Cell and Gene Therapies in Rare Disorders: From Rarity to Recovery

Jun 09, 2023

Table of Contents

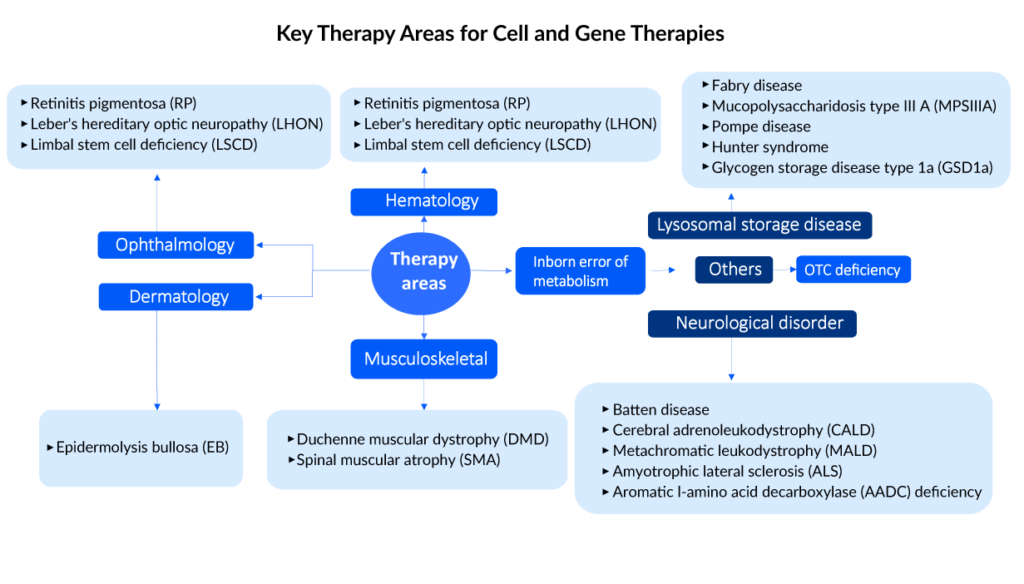

The cell and gene therapy market has seen a revolutionary transition in recent years, with advancements in scientific research and novel methods of treatment driving a rise in development activities. This has resulted in an increase in the number of cell and gene therapy choices available to patients suffering from a wide range of diseases, from rare genetic disorders to more prevalent diseases. With gene therapy quickly extending outside its traditional emphasis on rare diseases, the market is primed for tremendous development and presents an attractive opportunity for biotechnology and pharmaceutical companies to have a meaningful impact on patient outcomes. As a result, the cell and gene therapy market represents a truly transformative field of healthcare innovation that is likely to alter the future of medicine for years to come.

Rare diseases are caused by genetic mutations in about 85% of cases, putting them great candidates for gene therapy. As per DelveInsight estimates, the highest prevalent cases from the selected indications for cell and gene therapies in rare disorders were for retinitis pigmentosa in the United States in 2022 whereas the least cases were reported for Hunter syndrome. DelveInsight estimates that, the total prevalent cases of selected indications for cell and gene therapies in rare disorders in the United States were approximately 400,000.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- FDA Approves AstraZeneca’s Enhertu; Bayer Wins FDA Approval for Prostate Cancer Therapy, Nubeqa; ...

- First Gene Therapy for Severe Hemophilia A; FDA Approves CellTrans’s Type 1 Diabetes Cellular The...

- Sanofi’s Qfitlia Becomes First FDA-Approved Therapy for Hemophilia A or B; FDA Approves AstraZene...

- Hemophilia B Market: How Pipeline Therapies are Transforming the Treatment Hemisphere?

