How Novel Therapies Could Transform the Ulcerative Colitis Treatment Landscape

Jul 14, 2025

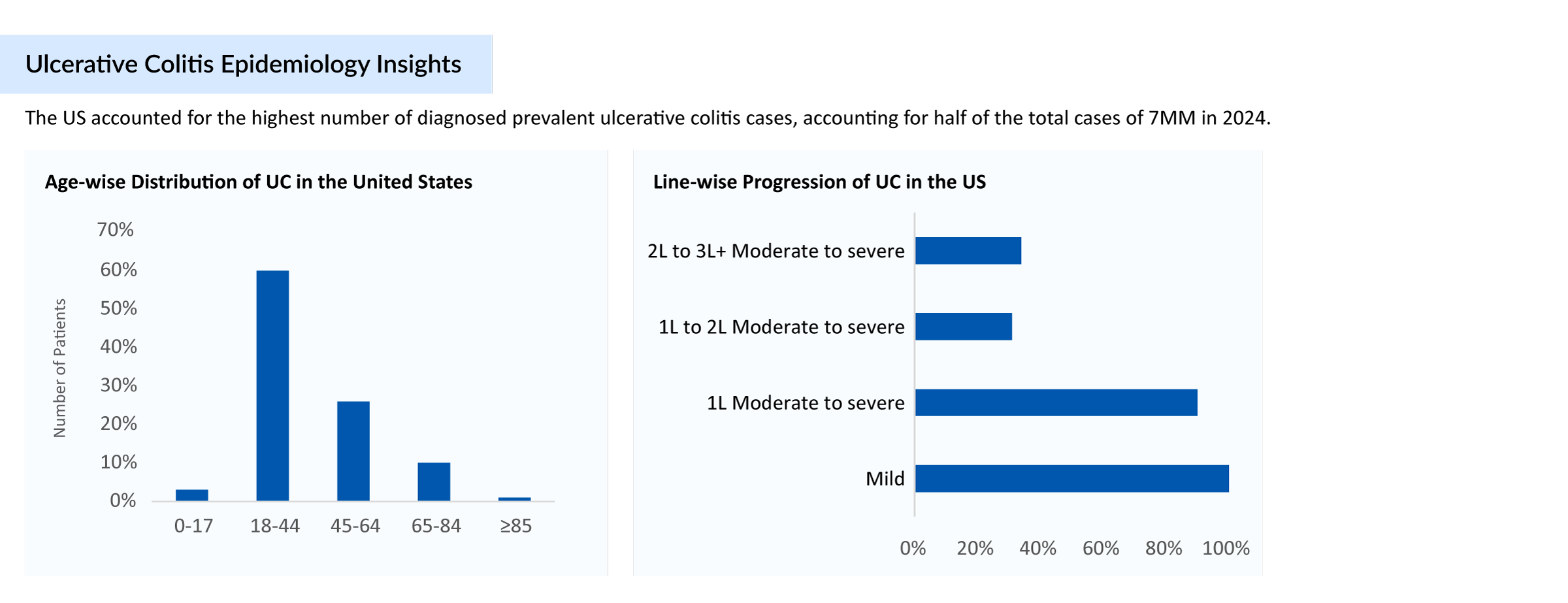

Almost two decades ago, there were limited options for ulcerative colitis treatment. Choosing the right ulcerative colitis drugs depends on the severity of the condition and the patient’s response to previous therapies. To manage patients effectively, physicians often prescribe a combination of ulcerative colitis medications. The readily available ulcerative colitis therapies were aminosalicylates and immunomodulators (azathioprine, 6-mercaptopurine, and methotrexate), with biologics (Adalimumab, Golimumab, Infliximab, Ustekinumab, and Vedolizumab) reserved for patients with more refractory or severe disease. However, today we have several approved classes of ulcerative colitis medications used for the treatment, including JAK inhibitors, S1PR receptor modulators, IL-23 inhibitors, and others. The Ulcerative Colitis treatment landscape has become more diverse and competitive, with recent approvals reshaping physician preferences and market dynamics.

