From Sight to Insight: The Rise of Smart Ophthalmological Devices in Eye Care

Aug 06, 2025

Table of Contents

Ophthalmology devices are specialized medical instruments and equipment designed for the diagnosis, treatment, and management of eye-related conditions and disorders. These devices encompass a wide range of technologies, including diagnostic tools like optical coherence tomography (OCT) scanners and fundus cameras, surgical instruments such as phacoemulsification systems and lasers, and vision care products like contact lenses and spectacles. They play a critical role in addressing various eye conditions, such as cataracts, glaucoma, refractive errors, and retinal disorders, enabling ophthalmologists to provide precise interventions and improve patients’ quality of life through enhanced vision care.

Eye-Catching Stats

Globally, eye diseases pose a significant health burden. According to the World Health Organization (WHO), approximately 2.2 billion people worldwide suffer from some form of vision impairment, with nearly 1 billion cases being preventable or treatable. Cataracts, a leading cause of blindness, affect around 94 million people, while glaucoma impacts about 80 million individuals, making it the second leading cause of blindness globally. Additionally, age-related macular degeneration (AMD) affects roughly 196 million people, and diabetic retinopathy, driven by the rising prevalence of diabetes, impacts millions more.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Insights Into the Evolving Landscape of the Ocular Implants Market

- DelveInsight’s Gene Therapy Reports: Launched

- Gene Therapies as a Game-Changer in Ophthalmology: Eyeing the Future

- Aurora Spine’s Interbody Fusion Device; LENSAR’s ALLY Adaptive Cataract Treatment System; Abbott&...

- 8 Game-Changing Applications of Healthcare Mobility Solutions

The growing elderly population and lifestyle changes, such as increased screen time, further exacerbate the prevalence of refractive errors like myopia, which is projected to affect 50% of the global population by 2050. These staggering numbers underscore the critical need for advanced ophthalmology devices to diagnose, treat, and manage these conditions effectively.

The Global Ophthalmological Devices Market was valued at ~USD 60 billion in 2024, growing at a CAGR of 4.83% during the forecast period from 2025 to 2032 to reach ~USD 88 billion by 2032. This growth reflects the increasing demand for innovative devices driven by the rising prevalence of eye disorders and advancements in technology.

This blog will explore the diverse types of ophthalmology devices, recent technological advancements, and the market’s growth trends, providing insights into how these innovations are shaping the future of vision care.

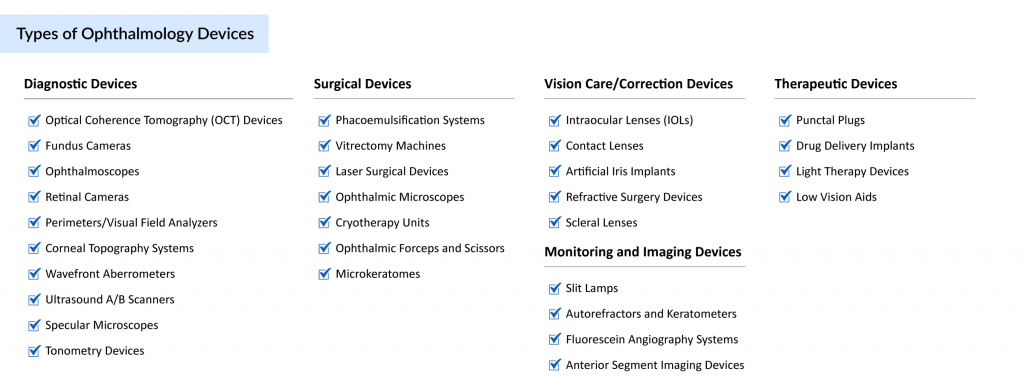

Types of Ophthalmology Devices

Ophthalmology devices are essential tools used by eye care professionals to diagnose, treat, and manage a wide range of eye conditions. These devices are categorized based on their application, ranging from diagnostics to surgical interventions and vision correction. Below is an overview of some of the key types of ophthalmology devices, each playing a vital role in addressing specific eye health needs.

Diagnostic Devices

Diagnostic devices are used to evaluate and monitor eye health, enabling early detection and management of eye conditions. Optical Coherence Tomography (OCT) scanners, which grab a market of USD 1.22 billion in 2023, provide high-resolution, cross-sectional images of the retina, aiding in the diagnosis of conditions like macular degeneration and diabetic retinopathy. Fundus cameras capture detailed images of the back of the eye, including the retina and optic disc, to detect abnormalities such as retinal detachment. Tonometers measure intraocular pressure, a critical tool for diagnosing and monitoring glaucoma. These devices are foundational in enabling precise and timely interventions to prevent vision loss.