- Gilead remunerates; Roche taps Halozyme’s drug delivery tech; Orchard Therapeutics prices its IPO

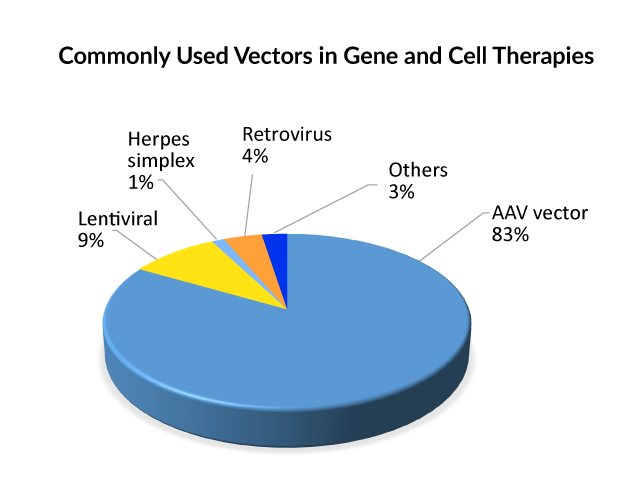

Commonly used vectors in cell and gene therapies

To incorporate genetic components into cells, they must be wrapped in a vector. The reasoning is that molecules with a negative charge, such as DNA and cell membranes, naturally repel one another. As a result, vectors act as carriers for genetic cargo into cells, where they can be released and employed to generate therapeutic proteins. Viruses are the most commonly used vector for gene therapy due to their inherent adaptability and efficacy in gene delivery. AAV, retrovirus, or lentivirus vectors are currently used in gene therapies that are approved. And, when it comes to gene treatments in the pipeline, the Adeno-associated viral (AAV) vector type is used in the majority of late and early-stage medicines, followed by lentivirus; hence, it can be said that AAV is presently the front-runner for delivering gene therapy. Lentivirus allows for ex vivo gene therapy by the donation of recombinant hematopoietic stem cells, whereas AAV allows for in vivo direct, corrected gene therapy.

