Rare but Real: Unraveling the Different Types of Bone Sarcoma

Oct 30, 2023

Table of Contents

Bone sarcoma is a rare and aggressive form of cancer that develops in bone tissue. The likelihood of a person being diagnosed with primary bone sarcoma and their recovery prospects depend on various unique factors. In 2023, it is expected that 4,000 individuals across all age groups in the United States will receive a primary bone sarcoma diagnosis, with 2,000 males and 1,800 females affected. For context, in 2020, about 400 cases were reported among those aged 15 to 19.

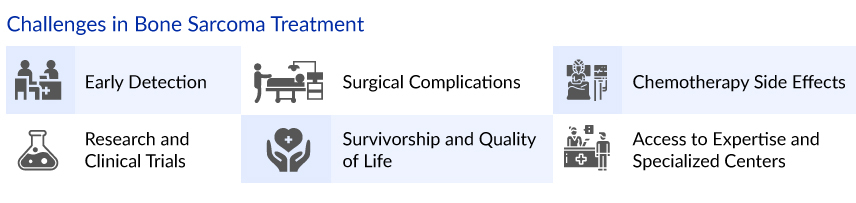

Challenges Associated with Bone Sarcoma Treatment

Treating bone sarcoma presents a multifaceted set of challenges for both patients and healthcare professionals. Firstly, early diagnosis is often difficult, as symptoms can be nonspecific, leading to delayed intervention. Surgical resection is a primary treatment approach, but it may result in loss of function and, in some cases, amputation. Adjuvant therapies, such as chemotherapy and radiation, are frequently required, but they come with their own side effects, including nausea, fatigue, and potential long-term complications. Additionally, the rarity of bone sarcomas necessitates specialized treatment centers, which can be geographically inaccessible for some patients. The emotional and psychological toll of the disease, as well as the uncertainties associated with long-term survival and recurrence, further compound the challenges. Overall, addressing these complexities in the management of bone sarcomas demands a holistic and multidisciplinary approach to provide the best possible care and support for patients.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Key Companies To Keep an Eye on for Pipeline Therapies in Osteosarcoma Market in the Next Decade

- Ewing Sarcoma: Key Companies and Emerging Therapies in the Landscape

- Pitfalls of Current Osteosarcoma Treatment Approaches

- Chondrosarcoma Treatment Market: Insight on Patient Burden and Inhibrx’s INBX-109 US Market Entry...

- Diagnosis Delays, Ineffective Treatment Options Plaque the Bone Cancer Market Growth

Most Common Bone Sarcomas

There are several types of bone sarcomas, each originating from different cells within the bone structure. Osteosarcoma is the most common form and arises from the bone-forming cells, predominantly in the long bones like arms and legs. Ewing sarcoma, another prevalent type, typically starts in the marrow and affects primarily the pelvis, ribs, and long bones. Chondrosarcoma originates in the cartilage cells within bones, often occurring in the pelvis, shoulder, and ribs. Additionally, there are other subtypes and rare variants of bone sarcomas, all of which require specialized diagnosis and treatment approaches. Let’s dive deep into the assessment of these bone sarcomas individually.

Osteosarcoma

Osteosarcoma, the most common type of bone cancer, primarily originates in the osteoblast cells within the bones. It exhibits a particular inclination for long bones located near the knee joint. Nevertheless, it can also manifest in various other areas, including the upper leg, lower leg, upper arm, and virtually any bone within the body, such as those in the pelvis, shoulder, and skull. It possesses the capability to infiltrate neighboring tissues, such as tendons and muscles, and has the potential to spread to distant organs or other bones through the bloodstream. According to DelveInsight analysts, the total number of newly diagnosed cases of osteosarcoma in the seven major markets was approximately 2,000 in 2022. The data reveals that the United States had the highest number of incident cases, with around 1,000 cases in 2022.

The standard approach for managing osteosarcoma typically involves a multimodal treatment strategy, which includes a combination of surgery, chemotherapy, and radiation therapy. Despite some recent advancements, substantial progress in the treatment of this cancer has been somewhat limited since the late 1980s, when chemotherapy was integrated into the surgical regimen, resulting in improved survival rates. It’s worth noting that radiation therapy can affect both healthy and cancerous cells, producing a range of effects. Commonly employed chemotherapeutic agents for osteosarcoma treatment encompass drugs such as cisplatin, doxorubicin, ifosfamide, and high-dose methotrexate coupled with leucovorin calcium rescue (HDMTX).

