Top 10 Expected Oncology Drug Launches in 2023

Feb 24, 2023

Table of Contents

Cancer is the world’s second leading cause of death. Every year, 10 million people die from cancer. Cancer kills 70% of people in low-to-middle-income countries. Cancer is estimated to cost the global economy USD 1.16 trillion per year. Millions of lives could be saved annually by implementing resource-appropriate prevention, early detection, and treatment strategies.

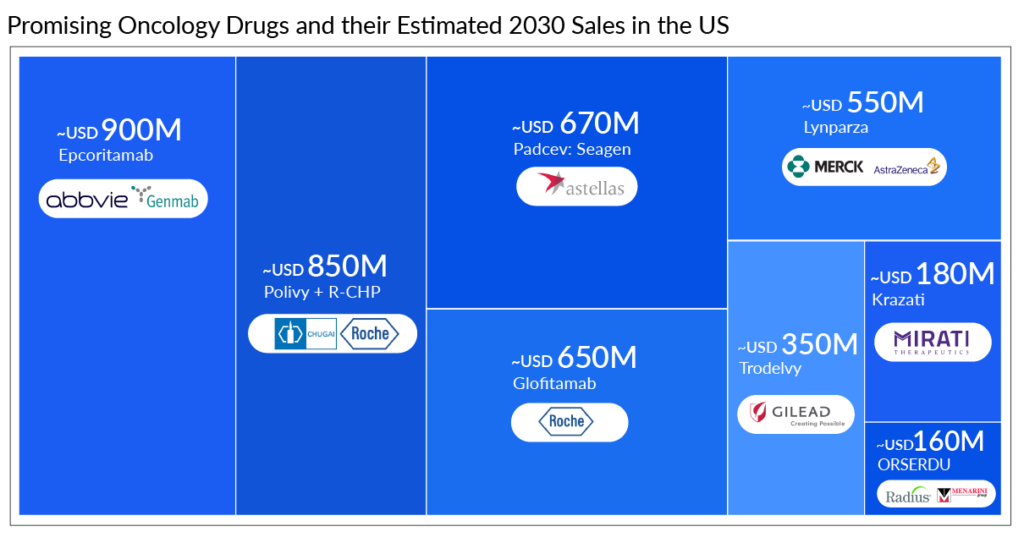

Every year leading goliaths operating in the oncology market, including Roche, AbbVie, Gilead Sciences, AstraZeneca, Merck, Astellas Pharma, and others, works hard to develop novel oncology drugs that would lower the burden on the patients. This year, the oncology drugs pipeline is also looking robust, with promising candidates such as Lynparza, Trodelvy, Glofitamab, Epcoritamab, and others. The launch of these oncology drugs will give a sign of relief to all the patients suffering from different types of cancer.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- BeiGene’s BRUKINSA Gets FDA Accelerated Approval; GSK’s Positive Results in DREAMM-8 ...

- AACR 2022: LAG-3, one of the most trending Next-generation Immunotherapy

- Össur Launches POWER KNEE; DePuy Synthes Acquires CrossRoads Extremity Systems; Myomo’s MyoPro; A...

- Bayer’s AskBio Initiates Phase II GenePHIT Trial; FDA Approves Merck’s KEYTRUDA Plus Chemoradioth...

- Novo Nordisk Gains US Approval for Oral WEGOVY; Windward Bio Strengthens Immunology Pipeline With...

Promising Oncology Drugs in the Pipeline

The oncology drug pipeline comprises some highly anticipated therapies representing new drug classes and distinct MoAs. These oncology drugs will create significant market opportunities across a wide range of indications. Let’s dive deep into the upcoming oncology drugs and learn more about them.