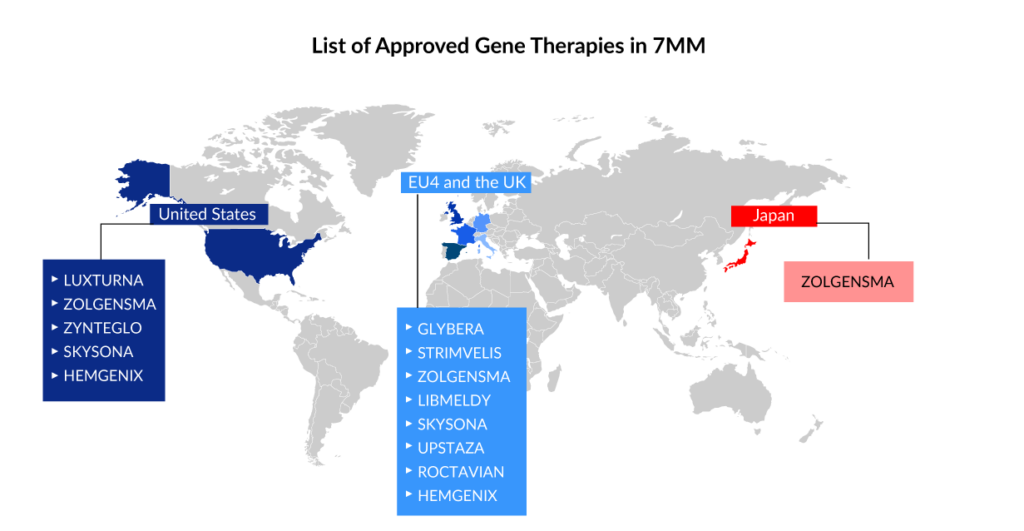

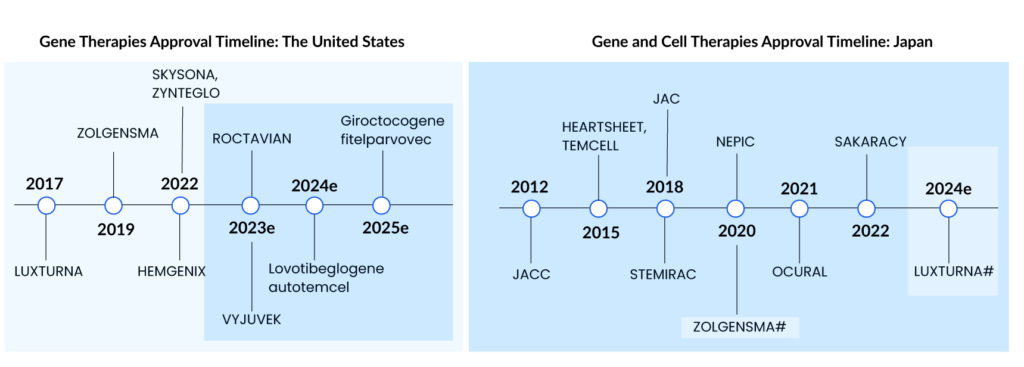

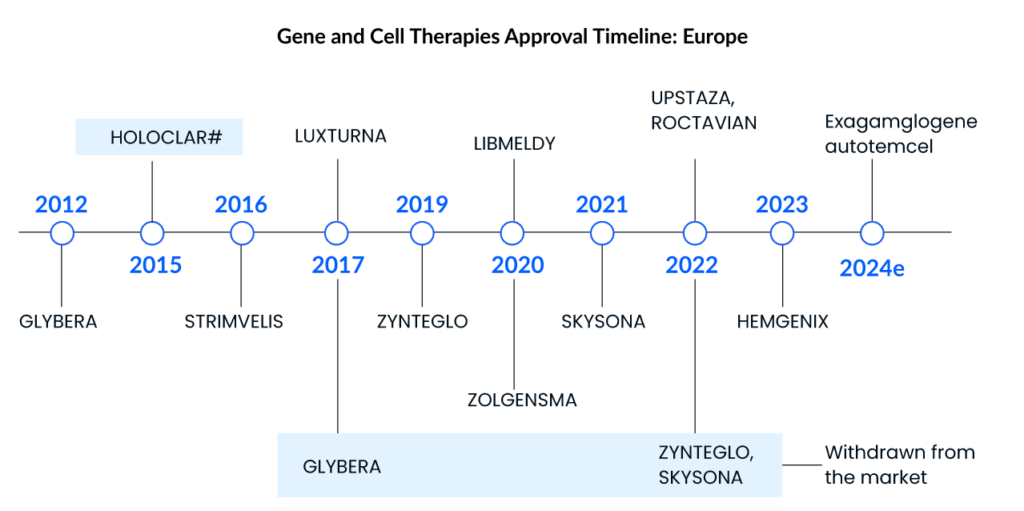

Current gene therapies scenario

Spark Therapeutics’ LUXTURNA was the first gene therapy approved in the United States in 2017, restoring vision to people suffering from a type of retinal blindness (confirmed biallelic RPE65 mutation-associated retinal dystrophy), while Novartis’ ZOLGENMSA (approved in 2019) addresses spinal muscular atrophy (SMA), a disease that is typically fatal in children. GLYBERA (uniQure Biopharma), the first gene therapy approved in the European Union (EU) for a rare pancreatic condition, was removed due to its high price and small market, despite the fact that it, like the others, is effective in treating the disease.

STRIMVELIS, a gene therapy initially developed by GlaxoSmithKline (GSK) and authorized in Europe in 2016, is one of the gene therapy in which Orchard intends to discontinue investment. GSK developed this therapy, which was later bought by Orchard in 2018. Since then, only 16 individuals have received the medication, which treats the rare immunological condition Adenosine deaminase severe combination immunodeficiency (ADA-SCID). STRIMVELIS has not been authorized by the US Food and Drug Administration. However, STRIMVELIS made headlines in November 2020 after a case of leukemia was detected in a patient who had received gene therapy. When STRIMVELIS was approved, EU officials identified the issue as a known adverse impact.