Besides these treatment protocols, there are a limited number of FDA-approved products available for osteosarcoma, which include FUSILEV and KHAPZORY. These drugs are folate analogs used to counteract the toxic effects of high-dose methotrexate therapy in osteosarcoma patients. FUSILEV received FDA approval in 2008, but it has been discontinued from the market after its patent expiration. Subsequently, the same company introduced KHAPZORY, which contains the same generic medication, levoleucovorin, and it gained FDA approval in 2018 for the same indication. Additionally, in March 2009, the European Commission granted IDM Pharma a marketing authorization valid throughout the European Union for MEPACT. Later in the year, Takeda acquired IDM Pharma, which included MEPACT (mifamurtide), the first osteosarcoma treatment to gain approval in over two decades. It’s important to note that this product is not approved in the United States. However, some osteosarcoma patients in the United States have been able to access MEPACT through the FDA’s compassionate use and personal importation programs.

Companies across the globe are diligently working toward the development of novel osteosarcoma treatment therapies with a considerable amount of success over the years. Key players, such as Eisai (Lenvatinib), Bayer (BAY80-6946), Y-mAbs Therapeutics (Naxitamab), MedPacto (Vactosertib), Zentalis Pharmaceuticals (Azenosertib), Hutchmed (Surufatinib), and others, are developing therapies for the treatment of osteosarcoma.

Naxitamab, a monoclonal antibody that targets GD2, was developed by investigators from Memorial Sloan Kettering Cancer Center (MSK) and is exclusively licensed by MSK to Y-mAbs Therapeutics. The drug is directed against the human tumor-associated antigen GD2, with potential antineoplastic activity. Upon vaccination, naxitamab stimulates antibody-dependent cell-mediated cytotoxicity (ADCC) against GD2-expressing tumor cells. GD2, a disialoganglioside with expression in normal tissues restricted primarily to the cerebellum and peripheral nerves, is commonly expressed at high levels on tumors of neuroectodermal origins such as melanomas and neuroblastomas. Compared to the murine monoclonal antibody 3F8 (m3F8), the humanized form does not cause a human anti-mouse antibody (HAMA) response and shows enhanced ADCC activity. The company is currently evaluating naxitamab in a Phase II clinical trial for the treatment of recurrent osteosarcoma.

LENVIMA (Lenvatinib) is an anti-cancer drug for the treatment of osteosarcoma. It was developed by Eisai and acts as a multiple kinase inhibitor against the VEGFR1, VEGFR2, and VEGFR3 kinases. Currently, the company is investigating this molecule in the Phase II stage of development for osteosarcoma. As per DelveInsight analysis, the osteosarcoma market size is expected to increase at a significant CAGR by 2032 owing to the increase in the patient pool and the expected entry of emerging therapies.

Ewing Sarcoma

Ewing Sarcoma, a malignant tumor, typically begins its growth within the bones and has a higher occurrence among children and young adults, often emerging during adolescence. While it can develop in any bone, it mainly affects the long bones, such as the femur, tibia, and humerus. Pelvic bones are also commonly affected. In certain instances, the tumor may originate in muscle and soft tissues. Common symptoms include bone stiffness, pain, swelling, or tenderness, along with the surrounding tissue. According to DelveInsight’s assessment, there were approximately 1.2K incident cases of Ewing sarcoma in the 7MM in 2022, and this number is expected to rise during the forecasted period.

The treatment approach for Ewing sarcoma typically involves a holistic strategy, which may include a combination of surgical procedures, chemotherapy, and radiation therapy. The National Comprehensive Cancer Network (NCCN) provides specific chemotherapy regimens for both localized and metastatic Ewing sarcoma. In the first-line Ewing sarcoma treatment, NCCN recommends VDC/IE (vincristine, doxorubicin, cyclophosphamide alternating with ifosfamide and etoposide), VAIA (vincristine, doxorubicin, ifosfamide, and dactinomycin), and VIDE (vincristine, ifosfamide, doxorubicin, etoposide) for initial presentations and as the primary therapy for metastatic disease. In the second-line setting, NCCN suggests alternatives such as Cyclophosphamide and topotecan, Irinotecan + temozolomide ± Vincristine, Ifosfamide, carboplatin, etoposide, and Lurbinectedin.

As per DelveInsight analysis, the total Ewing sarcoma market size in the 7MM is approximately USD 26 million in 2022 and is projected to increase during the forecast period (2023–2032). The dynamics of the Ewing sarcoma market are expected to change due to the improvement in the diagnosis, incremental healthcare expenditure across the world, and the expected launch of emerging therapies during the forecast period of 2023─2032. Companies all over the globe are persistently working towards the development of new treatment therapies and some of the key players at the global level are Tyme (SM-88), BioAtla (BA3011), Salarius Pharmaceuticals (Seclidemstat), EIi Lilly (Abemaciclib), Inhibrx (INBRX-109), and others.