For patients diagnosed with mild to moderate ulcerative colitis, first-line therapy begins with aminosalicylate or sequential induction with corticosteroids followed by 5-ASA maintenance therapy; whereas in the case of patients with moderate to severe ulcerative colitis, an immunosuppressant such as azathioprine or 6-mercaptopurine is prescribed as maintenance therapy following induction of corticosteroids. On the other hand, anti-TNF agents are prescribed with or without a concurrent immunomodulator in moderate to severe ulcerative colitis patients to promote and maintain mucosal healing and clinical remission.

In the current ulcerative colitis treatment market landscape, AbbVie is one of the strongest players, and HUMIRA is a best-selling product approved for several autoimmune indications. HUMIRA lost exclusivity in the US in January 2023. Since then, ten biosimilars have been launched, including AMJEVITA, YUFLYMA, CYLTEZO, and others, resulting in a ~32% drop in global HUMIRA sales in 2023.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Taltz (Ixekizumab) in Treatment of Plaque psoriasis

- InnoCare’s Trial In China; Sanofi/GSK COVID-19 Vaccine; Apellis’s Empaveli for PNH; LianBio...

- Johnson & Johnson’s TREMFYA Approved for Ulcerative Colitis; Roche’s Tecentriq Hybreza Approv...

- Idera’s Phase I Data; DelMar Initiates Trial; Novartis’ study; Humira gets EC approval

- Cancer, diabetes and eczema on list; AbbVie’s Humira; Teva weighs $2B; Fresenius in buyout ...

In response, AbbVie is actively mitigating HUMIRA’s patent losses by expanding its immunology portfolio through RINVOQ (upadacitinib) and SKYRIZI (risankizumab). In June 2024, the FDA approved SKYRIZI for moderate to severe ulcerative colitis, followed by approval in Japan in the same month, and RINVOQ was already FDA approved in March 2022 for moderately to severely active ulcerative colitis in adults. To treat ulcerative colitis, SKYRIZI became the first IL-23 inhibitor. In ulcerative colitis treatment options, the addition of SKYRIZI has helped AbbVie strengthen its IBD portfolio.

SKYRIZI and RINVOQ are performing exceptionally well and are expected to continue capturing significant market share across IBD (Crohn’s disease, ulcerative colitis), along with other indications like psoriatic disease, and atopic dermatitis. SKYRIZI’s sales and RINVOQ’s sales in 2024 were outstanding, generating a combined total of over USD 17.6 billion in sales (USD 11.7 billion from SKYRIZI and USD 5.9 billion from RINVOQ), marking a year-over-year growth of more than 50%. While both UC drugs are growing, RINVOQ’s sales have been increasing at a slightly more modest growth rate than SKYRIZI.

Analyzing the current ulcerative colitis treatment scenario, the consensus of physicians is leaning toward the prescription of oral inflammatory bowel disease medications, which is a highly positive sign for RINVOQ. In terms of acceptance, convenience, and adherence, oral drugs with a good safety profile are an enticing option for ulcerative colitis patients. At present, there are three JAK inhibitors approved for patients with moderate to severe UC: XELJANZ (tofacitinib), JYSELECA (filgotinib), and RINVOQ (upadacitinib). One major barrier to the adoption of JAK inhibitors is “safety”. Safety concerns, such as cardiovascular events, thromboembolism, and malignancy, have plagued this class of therapy, and this issue has led to class-wide regulatory restrictions for JAKi use across all inflammatory diseases.

Analysts at DelveInsight view RINVOQ as the better option and might lead the ulcerative colitis treatment market space. As per the analysis and survey, RINVOQ could be the most preferred among physicians based on the different attributes such as safety, efficacy, clinical response, and mucosal healing. Also, RINVOQ showed better and superior results to XELJANZ. Despite the warning associated with the JAK inhibitors class and restricted usage of RINVOQ, the majority of physicians are not hesitant to use it due to its better efficacy. Also, they believed that it would be unfair if we paint Rinvoq’s future with the same brush as tofacitinib, as these risks have not been reported in inflammatory bowel disease or ulcerative colitis specifically. Rinvoq presented a clinical remission of 42% and 52% for 15 mg and 45 mg dosages, respectively, and showed that around 26% of untreated moderate and severe ulcerative colitis patients received remission in 8 weeks.