Based on two Phase III studies, the US FDA approved bluebird bio’s ZYNTEGLO last August, a one-time gene therapy custom-designed to cure the underlying genetic cause of beta-thalassemia in adult and pediatric patients who require regular red blood cell transfusions. ZYNTEGLO was granted conditional approval by the European Medicines Agency (EMA) in April 2019 to treat transfusion-dependent beta-thalassemia and will be available in 2020. However, Bluebird Bio recently revealed that the pricing conversations in Germany had failed because the health authorities had offered a lower price than Bluebird Bio would have accepted. ZYNTEGLO commercialization in Germany has now been discontinued. The pricing dispute has cast doubt on the feasibility of a European market for cutting-edge medications such as cell and gene therapies. These treatments reverse the impact of deleterious mutations by injecting functional cells or therapeutic genes into the body. However, in March 2022, the European Commission (EC) terminated ZYNTEGLO’s European Union marketing license.

ROCTAVIAN (valoctocogene roxaparvovec) was given conditional marketing authorization by the European Commission in August 2022 for severe hemophilia A (congenital Factor VIII deficiency) treatment in adult patients without a history of Factor VIII inhibitors and detectable antibodies to adeno-associated virus serotype 5. ROCTAVIAN had to take a long ride to reach the FDA goalpost. Prior to its initial rejection, this gene therapy was designated as a breakthrough therapy in 2017. However, the FDA issued a comprehensive response letter (CRL) to BioMarin in 2020, expressing concern about how long the drug’s benefits would endure. BioMarin resubmitted its latest application in September. The FDA determined on March 6, 2023, that submitting the 3-year data analysis from the ongoing Phase III GENEr8-1 study constituted a major amendment due to the substantial amount of additional data, and set a new Prescription Drug User Fee Act (PDUFA) target action date of June 30, 2023, up from March 31, 2023.

HEMGENIX, an adeno-associated virus vector-based gene therapy approved by the US FDA in November of last year, is an adeno-associated virus vector-based gene therapy for the treatment of adults with hemophilia B (congenital Factor IX deficiency) who are currently using Factor IX prophylaxis therapy, have a current or historical life-threatening hemorrhage, or have repeated, serious spontaneous bleeding episodes. HEMGENIX costs a whopping USD 3.5 million for each dose. CSL Behring and uniQure’s Haemophilia B gene therapy startled everyone by becoming the world’s most costly medication and the first gene therapy licensed for the rare disease.

Leukodystrophies include X-linked adrenoleukodystrophy, metachromatic leukodystrophy (MLD), globoid cell leukodystrophy (Krabbe’s disease), Alexander’s disease, Canavan’s disease, Pelizaeus-Merzbacher disease (PMD), and others. LIBMELDY is the world’s first ex vivo gene therapy for the treatment of MLD. It consists of autologous CD34+ cells that have been transduced with the gene encoding the Arylsulfatase A (ARSA) enzyme. LIBMELDY was approved in Europe in December 2020. The company expects to submit a Biologics Licence Application (BLA) in the second half of 2023, with approval in 2024 and a launch in 2025. SKYSONA, a one-time gene therapy approved in Europe in July 2021 for treating cerebral adrenoleukodystrophy, received accelerated clearance from the US FDA in September 2022. It was later withdrawn from the European market in October 2021 owing to pricing issues.

UPSTAZA, a gene therapy developed by PTC Therapeutics, was approved in July of last year to treat aromatic l-amino acid decarboxylase deficiency (AADC) in individuals 18 months of age. Following European clearance in the first half of 2023, the company aims to file a BLA for UPSTAZA with the US FDA.

Cell and gene therapies in clinical development

Several therapies are now being evaluated by regulatory authorities (FDA or EMA), and some companies intend to submit authorization applications to the authorities. Not only this, but many gene therapies in the early to mid-stages of drug development show a lot of promise.

