Guardant Health Secured FDA Breakthrough Device Designation for Its Shield Multi-Cancer Detection Test

On June 03, 2025, Guardant Health, Inc., a precision oncology company, reported that the U.S. Food and Drug Administration (FDA) granted breakthrough device designation to its Shield multi-cancer detection (MCD) test. This test, which utilized methylation-based blood analysis, was intended for screening several cancer types, such as bladder, colorectal, esophageal, gastric, liver, lung, ovarian, and pancreatic cancer in individuals aged 45 or older at average risk.

The breakthrough device designation was granted by the FDA to a limited number of devices with the potential to significantly improve the treatment or diagnosis of serious conditions like cancer. The purpose of the FDA’s breakthrough devices program was to provide patients and clinicians with quicker access to innovative medical technologies by expediting their development and regulatory review.

“Every late-stage cancer we avert is a win for patients and for the entire healthcare system,” said AmirAli Talasaz, Guardant Health co-founder and co-CEO. “This recognition by the FDA shows the promise of the Shield MCD test to detect multiple cancers at an early stage with just a single, routine blood draw. We look forward to partnering with the agency and other stakeholders to bring this breakthrough to patients quickly.”

The FDA’s Breakthrough Device designation for Guardant’s Shield MCD test followed its earlier selection by the National Cancer Institute (NCI) for the Vanguard Study, which assessed new multi-cancer detection technologies. The test had been selected based on its strong predictive performance for both cancer presence and tissue of origin.

During the 2025 Annual Meeting of the American Society for Clinical Oncology (ASCO) in Chicago, Guardant revealed clinical validation results for the Shield MCD test. The findings showed that the blood-based test had demonstrated 98.6% specificity, 75% sensitivity across major cancers including bladder, colorectal, esophageal, gastric, liver, lung, ovarian, and pancreatic (with individual cancer sensitivity ranging from 62% to 96%) and a 92% accuracy rate in identifying the cancer signal origin.

As per DelveInsight’s “Cancer Diagnostics Market Report,” the global cancer diagnostics market was valued at USD 125.13 billion in 2023, growing at a CAGR of 9.43% during the forecast period from 2024 to 2030, to reach USD 214.88 billion by 2030. The increase in demand for cancer Diagnostics products and services is predominantly attributed to the spike in cancer cases reported worldwide. In addition, growing manufacturers’ focus on developing advanced cancer diagnostic products, the establishment of various cancer diagnostic labs, and rising government initiatives to raise awareness regarding early detection and management of cancer among patients, and others, are anticipated to drive the global cancer diagnostics market during the forthcoming years.

Reflow Medical Secured FDA De Novo Clearance for its Spur Peripheral Retrievable Stent System

On May 29, 2025, Reflow Medical, Inc., a leading innovator in medical devices for complex cardiovascular conditions, announced that the U.S. Food and Drug Administration (FDA) has granted De Novo clearance for its Spur™ Peripheral Retrievable Stent System. This novel device offers a unique treatment solution for de novo or restenotic lesions following predilatation in patients with infrapopliteal arterial disease.

The Spur® Stent System was the first and only retrievable stent system to combine a self-expanding stent with a dilatation balloon catheter on an over-the-wire platform. Engineered for precision, it utilized a series of radially expandable spikes to enable controlled lesion penetration and treatment. This innovative approach, known as Retrievable Scaffold Therapy (RST), allowed the spikes to modify lesion morphology by increasing the acute luminal diameter, enhancing vessel compliance, and reducing the risk of vessel recoil.

“Clinical data submitted to the FDA demonstrated the safety and efficacy of the Spur Stent System,” said Mahmood K. Razavi, MD, FSIR, FSVM, who serves as Director of the Clinical Trials and Research Center at St. Joseph Heart and Vascular Center in Orange, California. “This novel device will be a valuable and innovative expansion of our treatment toolbox as a unique device for the treatment of complex BTK disease.”