Abemaciclib, a small-molecule CDK4 and CDK6 inhibitor currently under clinical investigation for the treatment of Ewing sarcoma by Eli Lilly. The company is conducting Phase II (CAMPFIRE) trial in combination with chemotherapy (irinotecan and temozolamide) and the estimated completion of this study is by 2027.

BA3011, a conditionally active biologic (CAB) AXL-targeted antibody-drug conjugate (CAB-AXL-ADC). The pharmacological properties of BA3011 were characterized in a number of in vitro and in vivo pharmacology studies. BA3011 binds selectively to human and cyno AXL in conditions reflective of the tumor microenvironment but has reduced binding under normal tissue conditions. The company is conducting Phase I/II trial for the treatment of Ewing sarcoma.

Chondrosarcoma

Chondrosarcoma encompasses a cluster of bone tumors originating from cells that overproduce cartilage. Within this group, conventional chondrosarcoma is the most common subtype, typically characterized by slow growth. In contrast, less common subtypes such as dedifferentiated chondrosarcoma, myxoid chondrosarcoma, clear cell chondrosarcoma, and mesenchymal chondrosarcoma tend to display a more aggressive growth pattern and have the potential to metastasize to distant parts of the body. DelveInsight estimated that there were approximately 2,000 incident cases of chondrosarcoma in the 7MM in 2022, and this number is projected to increase during the forecasted period.

The management strategy for chondrosarcoma relies on variables such as tumor type, grade, and location. Of these, the grading system stands out as the most dependable predictor of clinical outcomes. It is widely accepted that surgical intervention remains the primary and effective approach for treating chondrosarcoma. Other treatment modalities, such as radiotherapy and chemotherapy, have demonstrated limited effectiveness and a tendency to encounter resistance. Surgical choices include curettage, radical resection, and amputation, and the decision on which to pursue depends on a thorough clinical assessment and considerations like lesion size, location, and malignancy.

The anticipation of advancements in upcoming chondrosarcoma therapies and the increased integration of early patient screening and medication within secondary care and other clinical settings, along with ongoing research aimed at identifying optimal implementation methods, are poised to play a pivotal role in the development of more effective treatment options. Nonetheless, chondrosarcoma, categorized as an orphan disease, poses unique challenges for conducting clinical trials. The scarcity of outcome data for patients with locally advanced or metastatic conditions underscores the pressing need for innovative treatment approaches. The limited number of chondrosarcoma patients at varying dose levels in Phase I trials makes it difficult to draw definitive conclusions.

However, certain Phase II trials have shown promising results, prompting further investigation. Encouraging retrospective studies could help augment the presently limited dataset. Urgent efforts to bolster research studies on this orphan disease are imperative. According to DelveInsight’s analysis, only Inhibrx is currently working with their lead asset INBRX-109 in the chondrosarcoma treatment space. As per the estimates, the total market size of chondrosarcoma in the 7MM reached approximately USD 9 million in 2022 and is projected to experience a significant CAGR of 24.8% due to heightened disease awareness and the introduction of emerging therapies.

Promising Future of Bone Sarcoma Treatment

The future treatment outlook for bone sarcoma holds promise as medical research and technology continue to advance. The field of oncology is witnessing significant progress in the development of targeted therapies and personalized treatment plans. Molecular profiling and genetic testing are enabling healthcare professionals to tailor treatments to an individual patient’s specific genetic makeup, potentially improving the efficacy of therapies and minimizing side effects. Additionally, advancements in immunotherapy and the discovery of novel drug compounds are providing new avenues for treating bone sarcoma. As our understanding of the disease deepens and clinical trials yield innovative treatments, the future may bring improved survival rates and enhanced quality of life for those affected by bone sarcoma. However, early diagnosis and access to these cutting-edge treatments will remain essential in improving the overall outlook for patients with this challenging condition.

Downloads

Article in PDF

Recent Articles

- Pitfalls of Current Osteosarcoma Treatment Approaches

- Ewing Sarcoma: Key Companies and Emerging Therapies in the Landscape

- Diagnosis Delays, Ineffective Treatment Options Plaque the Bone Cancer Market Growth

- Key Companies To Keep an Eye on for Pipeline Therapies in Osteosarcoma Market in the Next Decade

- Chondrosarcoma Treatment Market: Insight on Patient Burden and Inhibrx’s INBX-109 US Market Entry...