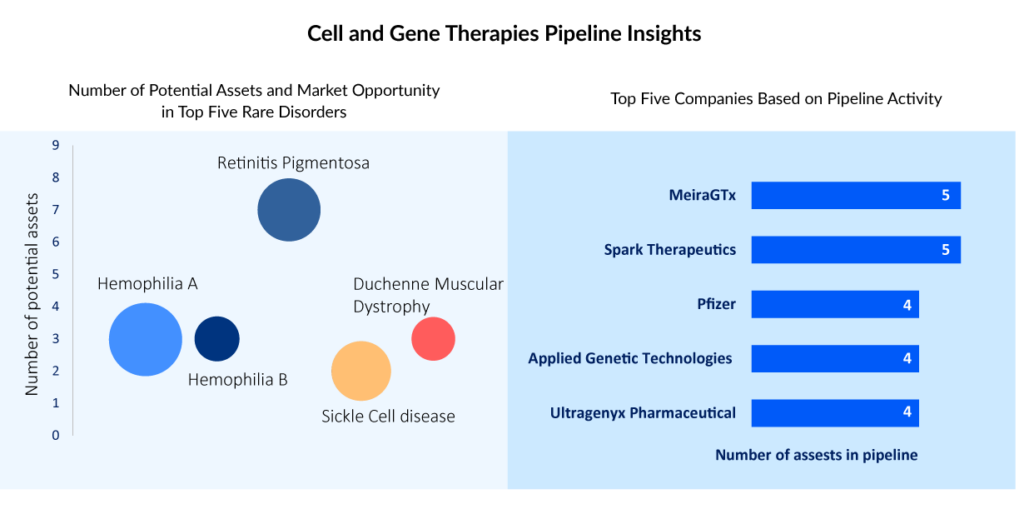

According to DelveInsight, it has been identified that certain cell and gene therapies have the potential to revolutionize the treatment of diseases such as retinitis pigmentosa, sickle cell disease, Duchenne muscular dystrophy, and Hemophilia A and B. Among these, Hemophilia A has the largest cell and gene therapies in rare disorders market size, while Retinitis pigmentosa has the highest number of potential gene therapies in the pipeline.

These findings suggest that the gene therapy market is poised for significant growth in the coming years, particularly in the treatment of rare genetic disorders. Biotechnology and pharmaceutical companies such as Roche, Freeline Therapeutics, Spark Therapeutics, Astellas Gene Therapies, Actus Therapeutics, GenSight Biologics, Coave Therapeutics, Johnson & Johnson, MeiraGTx, CRISPR Therapeutics, Vertex Pharmaceuticals, Editas Medicine, Sangamo Therapeutics, and several others that focus on these disease areas and invest in developing gene therapies are likely to benefit from this trend, both in terms of improving patient outcomes and realizing commercial success.

More than 20 gene therapies are anticipated to enter the major markets by 2032, with the major development in hemophilia, retinitis pigmentosa, Duchenne muscular dystrophy, and sickle cell disease space. The potential cell and gene therapies in these treatment segments include

Retinitis Pigmentosa

Among the developing candidates, AGTC-501 from Applied Genetic Technologies Corporation is expected to advance to the X-linked retinitis pigmentosa confirmed by a pathogenic variant in the RPGR gene. This candidate’s Phase I/II results was reported in May 2022. The primary endpoint is the proportion of treated eyes that show improvement in visual sensitivity from baseline after 12 months, with secondary endpoints (also at 12 months) including improvements in best-corrected visual acuity (BCVA) and the patient’s ability to navigate a mobility maze more successfully under varying light and challenging conditions. Botaretigene sparoparvovec, developed by Johnson & Johnson/MeiraGTx, is another gene therapy that targets the RPGR gene. The company intends to file a BLA by 2024 based on the results of a Phase III trial.

Aside from that, Coave Therapeutics’ CTx-PDE6b gene therapy candidate is in Phase I/II testing. It is now being studied for PDE6B-related retinitis pigmentosa. The open-label, monocentric, dose-escalation Phase I/II trial was approved by the French National Agency for Medicines and Health Products Safety (ANSM) in October 2017. Other companies doing Phase I/II trials and developing their candidate for the treatment of retinitis pigmentosa include GenSight Biologics (GS030), Nanoscope Therapeutics (MCO-010), 4D Molecular Therapeutics (4D-125), Ocugen (OCU400), and others.