“Extensive research and development, which laid the groundwork for the DEEPER REVEAL trial, enabled the creation and clinical validation of the Spur Stent System, an innovative mechanical endovascular device engineered to enhance lesion penetration and optimize the treatment of BTK peripheral arterial disease,” said Teo Jimenez, Senior Vice President of R&D at Reflow Medical.

The recently concluded DEEPER REVEAL clinical trial (NCT05358353), which evaluated the Spur Stent System for below-the-knee (BTK) treatment of chronic limb-threatening ischemia (CLTI), showed that following predilatation, the Spur Stent System achieved a 99.2% technical success rate and 97.0% freedom from MALE and POD at 30 days.

As per DelveInsight’s “Peripheral Vascular Devices Market Report,” the global peripheral vascular devices market was valued at USD 9.63 billion in 2023, growing at a CAGR of 7.88% during the forecast period from 2024 to 2030, to reach USD 15.13 billion by 2030. The demand for peripheral vascular devices is primarily being boosted by the rising prevalence of cardiovascular diseases and peripheral vascular diseases, the approval of new and advanced products, and the rising incidence of lifestyle disorders such as diabetes and hypertension. Furthermore, the increase in the geriatric population is also likely to contribute to the growth of the peripheral vascular devices market during the forecast period from 2024 to 2030.

FastWave Medical Completed First Human Use of Coronary Laser IVL System

On June 03, 2025, FastWave Medical announced the completion of the first human procedures using its Sola coronary laser intravascular lithotripsy system. These initial procedures initiated a multi-center feasibility study to assess the safety and performance of the platform.

The Minneapolis-based startup developed Sola as a laser-based intravascular lithotripsy balloon catheter for patients suffering from calcified coronary artery disease. In contrast to traditional IVL devices relying on mechanical shockwaves, Sola utilized laser pulses to emit 360-degree energy inside the vessel, targeting more uniform calcium disruption in challenging vascular anatomies.

“There’s a moment in every FIH study where you see if the technology lives up to its promise,” said Dr. Arthur Lee of TCAVI in Gainesville, Florida. “With Sola, we saw that moment early on. It demonstrated exceptional crossability through complex anatomy where existing IVL technology might struggle, and its 5Hz pulse rate allowed us to deliver therapy efficiently, reducing ischemic time in patients with compromised cardiac output.”

“Every step of developing Sola has focused on solving the real-world problems physicians face in treating complex arterial disease,” FastWave Medical Chief Operating Officer Tristan Tieso. “Early feedback from these cases shows we’re on the right path.”

The new system follows FastWave’s earlier Artero electric IVL system, which it designed for peripheral artery disease. That device completed its first-in-human study in 2024 with 100% procedural success and no adverse events reported at 30 days.

According to DelveInsight’s “Lithotripsy Devices Market Report”, the global lithotripsy devices market was valued at USD 1.39 billion in 2023, growing at a CAGR of 4.32% during the forecast period from 2024 to 2030 to reach USD 1.78 billion by 2030. The lithotripsy devices market is growing significantly due to the rising prevalence of urolithiasis, technological advancements in product development, increased risk of end-stage renal failure, and rising awareness of the procedure is expected to escalate the demand for lithotripsy devices during the forecast period from 2024 to 2030.

BD Began Real-World Patient Data Registry for Rotarex™ Atherectomy System in Peripheral Artery Disease

On May 28, 2025, BD (Becton, Dickinson and Company), a global medical technology leader, revealed that it had planned to start a patient data registry for the Rotarex™ Atherectomy System aimed at measuring real-world patient outcomes in peripheral artery disease (PAD).