If we look at another ulcerative colitis drug in the same class, i.e., JYSELECA (filgotinib), it was expected to provide similar or better efficacy than Pfizer’s XELJANZ (tofacitinib) but with fewer side effects. It showed significant improvement in stool frequency and rectal bleeding in patients on a 200 mg daily dose. However, the FDA rejected the NDA and raised concerns over the 200 mg dose and the drug’s impact on sperm parameters in male patients. The company is not planning to proceed with the indication in the US as filgotinib results are not promising. The drug was approved in Europe and Japan for ulcerative colitis treatment in 2021 and 2022, respectively, based on findings from Phase IIb/III SELECTION study. One new class entry is ZEPOSIA (ozanimod) of the S1PR receptor modulator class, which is the first-in-class drug approved in May 2021 in the US and in November 2021 in the EU for moderately to severely active ulcerative colitis treatment. It was initially approved for the treatment of multiple sclerosis. Compared to RINVOQ, ZEPOSIA has demonstrated a clinical remission rate of 18.4%.

In ulcerative colitis, ZEPOSIA from BMS is no longer the only S1P receptor modulator. Marketed as VELSIPITY (etrasimod), it received FDA approval in October 2023 and European approval in February 2024 as a second-in-class S1P receptor modulator after ZEPOSIA. VELSIPITY has shown statistically significant results in the ELEVATE UC 12 and UC 52 trials, with remission rates of approximately 27% to 32% at induction and sustained responses at 52 weeks. Unlike ZEPOSIA, VELSIPITY does not require dose titration and has demonstrated higher efficacy, making it the preferred agent among physicians in the S1P class. The drug’s launch has given Pfizer a much-needed boost in the UC space, following its acquisition of Arena Pharmaceuticals. o Head-to-head studies are comparing the efficacy and safety of VELSIPITY versus ZEPOSIA. However, VELSIPITY has demonstrated better efficacy than ZEPOSIA did in their separate trials. Although the uptake of ZEPOSIA and VELSIPITY has been somewhat sluggish, they seem to be living up to what has been reported from key clinical trials in the real world.

Many KOLs were positive about ZEPOSIA’s market uptake and were vocal about their willingness to use this agent as a first-line moderate-to-severe ulcerative colitis treatment if launched before RINVOQ and VELSIPITY. However, the market for ZEPOSIA turned out to be different. In the current landscape of RINVOQ vs ZEPOSIA, the best positioning for approved S1P receptor modulators in ulcerative colitis would be for patients who need their first advanced therapy and for patients who would prefer a safe, oral alternative, because S1P receptor modulators do not function nearly as quickly as JAK inhibitors.

There has been a significant shift in the UC market, as three new IL-23 inhibitors have been approved for the treatment of UC. This class has a lower likelihood of development of neutralizing antibodies and has the advantage of a favorable side effect profile, particularly when compared to anti-TNF agents. IL-23 therapies in UC are emerging as a strong contender against anti-TNFs. OMVOH (mirikizumab), the first-in-class α4‑IL‑23 agent, was approved in Japan in March 2023, in the EU in May 2023, and in the US in October 2023 for the treatment of moderate to severe ulcerative colitis. The drug showed significant induction and maintenance remission in clinical trials and presents an attractive alternative to both ustekinumab and anti-TNF agents. On the other hand, Johnson & Johnson’s TREMFYA (guselkumab), another IL-23 inhibitor, was FDA-approved in September 2024 for adult ulcerative colitis, marking the company’s fourth biologic in this space. It enters into direct competition with AbbVie’s SKYRIZI and will need aggressive payer contracting to gain traction. To ensure its commercial success, TREMFYA should adopt an approach similar to SKYRIZI, such as contracting payors for easy ulcerative colitis market access so that physicians do not face any hurdles in prescribing the drug.