Hemophilia A and B

Aside from ophthalmology, pharmaceutical companies have shown a strong interest in researching gene therapy for hemophilia A and B. Spark Therapeutics’ expertise in gene therapy has resulted in the first-ever AAV gene therapy approval in the United States, and the business is investigating its potential across a variety of conditions. Sparks possess possible hemophilia, Pompe disease, and other hereditary retinal disease candidates.

Currently, the most promising gene therapies for hemophilia A are ROCTAVIAN, Giroctocogene fitelparvovec (SB-525; Pfizer [formerly Sangamo Biosciences]), and SPK-8011 (Roche [previously Spark Therapeutics] in conjunction with Pfizer). ROCTAVIAN is an AAV vector gene therapy designed to treat hemophilia A. In terms of clinical development and regulatory status, BioMarin has a major advantage over Roche/Spark’s SPK-8011/RG6357 and Pfizer/Sangamo’s SB-525. It was approved in Europe last year, and the business submitted three years of Phase III data to the FDA, meeting all efficacy endpoints. Due to the significant amount of additional data, the FDA concluded that submitting the 3-year data analysis from the ongoing Phase III GENEr8-1 trial constituted a major modification and established a new PDUFA target action date of June 30, 2023.

The hemophilia B market is also substantial, and gene treatments for this disorder are expected to be commercially available soon. Spark Therapeutics is also working with Pfizer to develop fidanacogene elaparvovec (SPK-9001/PF-06838435), an AAV gene therapy for hemophilia B. This candidate has also shown a higher level of safety. Overall, it is expected that this gene therapy will attract a sizable patient population among hemophilia B patients who have not previously had inhibitors and do not have anti-AAV antibodies. The gene therapy candidate being developed by uniQure’s closest competitor Roche is expected to be several months behind schedule. Following the withdrawal of Sangamo’s SB-FIX and Takeda’s clinical hold on TAK-748, Uniqure’s main competitor is Pfizer/Roche.

Beta-thalassemia and sickle cell disease

Beta-thalassemia and sickle cell disease are two other rare blood disorders. A deficiency in the beta-globin gene produces beta thalassemia, which controls the creation of hemoglobin’s beta-globin chains; a fault in hemoglobin itself causes sickle cell disease with aberrant Haemoglobin S (Hgb S). In the quest to become the first CRISPR-based gene editing therapy, two gene therapy competitors are now fighting for FDA clearance. Bluebird Bio has submitted its lovo-cel gene therapy application to the FDA, whereas Vertex Pharmaceuticals/CRISPR Therapeutics’ exagamglogene autotemcel (exa-cel) sickle gene therapy was finished rolling BLA filing in April 2023. Bluebird was subjected to a partial clinical hold in 2021 but finally submitted on April 24, 2023, putting them in direct competition with CRISPR Therapeutics. Exa-cel’s submissions have already been vetted by European and British regulators, and both companies are now waiting to learn which therapy will be approved first by the FDA. This race illustrates gene therapy’s great possibilities as well as biotechnology’s continual developments. Exagamglogene autotemcel is expected to be the largest revenue-generating gene therapy in SCD and Beta-thalassemia due to factors such as the market absence of ZYNTEGLO in EU countries, as well as its effectiveness and safety profile.

Duchenne Muscular Dystrophy (DMD)

Moving on, Duchenne muscular dystrophy (DMD) is a degenerative form of muscular dystrophy that predominantly affects men, however, it can afflict women in rare situations. Glucocorticoids and authorized medicines are utilized in the treatment of DMD, followed by standard of care, medical management, supporting measures, and psychological management. The market also includes the introduction of numerous new medicines, like SRP-9001, which will boost the DMD industry post-launch. Sarepta Therapeutics is a major player in the DMD treatment market, with two approved medications for treating DMD patients, Vyondys 53 (golodirsen) and Exondys 51 (eteplirsen).