The registry, named “XTRACT,” was a prospective, multi-center, single-arm, post-market study intended to evaluate the clinical performance of the Rotarex™ Atherectomy System for U.S. patients with PAD lesions. The study was conducted under the leadership of Co-Principal Investigators Dr. Prakash Krishnan, an interventional cardiologist, and Dr. Todd Berland, a vascular surgeon. It was expected to enroll up to 600 patients across roughly 100 clinical sites in the United States, with the initial patient enrollment anticipated later that year. Follow-up clinical assessments were planned for 30 days, 6 months, and 12 months after the procedure to evaluate safety and effectiveness.

“This registry will provide valuable data to support clinical decision-making and enhance patient outcomes in the management of PAD,” said Dr. Krishnan. “The Rotarex™ System has been extensively studied internationally, and we are excited to further evaluate its adaptability in treating a wide range of PAD lesions within the U.S. patient population.”

“The XTRACT Registry is the first comprehensive registry aimed at providing key insights into the real-world applications of the Rotarex™ System,” said Rima Alameddine, worldwide president of BD Interventional-Peripheral Intervention. “This study underscores our unwavering commitment to optimizing treatment strategies in partnership with leading physicians to improve patient care.”

The Rotarex™ Atherectomy System is a minimally invasive solution designed to efficiently remove both plaque and thrombus in peripheral arteries. Offering dual indications as both an atherectomy and thrombectomy device, the Rotarex™ Atherectomy System is a proven tool for treating PAD.

As per DelveInsight’s “Atherectomy Devices Market Report”, the global atherectomy devices market size was valued at USD 939 million in 2023, growing at a CAGR of 9.24% during the forecast period from 2024 to 2030 to reach USD 1,596 million by 2030. The demand for atherectomy devices is primarily being boosted by increasing geriatric population, rising prevalence of cardiovascular diseases, growing prevalence of lifestyle disorders such as hypertension and diabetes, and innovation in product development, thereby contributing to the overall growth of the Atherectomy devices market during the forecast period.

On June 03, 2025, Johnson & Johnson MedTech had launched the KINCISE™ 2 Surgical Automated System, positioning it as a next-generation automated power tool designed to enhance surgical efficiency, deliver better control, and alleviate the physical stress surgeons faced during manual impaction in both primary and revision hip, and revision knee replacement surgeries.

With increasing complexity in operating rooms, longer surgical durations, higher case loads, and physically strenuous techniques, orthopaedic surgeons were increasingly exposed to risks. Tasks involving repeated high-force mallet strikes have been associated with overuse injuries. Nearly 97% of surgeons reported experiencing musculoskeletal pain, particularly in the lower back, hands, and neck. The development of the KINCISE™ 2 System was a response to these conditions, offering a solution that aimed to improve workflow and lessen physical fatigue for surgeons.

“When I think about what the KINCISE™ 2 System means for the future of orthopaedic care, it’s simple: it helps surgeons stay at their best, longer,” said Dr. Vasilios Mathews||, M.D., Texas Orthopedic Hospital. “This system is designed to reduce strain and support surgical precision, which means we can focus more fully on the patient in front of us. That’s the true value of technology that not only improves surgical experience but helps us deliver better outcomes for every patient we treat.”

“The KINCISE™ 2 System exemplifies the needs-based innovation we’re bringing to Orthopaedics this year,” said Aldo Denti, Company Group Chairman, Orthopaedics, Johnson & Johnson MedTech. “As more patients undergo joint replacements earlier in life, the demand for revision surgeries is rising. The KINCISE™ System has demonstrated the ability to help surgeons manage those complex cases by reducing operating time and providing procedural control, ultimately supporting better outcomes for patients.”

Johnson & Johnson MedTech expanded upon the capabilities of its original KINCISE™ System with the launch of KINCISE™ 2, which featured enhanced reverse energy and newly added push-to-lock adaptors to streamline surgical workflow. The latest version introduced Acetabular Cup Extraction, making it the first and only automated impactor approved for the removal of well-fixed acetabular components. This advancement significantly expanded the system’s utility in complex hip revision surgeries and aligned well with modern techniques like the Anterior Approach. As it became commercially available in the U.S., the KINCISE™ 2 System reflected Johnson & Johnson MedTech’s dedication to innovating smart and adaptive orthopedic technologies that improved the surgical experience, optimized care team efficiency, and elevated patient outcomes.