With growing biosimilar activity, STELARA (ustekinumab) has now seen multiple biosimilars (including STEQEYMA, WEZLANA & others) approved in the US and EU between July 2024 and June 2025. Celltrion’s STEQEYMA (ustekinumab-stba) gained FDA approval in December 2024 for both UC and Crohn’s disease. Settlements involving Formycon–Fresenius and Johnson & Johnson for FYB202 in March 2024 also point toward intensified biosimilar competition in the IL-12/23 inhibitor class. These approvals are expected to significantly improve access to biologics in both the US and EU markets.

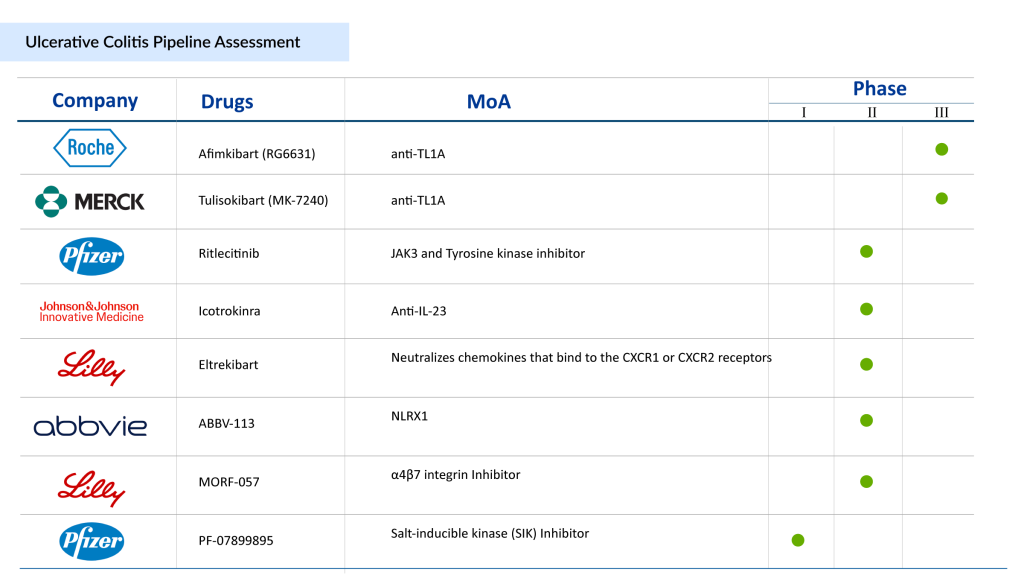

The ulcerative colitis current market and its pipeline are now crowded with multiple UC drugs of different and new drug classes. There is also growing interest in a few novel emerging therapies in the ulcerative colitis pipeline with enormous potential. The drug list and pipeline for colitis are robust. These UC treatment drugs continue to progress in late-to-mid-stage trials and could offer new mechanisms for patients unresponsive to current biologics and oral agents.

Anti-TL1A therapies represent a promising new class of treatments for ulcerative colitis. Anti-TL1A that is currently being evaluated for the UC treatment in Phase III is Merck’s Tulisokibart (MK-7240). In the Phase II ARTEMIS-UC study (NCT04996797), tulisokibart showed superior efficacy in achieving clinical remission for ulcerative colitis patients. Merck became the first company to initiate phase III clinical studies for an anti-TL1A antibody in inflammatory bowel disease. This marks a significant step in the development of a new class of drugs targeting TL1A for IBD. Roche’s Afimkibart (RG6631) is another potential therapy targeting TL1A, currently being evaluated in a Phase III clinical trial (NCT06588855) for the treatment of moderately to severely active ulcerative colitis.