Polivy + R-CHP

Drug: Polivy + R-CHP (Rituximab, Cyclophosphamide, Doxorubicin, and Prednisone)

Mechanism of Action: CD79b targeted ADC

Company: Roche-Genentech/Chugai Pharmaceuticals

Indication: Diffuse Large B-cell Lymphoma (DLBCL) (1L)

Estimated 2030 sales in the US: ~USD 850 million [1L+, 2L+ (Non transplant eligible {NTE}), and 3L+]

Eyes on Roche’s Polivy + R-CHP, expected to launch in 2023 in the United States for patients with untreated DLBCL. The company has high hopes for Polivy + R-CHP as the FDA has set a PDUFA goal date of April 2, 2023. Polivy + R-CHP showed a 27% PFS benefit over R-CHOP, although the overall survival (OS) at 2 years was 88.7% in the Polivy + R-CHP group and 88.6% in the R-CHOP group with no significant difference in both regimes. Polivy, in this combination, is expected to be the first ADC that could revolutionize the field of untreated DLBCL treatment.

R-CHOP continues to be challenged to better patient outcomes through novel drug combinations and therapeutic approaches. Polivy demonstrated a considerable uptake due to its efficiency in improving patient outcomes with DLBCL. Despite previous failures in 1L DLBCL, POLIVY, combined with R-CHP in 1L DLBCL, has now received approval in more than 50 countries. It was approved in Europe in May 2022, followed by Japan in August 2022.

As per Delveinsight’s estimates, Polivy made ˜USD 450 million in the seven major markets (US, EU4 and the UK, and Japan) in 2022 from its usage in 3L (US) and 2L NTE (Europe and Japan), and a significant uptake is anticipated from Polivy in the upcoming year owing to first-mover advantage in the first-line setting. However, this oncology drug might face competition with other emerging bi-specific antibodies and CAR-Ts entering later in this line. In the future, the willingness of physicians to prescribe Polivy with R-CHP as first-line therapy will also be a key factor in winning over patients. However, Polivy + R-CHP’s acceptance may be affected in 1L treatment due to the lack of an OS benefit.

Epcoritamab

Drug: Epcoritamab

Mechanism of Action: CD20 and CD3 directed bispecific antibody

Company: AbbVie and Genmab

Indication: Diffuse Large B-cell Lymphoma (3L+)

Estimated 2030 sales in the US: ~USD 900 million [1L+, 2L+ (NTE and Transplant eligible {TE}), and 3L+]

Epcoritamab is all set to become the first-ever bispecific antibody ever approved for DLBCL treatment, with a PDUFA action date set for May 21, 2023. This oncology drug wowed the crowd in terms of efficacy in R/R DLBCL by achieving an overall response rate (ORR) of 63%, with a complete response rate (CRR) of 39% from the EPCORE NHL-1 trial. European Medicines Agency (EMA) also validated Marketing Authorization Application (MAA) for R/R DLBCL last year. Although the occurrence of Grade 3 Cytokine Release Syndrome (CRS) with monotherapy tones down epcoritamab’s potentially best-in-class safety profile yet the effectiveness surpasses its tolerable safety concerns.

Bispecific antibodies will gain a sizable market share in 3L+ DLBCL as CAR-T and ADCs advance in earlier lines. Apart from 3L R/R DLBCL treatment, the drug is also being evaluated in combinations with other agents in an earlier lines of therapies, including first-line, first-R/R transplant-eligible, and first-R/R transplant-ineligible. While epcoritamab’s first-mover advantage would give it an edge in the bispecific antibodies space, glofitamab’s fixed-duration treatment could be a major selling point.

Glofitamab

Drug: Glofitamab

Mechanism of Action: CD20 and CD3 directed bispecific antibody

Company: Roche

Indication: Diffuse Large B-cell Lymphoma (3L+)

Estimated 2030 sales in the US: ~USD 650 million (1L+, 2L+ (NTE), and 3L+)

Roche’s glofitamab is not too far behind in the race from epcoritimab. As AbbVie’s possible competitor, Roche gets closer to entering the DLBCL market and is excavating its roadway with newer modifications for the drug glofitamab.

Roche filed for approval of glofitamab in April 2022 in Europe for 3L R/R DLBCL, and the FDA is expected to decide on approval by July 1, 2023, based on results from the Phase I/II NP30179 study, where 51.6% of patients achieved an ORR, with 40% achieving a CRR.

If approved, glofitamab would be the first fixed-duration, off-the-shelf CD20xCD3 T-cell engaging bispecific antibody available to treat people with aggressive lymphoma who have previously received multiple courses of treatment. Fixed-duration treatment is a key selling point that Roche thinks could differentiate its bispecific from the others and give head-to-head competition to epcoritamab.