According to DelveInsight’s “Hip Replacement Devices Market Report”, the hip replacement devices market was valued at USD 8.82 billion in 2023, growing at a CAGR of 5.04% during the forecast period from 2024 to 2030 to reach USD 11.83 billion by 2030. The hip replacement devices market is growing significantly due to the rising global incidence of osteoarthritis and osteoporosis, increasing numbers of hip fractures, coupled with advancements in joint-replacement technology and innovative product developments by leading hip reconstruction devices companies is expected to escalate the demand for hip replacement devices during the forecast period from 2024 to 2030.

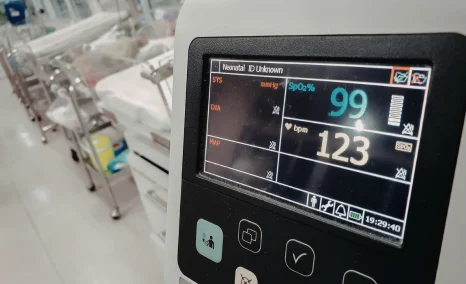

Cardinal Health Introduced a System that Continuously Monitored Three Key Vital Signs in a Single Device

On June 04, 2025, Cardinal Health launched its Kendall DL™ Multi System in the U.S. a single-patient use monitoring cable and lead wire solution that continuously monitored three vital signs: cardiac activity, SpO₂, and temperature via one connection. The system was developed to move with the patient across the care journey, from admission through discharge, streamlining transport. It enhanced clinical workflow efficiency, supported accurate care decisions, and optimized hospital resource utilization.

“This innovative addition to the Kendall DL portfolio removes complexity for busy care teams, and at the same time, helps enhance clinical performance with multi-parameter monitoring,” said Rachel Schott, global vice president for specialty products at Cardinal Health. “The product streamlines steps that clinicians must follow to provide effective care and controls common lead wire clutter with its built-in cable management system.”

“By enabling more efficient workflows and driving clinical excellence, this new solution can potentially support the financial performance of healthcare providers,” Schott said. “Expanding our Kendall DL offerings demonstrates our commitment to providing products designed to address multiple clinical and operational challenges across healthcare organizations, and builds upon our legacy of safe, high-quality patient monitoring solutions that providers have come to trust.”

The Kendall DL™ Multi System had been designed with proprietary, clinically validated technology that significantly reduced false “leads off” alarms and motion-related disruptions in ECG tracings caused by patient movement. These improvements delivered cleaner ECG outputs and allowed healthcare providers to better assess and prioritize treatment. Because the system was intended for single-patient use, it helped lower the potential for cross-contamination from reusable lead wires when monitoring vital signs like heart activity, oxygen saturation, and temperature. This led to fewer infection-related complications and decreased the likelihood of prolonged hospitalization or readmission. It was also approved for reprocessing under Cardinal Health’s medical device program.

As per DelveInsight’s “Vital Sign Monitoring Devices Market Report”, the global vital sign monitors market was valued at USD 7.59 billion in 2023, growing at a CAGR of 7.94% during the forecast period from 2024 to 2030, to reach USD 11.97 billion by 2030. The rising prevalence of chronic conditions like hypertension, diabetes, respiratory, and cardiovascular diseases is driving the demand for vital sign monitors. Additionally, this demand is bolstered by a global shift towards health-conscious behavior, with more consumers using wearable fitness devices to track vital signs daily. The integration of these monitoring capabilities into popular devices, along with advancements in product development and the push towards digital health and telemedicine, are accelerating the adoption of vital sign monitors. As a result, the market is poised for rapid growth from 2024 to 2030.