Cataract Surgery Devices

Cataract surgery devices are designed to treat cataracts, a leading cause of blindness characterized by clouding of the eye’s lens. Phacoemulsification systems use ultrasonic waves to break down and remove the cloudy lens, allowing for minimally invasive surgery with faster recovery. Intraocular lenses (IOLs) are implanted to replace the natural lens, restoring clear vision. The cataract surgery devices market was valued at USD 7.73 billion in 2023, growing at a CAGR of 5.50% during the forecast period from 2025 to 2032 to reach USD 10.66 billion by 2032. The demand is driven by the rising prevalence of cataracts, fueled by aging populations and lifestyle disorders like diabetes and hypertension, which increase the risk of cataract development.

Refractive Surgery Devices

Refractive surgery devices correct vision disorders such as myopia (nearsightedness), hyperopia (farsightedness), and astigmatism, reducing dependence on glasses or contact lenses. Excimer lasers, used in procedures like LASIK, reshape the cornea with precision to improve focus. Femtosecond lasers enhance accuracy in creating corneal flaps during LASIK and other procedures like SMILE (Small Incision Lenticule Extraction). The refractive surgery devices market was valued at USD 210.32 million in 2023, growing at a CAGR of 6.08% during the forecast period from 2025 to 2032 to reach USD 316.32 million by 2032. This growth is propelled by the increasing prevalence of refractive errors and advancements in laser technologies, improving safety and outcomes.

Glaucoma Surgery Devices

Glaucoma surgery devices manage glaucoma, a condition caused by elevated intraocular pressure that can lead to optic nerve damage and vision loss. Microstents and drainage implants, part of Micro Invasive Glaucoma Surgery (MIGS), offer minimally invasive solutions to improve fluid drainage and reduce pressure. The MIGS device market was valued at USD 406.55 million in 2023, growing at a CAGR of 13.34% during the forecast period from 2025 to 2032 to reach USD 972.26 million by 2032. The demand is driven by the rising prevalence of glaucoma, exacerbated by lifestyle disorders like diabetes and hypertension, which double the risk of vision loss and blindness, boosting the adoption of these innovative devices.

Retinal Disorder Devices

Retinal disorder devices address conditions affecting the retina, such as diabetic retinopathy and age-related macular degeneration. Vitrectomy machines remove the vitreous gel from the eye during retinal surgeries, enabling repairs for issues like retinal detachment. Retinal lasers are used to seal retinal tears or treat abnormal blood vessels in conditions like diabetic retinopathy. These devices are critical for preserving vision in patients with complex retinal conditions, with ongoing advancements improving their precision and effectiveness.

Vision Care Devices

Vision care devices include non-invasive solutions to correct or enhance vision. Contact lenses and spectacles are widely used to correct refractive errors like myopia, hyperopia, and presbyopia, offering accessible and cost-effective vision correction. Advanced lens technologies, such as multifocal and toric lenses, cater to specific needs, improving comfort and visual clarity. These devices remain a cornerstone of vision care, addressing the needs of millions worldwide with vision impairments.

Recent Developments in Ophthalmology Devices

The field of ophthalmology is undergoing transformative changes, driven by innovative technologies that enhance diagnostic precision, surgical outcomes, and patient access to care. Advancements in imaging technology, minimally invasive surgeries, and AI and telemedicine integration are addressing the rising global demand for effective vision solutions. Below, we explore these developments, incorporating key FDA approvals and clearances that are shaping the future of ophthalmology.

Advancements in Imaging Technology

Imaging technology continues to evolve, enabling earlier and more precise detection of eye conditions. Optical Coherence Tomography (OCT) systems have advanced with higher resolution and faster processing, providing detailed retinal images for diagnosing conditions like diabetic retinopathy and age-related macular degeneration (AMD).

In January 2024, Bausch + Lomb Corporation received FDA approval for the TENEO Excimer Laser Platform, which enhances LASIK procedures for myopia and myopic astigmatism with advanced imaging and eye-tracking software for precise corneal ablation.

Similarly, in January 2025, Zeiss Medical Technology secured FDA approval for the MEL 90 excimer laser, integrated into the Corneal Refractive Workflow ecosystem with the VISUMAX 800 femtosecond laser and SMILE PRO for refractive surgeries, including LASIK, keratoplasty, and incisions. These advancements, combined with adaptive optics in systems like P-GAN, improve retinal imaging clarity, enabling earlier detection and better management of complex eye diseases.

Innovations in Minimally Invasive Surgeries

Minimally invasive surgical techniques are revolutionizing ophthalmology by minimizing recovery times and complications. In July 2024, Oertli Instrumente AG received FDA 510(k) clearance for the Faros anterior cataract surgery system, a high-performance platform for cataract, vitreoretinal, and glaucoma procedures with advanced fluid and vacuum control for precise adaptation to varying cataract hardness levels.

In June 2024, Alcon secured FDA 510(k) clearance for the UNITY Vitreoretinal Cataract System (VCS) and UNITY Cataract System (CS), enhancing precision in vitreoretinal and cataract surgeries. In May 2025, Atia Vision, Inc. received FDA Investigational Device Exemption (IDE) approval for a feasibility study of its OmniVu™ Lens System, a novel intraocular lens designed to restore dynamic vision range post-cataract surgery, surpassing current presbyopia-correcting lenses.