The company anticipates submission to health authorities for glofitamab + chemotherapy in 2L DLBCL by 2024 and glofitamab + chemotherapy in 1L circulating tumor (ct) DNA + high-risk DLBCL by 2025 and beyond.

Roche has another CD20xCD3 bispecific antibody, LUNSUMIO (mosunetuzumab), being developed along with Biogen is also a fixed-duration treatment that can be administered in the outpatient setting, which could allow people the possibility of experiencing a lasting remission with a treatment-free period. It’s recent approval for follicular lymphoma treatment has made its portfolio strong and given more hope for approval in DLBCL treatment.

SYD985

Drug: SYD985 (Trastuzumab Duocarmazine)

Mechanism of Action: HER2 binding ADC, which interrupts DNA replication and results in tumor cell death

Company: Byondis

Indication: HER2+ metastatic breast cancer (3L+)

Estimated 2030 sales in the US: Not estimated

SYD985 is Byondis’ first product ever expected to hit the market. There are several HER2-targeting ADCs in development, but Byondis’ SYD985 is currently gaining steam and is anticipated to launch in 2023. According to Phase III results from the TULIP study in 3L+ HER2+ metastatic breast cancer, hitting its primary endpoint with an mPFS of 7.0 months vs. 4.9 months for physician’s choice chemotherapy and also demonstrated supportive overall survival (OS) results. Data support the potential of SYD985 to address the high unmet need of patients with HER2+ breast cancer. Adverse events for SYD985 include conjunctivitis (38.2%), keratitis (38.2%), and fatigue (33.3%) which may permanently occur if not properly treated, which could jeopardize the drug’s approval.

The FDA granted fast-track designation based on Phase I results, whereas last year, based on Phase III results, FDA gave a PDUFA action date of May 12, 2023. Byondis is exploring partnerships with big pharm to enable commercialization.

Byondis TULIP’s 7 months mPFS appears moderate compared to ENHERTU’S 18 months mPFS in the DESTINY-Breast01 trial; hence it is not expected to be a growing threat to ENHERTU.

Trodelvy

Drug: Trodelvy

Mechanism of Action: Trop-2-directed antibody-drug conjugate

Company: Gilead Sciences

Indication: HR+/HER2- breast cancer (3L+)

Estimated 2030 sales in the US: ~USD 350 million (3L+)

Trodelvy is approved in more than 40 countries. Trodelvy has already changed the treatment landscape in second-line metastatic triple-negative breast cancer and pre-treated metastatic urothelial cancer and has previously grabbed a significant market share. On February 3, 2023, the FDA approved Trodelvy for HR+/HER2- breast cancer patients based on the Phase III TROPiCS-02 trial. Roche is also exploring TRODELVY in Europe for HR+/HER2- breast cancer. We expected it to get a green signal from EMA in 2023 as EMA has already validated the MAA application on January 5, 2023.

As per data presented in ASCO 2022 and ESMO 2022 last year, Trodelvy demonstrated a 34% reduction in risk of disease progression or death (median PFS: 5.5 vs. 4 months) and a 21% decrease in the risk of death compared to treatment of physician’s choice (TPC) (median OS: 14.4 months vs. 11.2 months).

Currently, breast cancer (starting with TNBC) accounts for 90% of Trodelvy’s business. Trodelvy is expected to emerge as a blockbuster candidate however, boxed warning for severe or life-threatening neutropenia and severe diarrhea could impact the uptake of TRODELVY. However, the possible competition could impact Trodelvy’s growth in the coming years. Trodelvy is anticipated to face competition from AstraZeneca/Daiichi Sankyo Dato-DXd, Sermonix Pharma’s Fablyn (Lasofoxifene), and Veru Pharma’s Enobosarm in 3L HR+/HER2- Breast cancer treatment.

