKTI, have already received approval and are available in the multiple myeloma market. These therapies were developed by Bristol-Myers Squibb and Johnson & Johnson, respectively. Several companies are developing CAR-Ts, such as Arcellx, Novartis, CARsgen Therapeutics, and others. All of them are targeting later lines of multiple myeloma and are in the early phases of clinical development. In June 2023, Arcellx announced that the FDA has put a hold on its CART-ddBCMA program for RRMM due to a patient death, despite showing a remarkable 100% ORR in 38 patients in Phase I, as reported at ASH 2022. CARsgen Therapeutics plans to file BLA in 2024 for zevorcabtagene autoleucel, which also achieved a stunning 100% ORR in heavily pretreated RRMM patients in Phase II. Whereas, Novartis is developing PHE885, a BCMA-targeted CAR-T for RRMM.

How BMS is Revolutionizing Multiple Myeloma Treatment with CellMoDs?

Bristol-Myers Squibb, which is a major player in the multiple myeloma treatment space with its IMiDs REVLIMID and POMALYST, is not resting on its laurels. In 2022, the FDA approved a generic version of REVLIMID. After the patent expiry of POMALYST in 2024, the company, to maintain its market presence, is coming up with novel cellMoDs for multiple myelomas, such as mezigdomide and iberdomide in different lines and combinations that might bring a change in the treatment paradigm. Mezigdomide will be used as a replacement for POMALYST, and iberdomide for REVLIMID. The company presented results from different cohorts showing that iberdomide + dexamethasone + daratumumab achieved an ORR of 45.9% in Phase I/II and started Phase III of this cohort, while mezigdomide + bortezomib + dexamethasone achieved an ORR of 73.7% in Phase I/II.

The Battle of Bcl-2 Inhibitors in Multiple Myeloma Treatment: AbbVie’s Venetoclax vs. BeiGene’s BGB-11417

Besides IMiDs, CAR-Ts, and bispecific antibodies, the multiple myeloma pipeline also includes small molecules, ADCs, and interferons. Small molecules include two Bcl-2 inhibitors, venetoclax and BGB-11417, by AbbVie and BeiGene, respectively. VENCLEXTA/VENCLYXTO (venetoclax) is an oral B-cell lymphoma-2 (BCL-2) inhibitor developed by AbbVie and Genentech. In March 2019, the US FDA placed a partial clinical hold on Venetoclax’s multiple myeloma trials after new safety concerns were raised during a review of the BELLINI Phase III trial. This trial was designed to assess the safety and activity of Venetoclax in combination with standard Velcade (bortezomib) and dexamethasone in relapsed or refractory myeloma patients. Overall responses and very good partial responses were also better among those receiving venetoclax, researchers reported.

In July 2019, the US FDA removed the partial clinical hold based upon agreement on revisions to the CANOVA study protocol (Myeloma Positive for the t(11;14) Genetic Abnormality), including new risk mitigation measures, protocol-specified guidelines, and updated futility criteria. A Phase III (NCT03539744; CANOVA) clinical trial evaluates Venclexta for treating relapsed or refractory (11;14)-positive Multiple Myeloma. This ongoing study was designed to evaluate the safety and efficacy of venetoclax plus dexamethasone (VenDex) compared with pomalidomide plus dexamethasone (PomDex) in participants with t(11;14)-positive relapsed or refractory multiple myeloma.

The company, in its pipeline update, mentioned the CANOVA study is nearing completion, and the data readout is expected in 2022, with regulatory submissions anticipated in 2023. At ASH 2021, AbbVie also presented final overall survival results from BELLINI; in the final OS analysis, the addition of venetoclax to bortezomib and dexamethasone showed significantly improved PFS but resulted in increased mortality versus placebo in the total population.

Both companies target a specific subset of t(11;14)-Positive RRMM. AbbVie plans to file for approval in the US in 2023 for venetoclax based on Phase III results. BeiGene is conducting a Phase I/II trial for BGB-11417, which seems more potent than venetoclax and can potentially overcome venetoclax resistance.

ASCO 2024: Key Takeaways for Multiple Myeloma Treatment

At the ASCO 2024 annual meeting, numerous pharmaceutical companies presented their data readouts. With over 40,000 attendees, approximately 2,669 poster sessions, more than 359 oral abstracts, and 285 rapid oral abstract sessions were featured. A record-breaking 7,025 abstracts were submitted for the scientific program, and thousands of abstracts covering all major disease sites and research areas were presented. Non-small cell lung cancer (NSCLC) had the highest number of data readouts, followed by hematologic malignancies and breast cancer. Our team of analysts has reviewed the key abstracts relevant to multiple myeloma. They evaluated the launch results and assessed their impact on the overall indication domain. Some of the notable abstracts presented and analyzed include:

Evolving Dynamics of Multiple Myeloma Therapeutics Segment

The multiple myeloma treatment domain is expected to grow in the upcoming years, owing to the rise in incident cases of multiple myeloma, high adoption of newer therapies, rich emerging pipelines, and increased investment in R&D activities. Some factors, such as toxicities, the burden of long-term therapy, differences in clinical care, practice patterns between treatment centers, and access to and cost of therapy in real-world settings, may also play a role in the observed gap between trial-based and real-world outcomes.

As per DelveInsight analysis, the total multiple myeloma market size in the 7MM was estimated to be nearly USD 21 billion in 2023,, which is expected to show positive growth by 2034. In 2023, the US accounted for the maximum share of the total market in the 7MM, i.e., approximately USD 14 billion followed by EU4 and the UK.

In addition, the multiple myeloma treatment landscape has witnessed remarkable evolution in recent years, offering new hope to patients battling this complex hematologic malignancy. From conventional chemotherapy to targeted therapies and immunomodulatory agents, advancements have paved the way for more personalized and effective interventions. The advent of proteasome inhibitors, monoclonal antibodies, and CAR-T cell therapies has revolutionized the management of multiple myeloma, enhancing response rates and extending survival. Additionally, a deeper understanding of the disease’s genetic and molecular intricacies has enabled the development of precision medicine approaches, tailoring treatments to individual patients’ characteristics. With ongoing research and clinical trials, the future holds promise for even more innovative therapies, potentially transforming multiple myeloma into a chronic condition, allowing patients to lead fuller, longer lives.

Downloads

Article in PDF

Recent Articles

- DARZALEX FASPRO Regimen Approval: Johnson & Johnson Howling Success in Multiple Myeloma

- A New Era for Multiple Myeloma Treatment: Bispecific Antibodies Enter the Fray

- AZ offloads; Pfizer’s deal; Takeda’s work on plant; Germany’s doc payment

- The Rise of TCR Therapy: A Beacon of Hope in Cancer Treatment

- Gilead’s TRODELVY Shows PFS Benefit in 1L Metastatic TNBC; Otsuka’s Sibeprenlimab Gets FDA Priori...