Takeda also has a presence in the inflammatory bowel disease (IBD) space with their approved therapy ENTYVIO (vedolizumab). ENTYVIO remains Takeda’s one of the leading growth drivers and continues to hold the top market share despite increasing competition from rivals like AbbVie’s SKYRIZI and RINVOQ. Takeda still promotes ENTYVIO as the leading IBD brand, further supported by the approval of its pen formulation (September 27, 2023: in the United States). ENTYVIO’s competitors, like RINVOQ, SKYRIZI, and Etrasimod, are expanding treatment options in a rapidly evolving IBD market. Owing to these reasons, Takeda is also preparing to enter the UC market with another product, i.e., Zasocitinib (TAK-279), an oral and selective allosteric inhibitor of tyrosine kinase 2 (TYK2).

Janssen’s pipeline also includes a UC drug known as Icotrokinra. Icotrokinra is the first targeted oral peptide designed to block the IL-23 receptor. On March 10, 2025, J&J shared topline data from the Phase IIb ANTHEM-UC study, showing that Icotrokinra induced clinical remission in up to 30.2% of patients at Week 12 and had a favorable safety profile.

On March 28, 2025, Palatin Technologies reported positive topline results from a Phase II trial of PL8177, its novel oral therapy and selective melanocortin-1 receptor (MC1R) agonist, developed for treating active ulcerative colitis. The trial evaluated the safety, tolerability, and efficacy of PL8177 in adults with active UC.

With increasing understanding of disease mechanisms and growing awareness of unmet needs, the ulcerative colitis treatment market is rapidly evolving. New ulcerative colitis treatments are transforming the UC standard of care by offering safer and more effective options. The approval of novel oral agents, non-TNF biologics, and the entry of biosimilars are fundamentally reshaping treatment algorithms. Many emerging key players are still exploring ulcerative colitis medications that are easier to administer, including oral therapies. The competitive dynamics over the next few years will be dictated by long-term data, payer negotiations, patient adherence, and the ability of new entrants to differentiate themselves in an increasingly crowded marketplace.

FAQs

The treatment options for ulcerative colitis vary based on the disease’s severity and can be categorized into six main types: conventional therapies, biologics, S1P-receptor modulators, and JAK inhibitors. New mechanisms of action, such as LANCL2 protein stimulators, miR-124 enhancers, TNF-like ligand 1A inhibitors, and toll-like receptor 9 agonists, among others, are expected to broaden the range of ulcerative colitis medications.

Several FDA-approved drugs for ulcerative colitis are SIMPONI (Janssen Pharmaceuticals), ENTYVIO (Takeda Pharmaceuticals), XELJANZ/XELJANZ XR (Pfizer), STELARA (Janssen Pharmaceuticals), CAROGRA (EA Pharma/Kissei Pharma), JYSELECA (Gilead Sciences and Galapagos NV), RINVOQ (AbbVie), ZEPOSIA (Bristol-Myers Squibb), REMICADE (Janssen Pharmaceuticals), HUMIRA (AbbVie), OMVOH (Eli Lilly), and SKYRIZI (AbbVie).

Companies such as Janssen Pharmaceuticals (TREMFYA), Abivax (ABX464), Landos Biopharma/NImmune (BT-11), Merck (Tulisokibart), Eli Lilly (MORF-057), Takeda (TAK-279), Mesoblast Ltd. (Remestemcel-L), and others are currently evaluating their lead ulcerative colitis drugs in various stages of clinical trials.

SKYRIZI and RINVOQ have emerged as AbbVie’s two key therapies aimed at mitigating the impact of Humira’s patent expiry and sustaining overall revenue growth. These therapies are gaining strategic importance in enhancing AbbVie’s financial metrics. RINVOQ’s sales and SKYRIZI’s sales continue to grow steadily from year to year.

Downloads

Article in PDF

Recent Articles

- Bristol-Myers Squibb’s Opdivo Approval; Mirati’s KRAS-inhibitor Adagrasib; J&J and Legend Bi...

- Eli Lilly strengthening its Gastroenterology portfolio post Acquisition of Morphic. Tracking comp...

- Analyzing the Key Trends Driving the Biosimilar Market Growth

- New Player in Ulcerative Colitis Treatment: Pfizer’s Etrasimod Entry Counters BMS’ Zeposia

- 7 Hidradenitis Suppurativa Drugs Set to Hit the Market in the Next 5 Years