Want to know which oncology drugs got approved in 2022? Visit, Oncology Drugs Launches 2022

ORSERDU

Drug: ORSERDU (elacestrant)

Mechanism of Action: Selective estrogen receptor degrade (SERD)

Company: Radius Health/Menarini

Indication: ER+/HER2-, ESR1-mutated advanced or metastatic breast cancer (2L+)

Estimated 2030 sales in the US: ~USD 160 million (2L+)

It has been a great start to the new year with the approval of much awaited Next Generation SERD, elacestrant in ESR1-mutated HR+/HER2- breast cancer giving new hope to patients. By bringing the first oral selective estrogen receptor degrader (SERD) to treat breast cancer across the FDA finish line, Menarini wins the race where Roche and Sanofi have lost sight. ORSERDU is not the first SERD for breast cancer to be approved in the market. In 2002, AstraZeneca received an FDA nod for Faslodex for HR+ metastatic breast cancer, whose cancer has progressed following prior antiestrogen therapy. Elacestrant is expected to be widely adopted given the oral advantages and the improved efficacy compared to Faslodex.

The regulatory decision was based on data from the Phase III EMERALD trial, in which elacestrant reduced the risk of disease progression or death by 45% compared with fulvestrant or an aromatase inhibitor. The mPFS with elacestrant was 3.8 months vs. 1.9 months with the control.

Priority review and fast-track designations for elacestrant were previously granted by the FDA, and a PDUFA date of February 2023 was set. Three weeks before the deadline, the agency revealed its final decision. Other next-generation oral SERD candidate giredestrant and amcenestrant from Roche and Sanofi, respectively, flopped breast cancer trials last year, and Sanofi later stopped developing its drug.

Competitors outperform Menarini’s Elacestrant in 1L and adjuvant settings. In contrast to most of its rivals, Menarini has only recently begun Phase I/II dose-finding studies of elacestrant with CDK4/6i. There are no adjuvant studies either. Therefore, Menarini will have the first-mover advantage in key situations.

In the future, Menarini can face competition from AstraZeneca’s camizestrant, which showed significant results in a Phase II trial last year.

Lynparza

Drug: Lynparza (olaparib)

Mechanism of Action: PARP inhibitor

Company: AstraZeneca/Merck & Co

Indication: Metastatic Castration-resistant Prostate Cancer (mCRPC) (1L)

Estimated 2030 sales in the US: ~USD 550 million (1L)

Lynparza is approved in the US as monotherapy for patients with homologous recombination repair (HRR) gene-mutated mCRPC (BRCA-mutated and other HRR gene mutations) who have progressed following prior treatment with enzalutamide or abiraterone and in the EU, Japan, and China for patients with BRCA-mutated mCRPC who have progressed following prior therapy that included a new hormonal agent (NHA). These approvals were based on the data from the Phase III PROfound trial.

FDA granted Priority Review in August and assigned a PDUFA action date for the fourth quarter of 2022. FDA extends the evaluation period through December 2022 and pushes back the decision deadline by three months. However, at the same time, in December 2022, its label was expanded in Europe, and it was authorized for use in combination with abiraterone, prednisone, or prednisolone for the treatment of adult patients with mCRPC in whom chemotherapy is not clinically recommended. In the Phase III PROpel study, the Lynparza + abiraterone arm’s median radiographic progression-free survival (rPFS) was 24.8 months compared to 16.6 months for the placebo + abiraterone arm.

For the title of third PARP inhibitor in the US for mCRPC, Pfizer’s Talzenna + Xtandi, AstraZeneca’s Lynparza + abiraterone, and Janssen’s Zejula + abiraterone faced off against one another. While Zejula failed in 1L mCRPC patients without HRR, Lynparza, used on top of Zytiga and steroids, cut the risk of disease progression or death in all patients by 34% regardless of HRR status in its Phase III PROpel trial. With non-HRR-mutated patients, Zejula might not be an option for a broad label, but Talzenna and Lynparza might go up against one another.

Padcev

Drug: Padcev (enfortumab vedotin)

Mechanism of Action: Nectin-4-directed antibody-drug conjugate

Company: Seagen/Astellas Pharma

Indication: Locally advanced or metastatic urothelial cancer (1L)

Estimated 2030 sales in the US: ˜USD 670 million

As a potential treatment option for untreated cisplatin-ineligible patients with locally advanced or metastatic urothelial carcinoma, the combination of Merck’s Keytruda, Seagen’s, and Astellas’s Padcev have drawn a lot of attention.