Sarepta Therapeutics is developing SRP-9001, a single-dose new gene therapy designed for patients so that microdystrophin can reach muscle tissue directly via an IV mode of administration, to address the unmet need for gene therapy in the existing treatment regimen. Aside from that, Pfizer is looking into its DMD candidate. In 2020, Pfizer will begin the Phase III trial for PF-06939926 (fordadistrogene movaparvovec). The US FDA imposed a hold on PF-06939926 in December 2021 due to the death of a patient, however, the hold was lifted last year in April. According to the preliminary Phase I findings, fordadistrogene movaparvovec has an acceptable safety profile and the potential to improve ambulatory DMD patients by reducing or preventing function loss.

Pricing and reimbursement issues

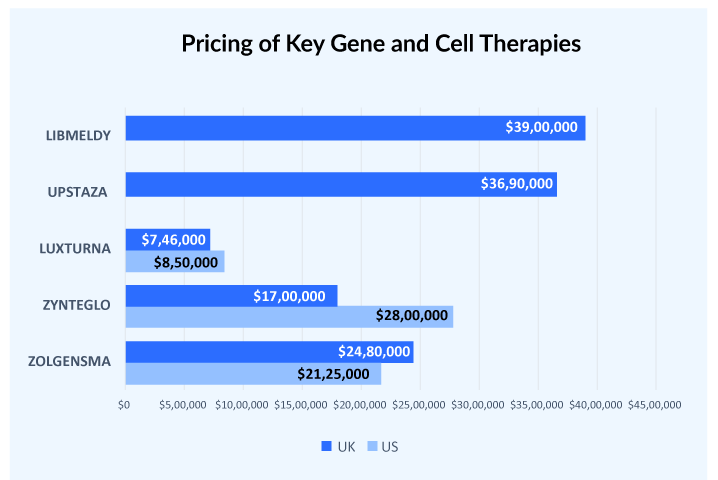

Since their approval and introduction to the market, cell and gene therapies have been the subject of debate and concern. With the approval of many gene therapies at high prices in recent years, there has been a dramatic shift in pricing assumptions in both Europe and the United States. While gene treatments were first thought to be high-priced but potentially cost-effective one-time treatment, this has not been the case.

Gene therapy was once estimated to cost roughly USD 1–2 million, which is thought to be an astronomical amount for a therapy. However, recent price negotiations have exceeded the pre-recognized price benchmarks. The cost of gene therapies, which is already approaching USD 3–4 million, is straining healthcare systems all around the world.

Generally, there is a price difference of at least 30-40% between the US and European countries. But this doesn’t hold true in cases of gene therapies, HEMGENIX used to be considered one of the most expensive therapy launched in the US with a price tag of USD 3.5 million but the launch of UPSTAZA and LIBMELDY in Europe with list prices of more than USD 3.7 million crossed that benchmark. Similarly, LUXTURNA was approved in the US in 2017 at a price tag of USD 850,000 per patient. Later in 2018, it was approved in European countries with a price range of USD 649,600-746,000 per patient.

The high prices have strained the healthcare system and made it harder for patients to obtain these life-saving therapies. As a result, there is a rising discussion over how to strike a balance between the need for innovation and investment and the requirement for affordability and accessibility. While gene therapies have shown amazing potential, finding a method to make them more available to those in need is critical.

Conclusion

The field of rare diseases is broad and complex. As new diseases are identified, the landscape of rare diseases changes. With the exception of a few rare disorders, where significant progress has been made, current research is still in its early stages. For a long time, pharmaceutical corporations and regulators have shown little interest in rare disorders. As a result, developing a comprehensive strategy for rare diseases was greatly hampered. Fortunately, things are changing gradually, and little but substantial measures are being taken to meet the unmet requirements associated with such diseases. To summarise, it is critical to make a determined effort, whether short or long-term, to address rare diseases holistically and fully.

Downloads

Article in PDF

Recent Articles

- Hemophilia: A Lifelong Genetic Disorder

- FDA declines the approval of Lipocine’s testosterone drug; Novartis Sandoz to buy Aspen Pharmaca...

- Aktis’s Novel Targeted Alpha Radiopharmaceuticals; Koye Partners with Sonde Health; Novartis to S...

- Lyfgenia or Casgevy: Who Will Lead the Sickle Cell Disease Treatment Space?

- Notizia