Additionally, in February 2025, New World Medical received FDA 510(k) clearance for the VIA360 Surgical System, which delivers controlled viscoelastic fluid during ophthalmic surgeries, with immediate U.S. market launch plans. These innovations, including laser-assisted techniques and micro-incision technologies, enhance safety and efficacy in surgical procedures.

Artificial Intelligence and Telemedicine Integration

Artificial Intelligence and telemedicine are reshaping ophthalmology by improving diagnostic accuracy and expanding access to care. AI-driven tools, such as automated retinal image analysis, enable early detection of conditions like diabetic retinopathy and glaucoma with high precision.

In April 2025, Avant Technologies, Inc. and Ainnova Tech, Inc. announced that the FDA is reviewing their VisionAI platform, which leverages AI for early disease detection, potentially revolutionizing screening processes. Teleophthalmology is also gaining momentum, particularly in underserved regions, with AI-enabled portable devices facilitating remote diagnosis.

In June 2024, C3 Med-Tech raised USD 0.23 million to develop AI-enabled portable eye screening devices, supporting telemedicine integration and real-time disease detection to reduce avoidable blindness. These advancements streamline workflows, reduce diagnostic errors, and make eye care more accessible, especially in remote or resource-limited areas.

Explore our in-depth blog on AI in diagnostics, where we cover its impact across various disease types and how it’s transforming detection and treatment.

Growth Trends and Challenges in Ophthalmology Devices

The Ophthalmological devices sector is witnessing significant expansion, driven by a confluence of demographic, technological, and socioeconomic factors. A primary driver is the global aging population, which is increasing the prevalence of age-related eye conditions such as cataracts, glaucoma, and macular degeneration.

For instance, the growing number of elderly individuals, particularly in developed nations, necessitates advanced diagnostic and surgical devices to manage these conditions effectively. Lifestyle changes, including prolonged screen exposure and rising rates of diabetes, are also fueling demand by contributing to refractive errors and diabetic retinopathy. Technological advancements, such as those in laser-assisted surgeries, exemplified by systems that enhance precision in corneal reshaping, are making treatments safer and more appealing, encouraging patient adoption.

Additionally, emerging markets in regions like Asia-Pacific and Latin America are driving growth due to improved healthcare infrastructure, rising disposable incomes, and greater awareness of eye care solutions. These regions are becoming key hubs for device manufacturers as demand for affordable yet advanced technologies grows.

Looking ahead, these trends are likely to accelerate innovation and market penetration. For example, the integration of AI-driven diagnostics could enable widespread screening in underserved areas, reducing preventable blindness.

However, challenges persist. High costs of cutting-edge devices, like those used in advanced retinal imaging, can restrict access in low-income regions. Regulatory complexities often delay the introduction of novel technologies, requiring manufacturers to navigate rigorous approval processes. Additionally, a shortage of trained ophthalmologists in developing countries limits the effective use of sophisticated devices, while inconsistent reimbursement policies in some healthcare systems hinder patient access to treatments.

Overcoming these barriers will require innovative pricing strategies, streamlined regulatory frameworks, and expanded training initiatives to ensure equitable access to advanced eye care solutions.

Conclusion

The ophthalmology devices sector is on a dynamic growth path, driven by technological breakthroughs and rising global demand for vision care. Innovations in diagnostics, minimally invasive surgeries, and AI-driven teleophthalmology are transforming the management of eye conditions like cataracts, glaucoma, and refractive errors. These advancements are enhancing precision and accessibility, enabling earlier interventions and better patient outcomes, particularly in emerging markets where healthcare infrastructure is rapidly improving.

Despite challenges like high costs and regulatory complexities, the industry is well-positioned to address the global burden of vision impairment. Leading companies, including Alcon Inc., Johnson & Johnson Services, Inc., ZEISS Group (incl. Carl Zeiss Meditec AG), Bausch Health Companies Inc. (incl. Bausch & Lomb), NIDEK CO., LTD., Abbott Laboratories, HOYA Corporation, STAAR SURGICAL, and Topcon Corporation, are driving innovation and expanding access to cutting-edge solutions. By overcoming barriers through strategic pricing and training initiatives, the sector is set to deliver a future where preventable blindness is significantly reduced.

Downloads

Article in PDF

Recent Articles

- Aurora Spine’s Interbody Fusion Device; LENSAR’s ALLY Adaptive Cataract Treatment System; Abbott&...

- Medical Odyssey: Solving the Dynamic Puzzle of Global Tourism Market

- Telemedicine: Can it be the future of healthcare?

- The Hidden World of Vision: Exploring the Top 5 Rare Eye Diseases

- Healthcare Mobility Solutions: Revolutionizing Patient Care and Operational Efficiency