Padcev was the first Nectin-4-directed antibody-drug conjugate (ADC) licensed for the treatment of advanced urothelial carcinoma and the 8th ADC approved by the FDA. Padcev’s approval journey began with FDA approval for urothelial cancer treatment in December 2019, continued with Europe approval in March 2021, label expansion in urothelial cancer in the US in July 2021, Japan approval in September 2021, and lasted with Europe approval in April 2022 for adult patients with locally advanced or metastatic urothelial cancer who have previously received treatment with platinum-containing chemotherapy and a PD-1/L1 inhibitor. This path will not end anytime soon because the FDA intends to decide whether to approve Padcev + Keytruda by April 21, 2023, for the treatment of patients with locally advanced or metastatic urothelial carcinoma who are ineligible for treatment with cisplatin-based chemotherapy. The sBLA supported by the Phase I/II (EV-103/ KEYNOTE-869) trial results, out of 76 patients who received the combination, 64.5% had tumor shrinkage, with 10.5% showing a complete response. Of the 73 patients on Padcev alone, the rate was 45.2%, with 4.1% responding completely.

A regulator’s approval would not only increase Padcev’s potential sales by billions but would also prolong Keytruda’s patent protection in the indication through 2027.

Brukinsa

Drug: Brukinsa (Zanubrutinib)

Mechanism of Action: BTK inhibitor

Company: BeiGene

Indication: Chronic lymphocytic leukemia (CLL) or small lymphocytic lymphoma (SLL) (1L and 2L+)

Estimated 2030 sales in the US: Not estimated

There is new hope for CLL patients after the FDA gave the green light to Zanubrutinib, a second-generation BTK inhibitor, in January 2023. Approval is based on two global Phase III clinical trials demonstrating superior efficacy and a favorable safety profile in ALPINE (R/R CLL/SLL) and SEQUOIA (untreated CLL/SLL) studies. Given that Brukinsa is a 3rd-in-market BTK inhibitor and entered the market six years after Imbruvica (ibrutinib) suggests that Brukinsa could capture high market share and demonstrate best-in-class potential.

We expect strong uptake of Brukinsa will continue to ramp up driven by multiple approvals (2L MCL, 2L MZL, and CLL/SLL in the US) and pivotal data readouts suggesting superior efficacy and safety in ALPINE in CLL over BTK market leader Imbruvica. Covalent first-generation BTK inhibitor intolerance is a major emerging issue with this class of medication due to cardiac issues such as cardiac arrhythmias, atrial fibrillation, or atrial flutter. ALPINE data suggest that atrial fibrillation was better with zanubrutinib vs. ibrutinib. Due to this advantage over ibrutinib in the coming years, we expect Imbruvia to lose its market share to Brukinsa steadily.

With the strong PFS benefit over ibrutinib in ALPINE study, it is well perceived by physicians. Superior relative efficacy vs. Calquence, foreshadowing a strong commercial adoption. As Calquence is currently the market leader in untreated patients of CLL, which starts for the BTK class in untreated patients, and much of the benefit is driven by the more tolerable profile rather than efficacy. Calquence did not demonstrate superiority to Imbruvica in terms of efficacy, but safety is better than Imbruvica.

Moreover, Lilly’s third-generation noncovalent BTK inhibitor, Pirtobrutinib, is also being evaluated in a Phase III trial in CLL treatment, which demonstrated good efficacy in the trial. Pirtobrutinib has a theoretical advantage over the currently marketed BTK inhibitor (Imbruvica, Calquence, Brukinsa) because of its reversible binding that allows for higher BTK inhibition while also reducing off-target toxicity.

Krazati

Drug: Krazati (adagrasib)

Mechanism of Action: Selective covalent inhibitor of KRAS G12C

Company: Mirati Therapeutics

Indication: KRASG12C mutation in Colorectal cancer (CRC) (3L+)

Estimated 2030 sales in the US: ˜USD 180 million (2L and 3L+)

In recent years, KRAS has become one of the most often explored targets in cancer therapies due to its function in the proliferation and expansion of cancer cells. Due to its earlier marketing than Krazati (adagrasib), Lumakras (sotorasib) has already attained market acceptance.

2023 could be a ‘massive showcase’ for Krazati as the drug was recently approved in NSCLC in December 2022. We expect this drug to hit the market in KRASG12C CRC this year. The company received the breakthrough designation for KRAS-Mutated CRC based on Phase I/II (KRYSTAL-1) trial. Now, the company is planning to meet with the FDA to discuss an accelerated approval pathway for 3L+ CRC in the first quarter of 2023. The data from Phase I/II KRYSTAL-1 trial, the combination of adagrasib and cetuximab demonstrated an ORR of 46%, a median duration of response (DOR) of 7.6 months, and a median PFS of 6.9 months.

Amgen and Mirati are in head-to-head competition with each other with their assets Lumakras and Krazati respectively. Phase II data had hit hard Lumakras in CRC and dashed Amgen’s hopes when ORR was not achieved. However, the company still feels that Lumakras has the potential, i.e., developing Lumakras in combination with other therapeutics to increase potential activity and overcome potential resistance mechanisms. The sotorasib + panitumumab combination was evaluated in the CodeBreaK 101 study, which had an ORR of 30% and an mPFS of 5.7 months. With combinations in refractory populations, KRYSTAL-1 and CodeBreaK 101 demonstrated excellent disease control rates of 100% and 93%, respectively, with median PFS data that outperformed other currently available choices.

Mirati is also conducting a Phase III KRYSTAL-10 trial evaluating adagrasib in combination with cetuximab in patients with KRASG12C-mutated CRC in the 2L+ compared with standard chemotherapy. However, Amgen is exploring the combination of sotorasib + panitumumab vs. the investigator’s choice of regorafenib or TAS-102 in the CodeBreaK 300 Phase III trial. Watching whether Amgen or Mirati takes the crown in CRC treatment will be fascinating.

What’s Ahead in the Oncology Market?

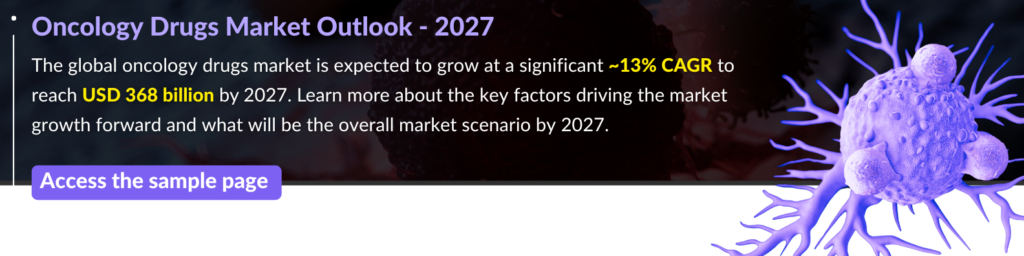

Oncology is a dynamic and fast-evolving therapeutic area, with several key players at the global level engaged in R&D activities to provide an effective therapeutic option for cancer patients. The global oncology drugs market has grown significantly in recent years due to various factors such as increased research and development activities, increased awareness, an increase in the geriatric population, an increase in the incidence of various cancer conditions, and growing interest in the domain by key pharmaceutical and biotech companies. Several global pharmaceutical companies are currently active in the oncology therapeutics segment. Moreover, the entry of new players developing novel cancer treatments is expected to improve the quality of life of affected people and their families in the coming years.

Furthermore, every year regulatory authorities approve many oncological drugs for various indications. The oncological drug pipeline is looking very promising this year too. The anticipated launch of these oncology drugs will give tough competition to already approved drugs in the market. With the robust oncological drug pipeline, we can witness remarkable growth in the oncology market this year.

Downloads

Article in PDF

Recent Articles

- Biohaven’s Troriluzole Failure; Daiichi/ AZ’s Enhertu; Fujifilm & Manufacturing ...

- The Evolving Landscape of ER+ Breast Cancer Treatments

- HR+/HER2- Breast Cancer: Unveiling the Worldwide Advances and Strategies

- Emerging Role of Digital Health in the Field of Oncology

- ADCs in Lung Cancer Treatment: ENHERTU’s Rise, HER3 & TROP-2 Challenges, and What’s Next in ...